News: Markets

7 June 2022

LED package market grew 15.4% to $17.65bn in 2021

The global LED market beat market expectations in 2021, growing 15.4% year-on-year to $17.65bn as a slowing pandemic drove the recovery of various global economic activities, according to TrendForce’s latest LED report.

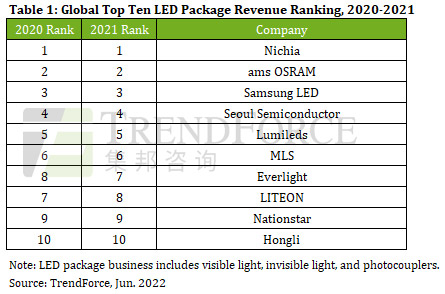

From the revenue ranking of LED makers, most constituents benefited from the rebound in market demand and showed significant revenue growth, with the top three manufacturers accounting for 29.5% of the market.

Nichia’s backlight LED business revenue declined due to increasing organic light-emitting diode (OLED) penetration. However, driven by the rapid growth of revenue in the flash LED, automotive LED and general lighting markets, overall revenue continued to grow steadily, ranking Nichia first in the world.

Exemplified by stable product quality, excellent light efficiency, and cost-effectiveness, ams OSRAM is regarded as a first-choice supplier for high-end automobiles and new energy vehicles (NEV) worldwide. In addition, benefiting from orders for horticultural lighting and infrared sensing, its revenue ranks second in the world.

Samsung LED also benefited from improved sales in automotive lighting, horticultural lighting, general lighting and mini-LED backlights, ranking third. Among these products, Samsung Lighting LEDs are positioned in the high-end market. In high-end markets such as Europe and the USA, Samsung LED’s market share is gradually expanding due to its advantages in quality and patents. Notably, Samsung LED’s horticultural lighting orders also showed rapid growth, driving its whole lighting LED business revenue to rank first in the world.

The remaining top-ten LED makers are rounded out by Seoul Semiconductor, Lumileds, MLS, Everlight, LITEON, Nationstar, and Hongli. Seoul Semiconductor took advantage of revenue growth from large-size backlights, automotive LEDs and lighting LEDs. Lumileds also performed well in automotive LEDs and lighting LEDs, and continued to launch a variety of LEDs for commercial lighting, horticultural lighting and architectural lighting to seize market share. MLS, Nationstar and Hongli have significantly increased their revenue in the display LED and lighting LED markets. Everlight and LITEON continue to develop photocoupler, infrared sensing and consumer electronic indicator LED products.

Looking at performance in first-half 2022, TrendForce indicates that, despite the gradual recovery of demand in Europe and the USA, the Russian-Ukrainian war continued to drive raw material pricing upward and exacerbate inflation, in turn suppressing demand in the consumer market. In addition, due to the impact of the pandemic in China, the industrial chain in some cities has experienced interruptions and disruption, with the scope to influence enveloping industries such as electronics and automobiles, inflicting a certain degree of collateral damage on supply and demand in the LED market.

Looking forward to second-half 2022, it is worth observing the imminent launch of corresponding economic stimulus policies by the Chinese government, says TrendForce. The global LED market is forecast to maintain a growth trajectory in 2022, but at a slower rate than the growth performance in 2021.