News: Markets

13 June 2022

Power GaN device market growing at 59% CAGR to $2bn in 2027

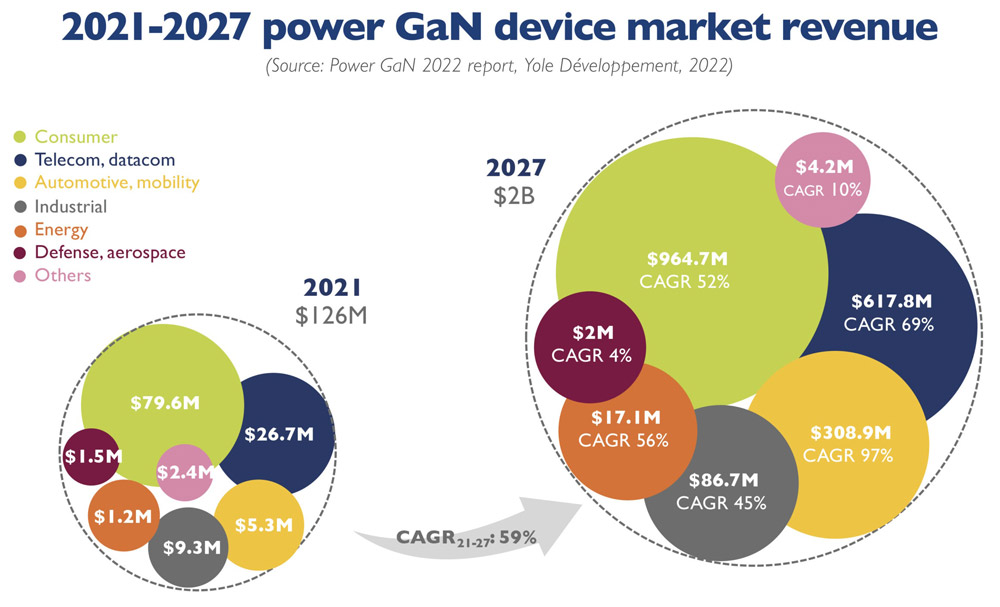

The power gallium nitride (GaN) device market is growing at a compound annual growth rate (CAGR) of 59% from just $126m in 2021 to $2bn in 2027, estimates market research and strategy consulting company Yole Développement in the latest edition of its annual report ‘Power GaN 2022’.

In particular, the consumer sector (including power supplies and Class D audio amplifiers) is growing at a 52% CAGR from $79.6m in 2021 to $964.7m in 2027 (comprising 48% of the total market). “GaN fast chargers are growing rapidly in the handset market,” notes Taha Ayari Ph.D., technology & market analyst, compound semiconductors, at Yole. “Since 2020, Yole has seen an increasing number of fast chargers featuring GaN devices from several players, like Power Integrations, Navitas and GaN Systems. Now, Innoscience is also contributing to this market with high volumes.”

For datacoms/telecoms, Yole expects an increase in GaN penetration in the mid-term as regulations become stricter. The interest in adopting 48V point-of-load systems in data centers to reduce power consumption and cabling volume will favor GaN for low-voltage applications. An increasing number of power supply firms are adopting GaN in their systems. Transphorm, EPC, Texas Instruments, Infineon and GaN Systems have all announced several design wins. Therefore, the GaN device market for the datacom/telecom sector is estimated to be growing at a 69% CAGR from $26.7m in 2021 to $617.8m in 2027.

At a lower penetration level, automotive DC-DC converters and on-board chargers (OBCs) will be part of the next wave of growth during the forecast period, reckons Yole. There are ever more collaborations between GaN device players, who are accelerating the automotive qualification of their products, and the tier-1 and original equipment manufacturer (OEMs), who are evaluating automotive GaN solutions. The GaN automotive/mobility sector is estimated to be growing at a 97% CAGR from $5.3m in 2021 to $308.9m in 2027.

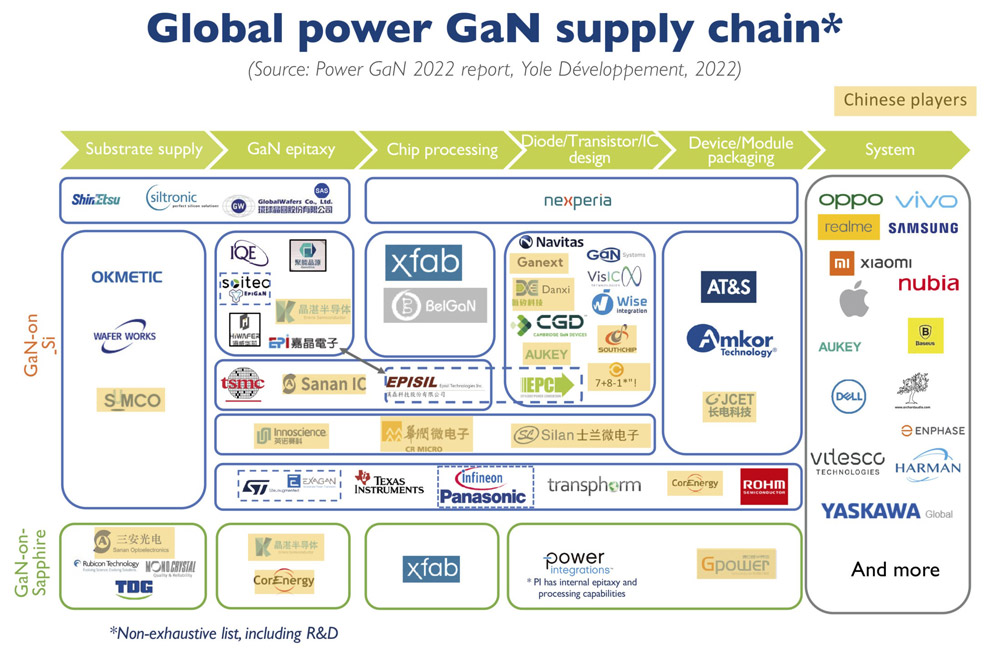

The Power GaN 2022 report also highlights the dynamic supply chain, with new entrants and significant investments. Indeed, since the release of the 2021 report, Yole has seen the entry of new players into the supply chain. Notably, ROHM is offering a 150V GaN product for telecom/datacom applications as part of its new EcoGaN portfolio. New GaN foundry BelGaN has recently acquired onsemi’s fab in Belgium. On the fundraising front, Navitas went public through a special purpose acquisition company (SPAC) business combination after an agreement valued at $1.04bn with Live Oak Acquisition Corp.

Focusing on the Chinese ecosystem, the government has supported more investments from GaN players. Notably, privately owned company Innoscience is investing more than $400m to expand its 8-inch wafer capacity from 10,000 to 70,000 wafers per month by 2025. A domestic supply chain for GaN power is well developed, especially for the consumer market.

In terms of technology, 6-inch GaN-on-silicon is still the mainstream platform. However, the transition to the 8-inch platform plus consolidation of the supply chain with more players at each level are driving lower manufacturing costs, especially at the epitaxy step, which constitutes the most significant part of a GaN device’s cost structure, notes Yole. In fact, one of the big questions is around the use of in-house epitaxy versus outsourced epitaxy for future high volumes, the report concludes.

GaN power market to reach $1.1bn in 2026, after doubling in 2020