News: Markets

11 November 2022

Ennostar and PlayNitride team up on 6” micro-LED epiwafer production

Ennostar subsidiary Epistar and PlayNitride subsidiary PlayNitride Display have teamed up to build a production line for 6-inch micro-LED epiwafers, reports market research firm TrendForce.

Looking at the latest progress in the development of micro-LEDs, large-sized displays are regarded as the forerunners to more advanced end-products. Even though micro-LEDs have unresolved technical bottlenecks and cost-related issues, TrendForce is optimistic that this technology will eventually be adopted for the development of different kinds of displays and end-products.

Examples include transparent augmented reality (AR) smart glasses, displays for wearable devices like smartwatches, automotive displays such as those embedded in a smart cockpit, and other transparent display products.

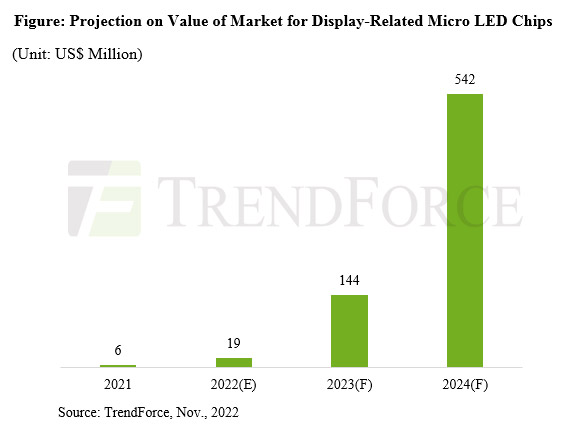

Furthermore, the latest efforts in product development will likely create new high-end applications for micro-LEDs. TrendForce currently forecasts that the market for micro-LED chips used in displays will reach $542m in 2024, then experience soaring growth starting in 2025 due to the maturation of technologies.

In dealing with a new high-end display technology such as micro-LEDs, there is a high degree of customization in display design, notes TrendForce. Additionally, the technologies responsible for fabricating micro-LED displays must meet a very stringent set of requirements regarding accuracy and precision. Hence, the possibility of creating commercially viable and mass-produced micro-LED displays depends on a high level of synergy among companies that are involved in display panels, LED chips, mass-transfer equipment, driver ICs etc. In the supply chain for traditional types of displays, different sections operate in a relatively independent manner and adhere to a certain division-of-labor scheme. By contrast, the supply chain for micro-LED displays operates under a very different model that requires close integration between sections.

Given this context, three coalitions have now emerged in the micro-LED market. The first comprises Ennostar (including its subsidiaries Epistar, Unikorn Semiconductor, and Lextar), AUO, and Innolux. The second coalition comprises BOE (including its subsidiary BOE Mled and joint venture BOE Pixey) and HC Semitek. The third coalition is formed by TCL CSOT, San’an Optoelectronics, and Extremely PQ Display Technology. It is worth noting that Hisense, through its recent actions such as increasing its stake in Changelight, appears to be forming another new faction in the micro-LED market as well.

TrendForce says that Ennostar, as one of the technology leaders in the global LED industry, has been working internally on micro-LEDs for many years as it looks forward to the explosive growth of related opportunities in the future. To get a firmer grasp of fabrication technologies and entrench itself in the industry ecosystem, Ennostar has taken the step of forming an alliance that prepares for the eventual mass production of micro-LED displays. With respect to the roles of the individual members of this alliance, Ennostar and Epistar will be responsible for high-end micro-LED chips. The development of mass-transfer solutions will center on PlayNitride. AUO and Innolux will be in charge of display backplanes and driver ICs. Their efforts must be closely interconnected and in sync in order to obtain successful results. In this latest chapter of the partnership between Ennostar and PlayNitride, the former will build a new production line by leveraging the expertise and experience that the latter has accumulated for mass-transfer solutions and micro-LED chips.

PlayNitride is currently a leader in micro-LED technology. Apart from meeting its clients’ demand as a component supplier, PlayNitride has a well-rounded portfolio of technology patents as well as a wealth of experience. For other companies that manufacture products for various display-related applications (e.g. large-sized, automotive, and wearable), PlayNitride can help them adopt micro-LEDs by providing services such as setting up production capacity and optimizing production flow. Such collaborations would create core competitive advantages for the partnering display manufacturers, says TrendForce. As PlayNitride simultaneously expands into component sales, IP services and construction of production lines, it will be able to create new and profitable business models, the market research firm concludes.

Micro-LED large-sized display chip market to reach $2.7bn by 2026

Micro-LED transparent AR smart glasses chip market to grow to $38.3m by 2026