News: Markets

29 July 2022

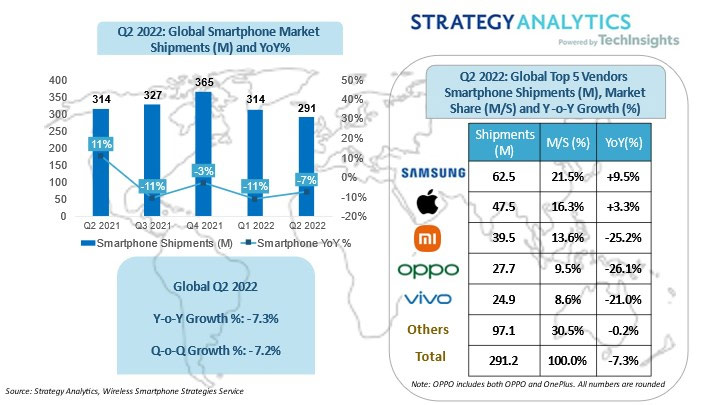

Smartphone shipments fall 7.3% year-on-year in Q2; Samsung on 21.5% marketshare and Apple at 16.3%

Global smartphone shipments fell by 7.3% year-on-year from 314 million units in second-quarter 2021 to 291 million units in second-quarter 2022 (the fourth consecutive quarter of year-on-year decline by smartphone volumes), according to market research firm Strategy Analytics.

“COVID disruption and geopolitical issues adversely impacted smartphone market in the second quarter,” notes senior director Linda Sui. “Meanwhile, unfavorable economic conditions continued to weaken consumers’ demand on smartphones and other non-essential products.”

Picture: Global smartphone shipments and market share by vendor, Q2/2022.

Samsung’s smartphone shipments grew by 9.5% year-on-year to 62.5 million in Q2/2022, topping the global market with a 21.5% share. “It is the vendor’s highest second-quarter performance by market share since 2020,” notes director Woody Oh. “Demand continued to remain strong for the newly launched flagship Galaxy S22 series, especially the higher-priced S22 Ultra model.”

Apple’s iPhone shipments rose 3.3% year-on-year to 47.5 million (16.3% marketshare). “This is the highest second-quarter market share for Apple over the past ten years, at the expense of leading Chinese brands who are hampered by the sluggish performance in both home and overseas market,” says Oh. “Apple had a good quarter, led by the iPhone 13 series, which continued to ramp up volumes in US, China and other key markets,” he adds.

Chinese firms Xiaomi, OPPO (including OnePlus) and vivo remained among the top five smartphone makers.

Xiaomi shipped 39.5 million smartphones and took third place with 13.6% marketshare in Q2/2022, down from 17% a year ago. “Xiaomi suffered from the geopolitical uncertainties in Europe,” notes senior analyst Yiwen Wu. “China and India market also delivered a mixed bag for the Chinese brand.”

OPPO (OnePlus) held fourth spot and captured 9.5% marketshare. Vivo stayed fifth, with 8.6%. “OPPO (OnePlus) and Vivo both lost ground in most markets, as 5G competition from Honor and other smartphone competitors intensified sharply in China and other markets,” says Wu.

“Global competition among other major smartphone brands, beyond the top five, was fierce during Q2/2022,” comments executive director Neil Mawston. “Transsion, Honor, Lenovo-Motorola and Huawei all outperformed the overall market but delivered different patterns. Transsion regained the leading position from Samsung in Africa region this quarter. Honor held firmly in China, being the largest vendor for the first time ever, and continued to ramp up in overseas markets. Lenovo-Motorola stabilized the performance in America region and made progress in Europe and Asia Pacific. Realme stayed in the top-ten list but delivered a mixed performance and lost ground in China, Latin America, Central Eastern Europe and Africa Middle East region,” he adds. “Among top-ten brands, there are eight Chinese brands. However, all these Chinese brands combined posted -13% annual decline, underperforming total market and the top two players.”

Strategy Analytics forecasts that global smartphone shipments will contract by 7-8% year-on-year in full-year 2022. “Geopolitical issues, economy downturn, price inflation, exchange-rate volatility, and COVID disruption will continue to weigh on the smartphone market during the second half of 2022,” says Sui. “All these headwinds would continue through the first half of next year, before the situation eases in the second half of 2023,” she adds. “Samsung and Apple would continue to outperform and remain top two places. Chinese brands need to stabilize the performance in China market and explore new growth engine to terminate the falling track.”

Apple iPhone tops smartphone market in Q4/2021, but Samsung remains top for full year