News: Markets

16 February 2023

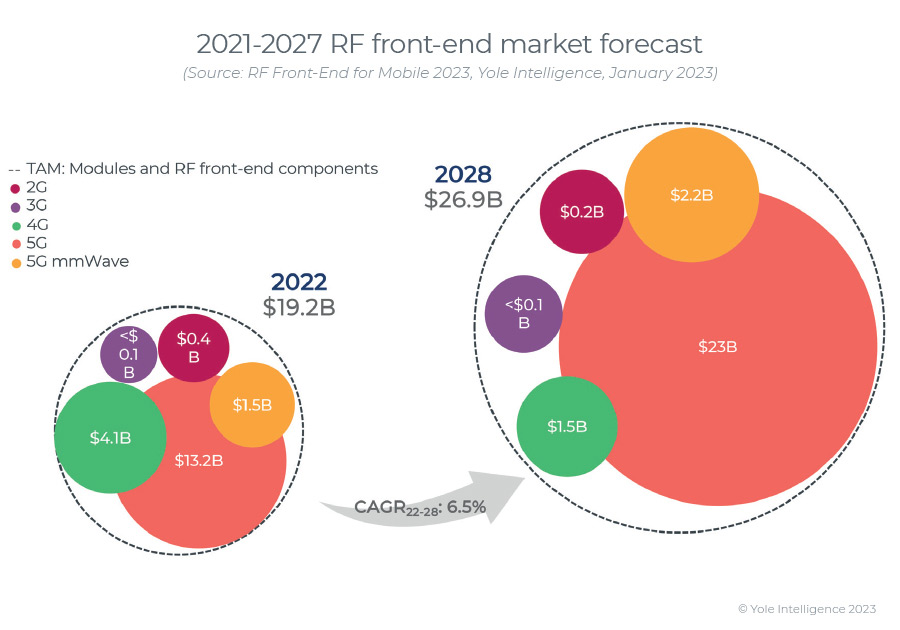

RF front-end market growing at 5.8% CAGR to $26.9bn in 2028

Following the dip caused by the COVID-19 pandemic in 2020, the cell-phone market recovered in 2021, but pre-COVID-19 levels have yet not been reached due to chip supply shortages. Furthermore, in 2022, the smartphone industry was seriously impacted following a global macroeconomic downturn: a market decline with high inflation caused by geopolitical tensions such as the Russia–Ukraine war and tensions between China and Taiwan. This downturn resulted in consumer hesitancy in purchasing new phones, pushing OEMs to enter an inventory correction phase. In addition, the zero-Covid policy in China further destabilized the smartphone manufacturing industry.

“Despite these challenging conditions, 5G phone production reached parity with 4G phone production in 2022, though the growth rate was significantly less than the industry’s expectation,” says Cédric Malaquin, team lead analyst of RF activity within the Power & Wireless Division at Yole Intelligence (part of Yole Group). “5G’s hype has evaporated; however, at Yole Intelligence we expect further penetration in the smartphone market as original equipment manufacturers (OEMs) and mobile network operators (MNOs) further push deployment of this technology.”

The RF front-end market leapt to more than $19bn in 2021 as an effect of the post-COVID-19 recovery and 5G penetration, but 2022 ended flat following the smartphone market decline associated with lower-than-expected 5G penetration, according to Yole Intelligence’s new RF Annual Report ‘RF Front-End for Mobile 2023’. Consequently, the bill of materials (BOM) growth engine has been in low gear. As per the moderate smartphone growth expected toward 2028, along with the limited potential for 5G penetration, Yole Intelligence forecasts that the RF front-end market will rise at a mid-single-digit compound annual growth rate (CAGR) of 5.8% to $26.9bn by 2028. Meanwhile, the market opportunity is huge, and new 5G technical features will keep driving RF front-end technology innovations. Mid to long term, there are developments in the pipeline, and investments are being made to prepare for the next growth wave, which will emerge from 5G advanced and the forthcoming 6G, says Yole.

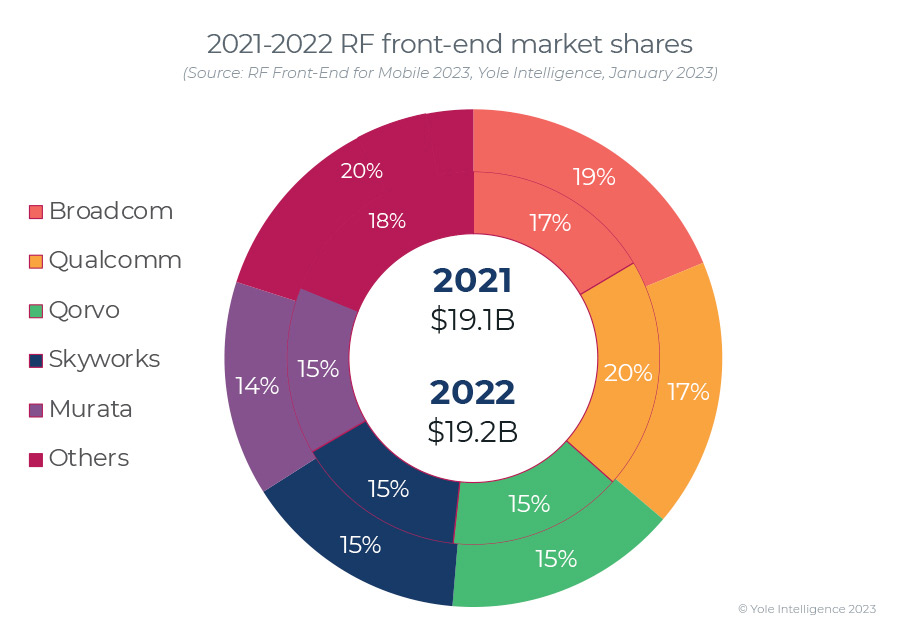

“In 2021, Qualcomm led the market with its end-to-end approach, followed by Broadcom’s custom power amplifier (PA) module offering,” notes Malaquin. “Skyworks and Qorvo have similar company profiles with broad RF portfolios serving all market segments, although Skyworks has been more exposed to increased Chinese competition. Murata’s revenue was low, suffering from growing competition for its filters, and it is restructuring its module portfolio,” he adds. “In 2022, traditional players were impacted by the deterioration in the macroeconomic environment. Except for Broadcom, revenues generated by companies in RF front-end-related segments have decreased.”

The Chinese RF front-end ecosystem has been growing, with fabless companies mainly emerging, most taking a share of their local market. Maxscend, Vanchip and Smarter Micro are the most relevant examples, although Maxscend recently invested in upgrading to a fab-lite business model. In addition, there is a long list of companies with great ambitions and access to financial capital through public offerings on the STAR market. However, not all initiatives will succeed, and Yole expects consolidation to happen in the mid-term. In summary, Chinese RF front-end players are capturing a limited fraction of the market, as OEMs still rely on the leading players for their premium products, but the largest Chinese companies are on their way to catching up with the leaders.

Malaquin is taking part in an RF-dedicated event at the 8th Automotive Sensors and Electronics Summit 2023 in Munich, Germany (22–23 February).