News: Markets

10 March 2022

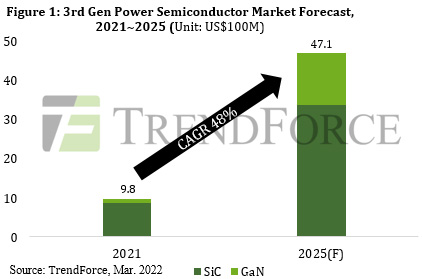

Third-generation power semiconductors growing at 48% CAGR from $980m in 2021 to $4.71bn in 2025

As the materials with currently the most development potential, the output value of ‘third-generation’ power semiconductors – i.e. wide-bandgap (WBG) semiconductors with high-power and high-frequency characteristics, including silicon carbide (SiC) and gallium nitride (GaN), that are used mainly in electric vehicles (EVs) and the fast-charging battery market – is rising at a compound annual growth rate (CAGR) of 48% from $980m in 2021 to $4.71bn in 2025, reckons market research firm TrendForce.

SiC is suitable for high-power applications, such as energy storage, wind power, solar energy, EVs, new energy vehicles (NEV) and other industries that utilize highly demanding battery systems. Among these industries, EVs have attracted a great deal of attention from the market. However, most of the power semiconductors used in EVs currently on the market are silicon based, such as Si IGBTs and Si MOSFETs. However, as EV battery power systems gradually develop to voltage levels greater than 800V, compared with silicon, SiC can produce better performance in high-voltage systems. SiC is expected to gradually replace part of the silicon base design, greatly improve vehicle performance, and optimize vehicle architecture. The SiC power semiconductor market is estimated to reach $3.39bn by 2025.

GaN is suitable for high-frequency applications, including communication devices and fast charging for mobile phones, tablets and laptops. Compared with traditional fast charging, GaN fast charging has higher power density, so charging speed is faster within a smaller package that is easier to carry. These advantages have proven attractive to many OEMs and ODMs, and several have rapidly started to develop this material. The GaN power semiconductor market is forecasted to reach $1.32bn by 2025.

TrendForce emphasizes that third-generation power semiconductor substrates are more difficult to manufacture and more expensive compared with traditional silicon substrates. Taking advantage of the current development of major substrate suppliers, companies including Wolfspeed, II-VI and Qromis have successively expanded their production capacities and will mass produce 8-inch substrates in the second-half 2022. The output value of third-generation power semiconductors is estimated to have room for continued growth in the next few years.

GaN power device market to grow 73% to $83m in 2021

GaN power device market to grow at 78% CAGR to $850m in 2025