News: Markets

8 November 2022

BOE becomes largest shareholder in HC Semitek with RMB2.1bn investment

After making a RMB2.1bn capital investment, BOE has become the largest shareholder in HC Semitek and is now partnering on the development of micro/mini-LED businesses, reports market intelligence firm TrendForce.

BOE has been involved in micro/mini-LEDs since 2017 and now possesses related offerings such as displays and backlight solutions. In 2020, BOE established BOE MLED Technology as a subsidiary dedicated to the R&D and manufacturing of micro/mini-LED products.

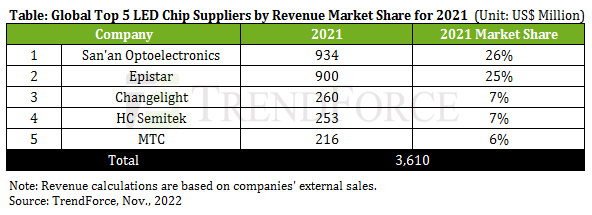

HC Semitek is a major Chinese LED chip supplier and has an overarching presence across the LED chip industry chain, producing not only LED chips but also LED epiwafers, sapphire substrates etc. According to data from TrendForce, in 2021 HC Semitek was the fourth largest LED chip supplier by external sales revenue. Also, in a ranking of LED chip suppliers based on revenue that is solely from sales of mini-LED chips, HC Semitek is currently in third place, following Epistar and San’an.

From BOE’s perspective, LED chips represent a critical section of the display industry chain. For end-products, the quality of LED chips directly affects their displays in terms of cost, production yield rate, and quality. This connection between chips and end-products is also noticeable in the micro-LED industry. For example, RGB micro-LED chips are already regarded as a key component among the leading brand manufacturers.

At the same time, these firms have taken actions to secure a stable supply of RGB micro-LED chips. For instance, Samsung has invested in PlayNitride in order to advance its micro-LED solutions. Also, TCL CSOT has formed a joint venture with San’an named Xiamen Extremely PQ Display Technology. Another example is Ennostar’s partnership with AUO and Innolux for the development of micro-LED displays.

BOE hopes that, by joining forces with HC Semitek, it will be able to further strengthen its already advantageous position in micro/mini-LEDs. Furthermore, in BOE’s efforts to develop related technologies, HC Semitek will provide significant support going forward.

In HC Semitek’s view, the competition in the LED chip industry has become fiercer in recent years as suppliers such as MTC, San’an and Changelight release new production capacity. This year, the situation in the LED chip market is particularly challenging because of factors such as the resurgence of local COVID-19 outbreaks in China, the Russia–Ukraine military conflict, and ongoing global inflation. With a sharp drop in demand for end-products, the LED chip market has shifted to oversupply, and most LED chip suppliers now operate at a loss. Over these years, HC Semtek has been expanding into the high-end market segments such as mini-LED solutions and automotive LED solutions. However, this move has come at the expense of abandoning some segments of the low-end market. HC Semitek’s share of the global LED chip market hence fell by 2 percentage points from 2020 to 7% in 2021, according to TrendForce’s data.

TrendForce points out that BOE was among the investors that HC Semitek targeted in its latest share placement, which aimed to raise a total of about RMB2bn. The proceeds are to be used to build a base for not only the production of micro-LED wafers but also the packaging and testing of micro-LED chips. This capacity expansion project, in turn, is expected to raise market share and generate profit for HC Semitek. Additionally, by forming a close partnership with BOE, HC Semitek will be able to develop technologies that are more suited to the needs of end-customers, it is reckoned. Simultaneously, BOE will serve as a major sales channel for HC Semitek’s micro/mini-LED chips.