News: Markets

21 September 2022

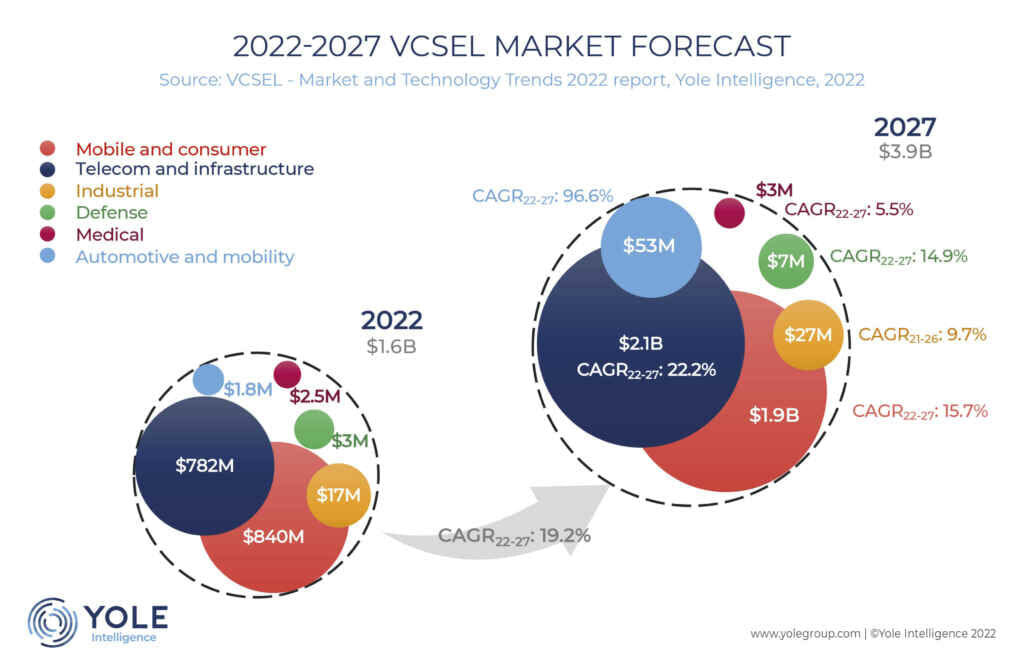

VCSEL market to grow at 19.2% CAGR from $1.6bn in 2022 to $3.9bn in 2027

According to Yole Intelligence’s annual ‘VCSEL – Market and Technology Trends 2022’ report, the vertical-cavity surface-emitting laser (VCSEL) market is reckoned to have almost doubled since 2018. Furthermore, it should rise at a compound annual growth rate (CAGR) of 19.2% from $1.6bn in 2022 to $3.9bn in 2027. In particular, by application during 2022-2027, the datacom sector should grow at a CAGR of 22.2% from $782m to $2.1bn (regaining its supremacy in 2023 and dominating the market), while mobile & consumer grows at a 15.7% CAGR from $840m to $1.7bn.

In the past, the VCSEL market was driven by the datacom sector, the technology’s first volume application. In November 2017, Apple released the iPhone X, embedding VCSELs for face recognition, which changed the game. In 2018, mobile and consumer became the largest market for VCSELs, reaching $440m. Other smartphone makers soon joined this trend, but then stopped using these components a few years later in favor of under-screen fingerprint sensors. Apple remains almost the only player integrating VCSELs.

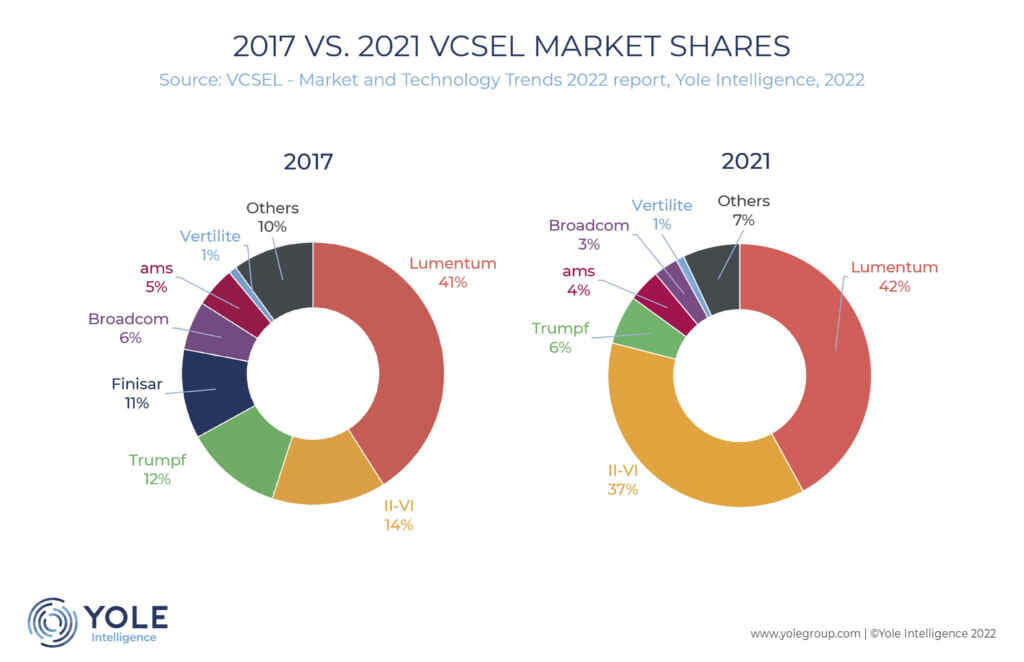

From an oligopoly to a duopoly

The VCSEL ecosystem has changed drastically since 2017, when the market was an oligopoly (dominated mainly by Lumentum, though several other players had significant market shares). By 2022, the VCSEL ecosystem had become a duopoly, with Lumentum and II-VI collectively taking 80% market share.

So, what happened during those five years? Lumentum was the only supplier qualified by Apple at that time. Finisar was still in R&D and struggling to qualify products for Apple. Other players were involved with other smartphone makers or supplying VCSELs for proximity sensors. Then, Coherent (formerly II-VI) acquired Finisar. Lumentum and II-VI are still the only players qualified by Apple for 3D sensing.

At the same time, the leaders also acquired other companies, such as Oclaro and Coherent, amongst several others. This reinforced their positions in the optical communication market, vertically integrating from the VCSEL device to the entire transceiver module.

8” wafers and wavelength shift from 940nm to 1380nm to be the next technology changes

Two major changes are expected in the coming years. In May, IQE demonstrated its first 8” wafers based on germanium instead of gallium arsenide (GaAs). These may not be needed to answer a sudden rise in VCSEL demand but to make possible the integration of photonics devices with CMOS technology. It also gives a potential roadmap toward 12” wafer manufacturing in the long term.

The second major change is the use of dilute nitride active layers to shift the emission wavelength from 940nm to 1380nm, which is needed to enable the integration of VCSELs behind organic light-emitting diode (OLED) displays (which are transparent at this wavelength).

“The iPhone 14 Pro, which was presented in September 2022, embeds a proximity sensor under the display but it could use a laser diode and InGaAs [indium gallium arsenide] photodetector based on InP substrate waiting dilute nitride technology for VCSELs to be ready,” says Pierrick Boulay. “As expected, the first long-wavelength application is a proximity sensor under the display, reducing the notch size on iPhones. Further 3D sensing applications could happen later”.

VCSEL market growing at 13.6% CAGR, doubling from $1.2bn in 2021 to $2.4bn in 2026