News: Markets

12 October 2022

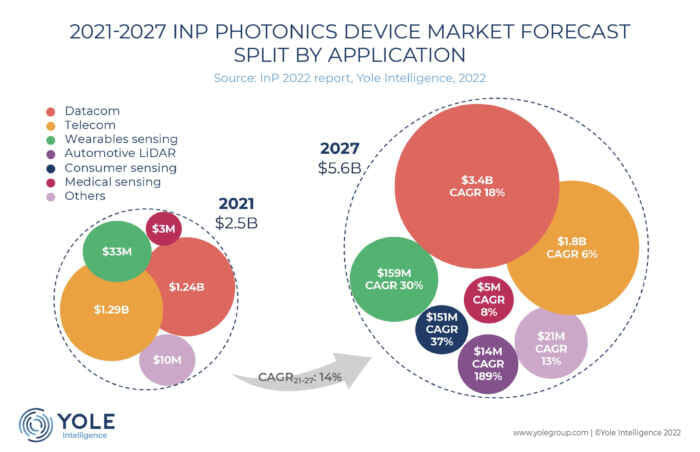

InP market growing from $2.5bn in 2021 to $5.6bn in 2027

The indium phosphide (InP) market, long dominated by datacom and telecom applications, will grow from $2.5bn in 2021 to about $5.6bn in 2027, forecasts the ‘InP 2022’ report from Yole Intelligence’s compound semiconductor team.

As an indispensable building block for high-speed and long-range optical transceivers, InP laser diodes remain the best choice for telecom and datacom photonic applications, with growth driven by the high-volume adoption of high-data-rate modules (above 400G), by big cloud services and national telecom operators requiring increased fiber-optic network capacity. Specifically, the development and growth of optical transceiver technology in the coming years will be driven by the migration to higher data rates, lower power consumption within data centers, and the deployment of 5G base stations.

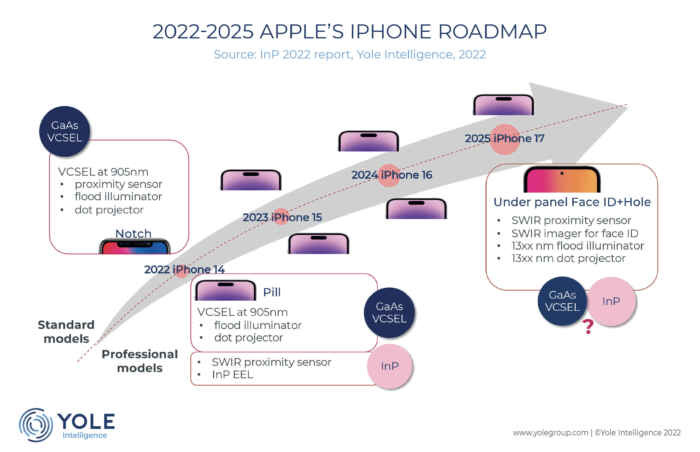

However, consumer applications are expected to be the next showcase for the InP industry, with a compound annual growth rate (CAGR) of 37% between 2021 and 2027. “There has been a lot of speculation on the penetration of InP in consumer applications,” says technology & market analyst Ali Jaffal Ph.D. “The year 2022 marks the beginning of this adoption. For smartphones, organic light-emitting diode (OLED) displays are transparent at wavelengths ranging from around 13xx to 15xxnm”.

OEMs are interested in removing the camera notch on mobile phone screens and integrating the 3D sensing modules under OLED displays. In this context, they are considering moving to indium phosphide EELs (edge-emitting lasers) to replace the current gallium arsenide (GaAs) VCSELs (vertical-cavity surface-emitting lasers). However, such a move is not straightforward from cost and supply perspectives. With the rise of the consumer applications, the InP supply chain will need more investment.

Yole Intelligence noted the first penetration of InP into wearable earbuds in 2021. Apple was the first OEM to deploy InP SWIR (short-wavelength infrared) proximity sensors in its AirPods 3 family to help differentiate between skin and other surfaces. This has been extended to the iPhone 14 Pro family. The leading smartphone player has changed the aesthetics of its premium range of smartphones, the iPhone 14 Pro family, reducing the size of the notch at the top of the screen to a pill shape.

To achieve this new front camera arrangement, some other sensors (such as the proximity sensor) had to be placed under the display. Will InP penetration continue in other 3D sensing modules, such as dot projectors and flood illuminators? Or could GaAs technology come back again with a different solution for long-wavelength lasers?

The impact of an innovative company like Apple adding such a differentiator to its product significantly affects companies in its supply chain, and vice versa. Traditional GaAs suppliers for Apple’s proximity sensors could switch from GaAs to InP platforms, since both materials could share similar front-end processing tools. Yole Intelligence certainly expects to see new players entering the InP sector, as the consumer market represents high-volume potential.

In addition, Apple’s move could trigger the penetration of InP into other consumer applications, such as smartwatches and automotive light detection & ranging (LiDAR) with silicon photonics platforms, concludes the report.