News: Suppliers

13 March 2023

Aixtron maintains annual revenue and earnings growth despite shipment push-outs and delays to export licenses

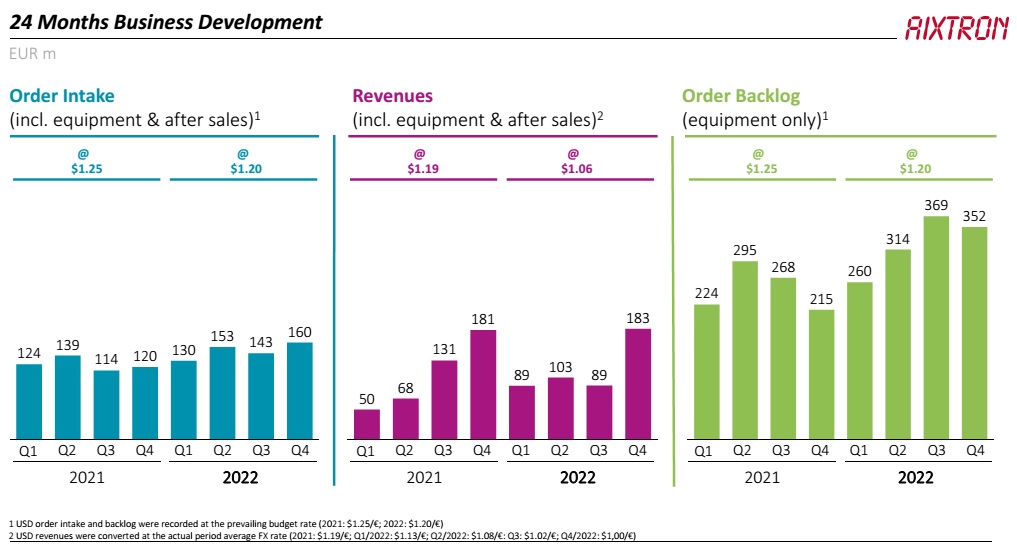

For fourth-quarter 2022, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €183.2m, up slightly (by 1%) from the strong €180.9m a year ago and more than doubling from Q3/2022’s €88.9m (and the best fourth-quarter in terms of shipments since 2011). The growth is attributed to unabated strong demand and stable supply chains plus shipment push-outs from Q3/2022.

“The current megatrends of sustainability, electrification and digitization create a continuously high demand in our core markets for our products. Accordingly, we were able to continue our strong growth from 2021 also in 2022,” notes CEO Dr Felix Grawert. “We have successfully mastered the global supply chain issues of the year 2022 and also maneuvered around some of the delays in export licenses that required us to shift some production slots back and forth within the year.”

Full-year revenue grew by 8% from 2021’s €429m to €463.2m in 2022, within the guidance range of €450-500m despite some customer-related delays in delivering systems.

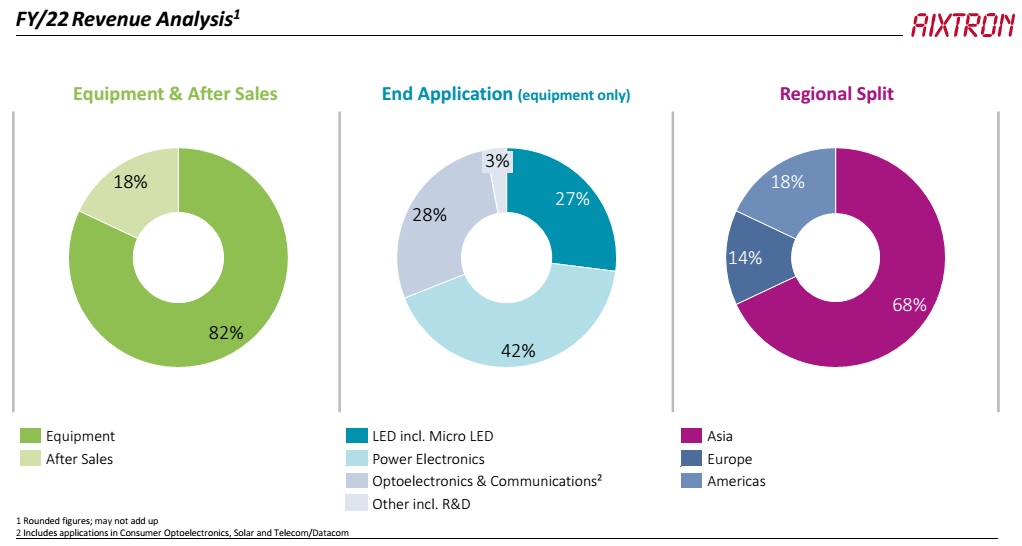

On a geographic basis, Asia fell further, from 70% to 68% of full-year revenue (due to China plummeting from €211.8m to €150.8m, while Taiwan grew from €66.1m to €77.5m and Korea rocketed from €4.7m to €40.8m). Europe fell from 20% to 14%, while the Americas rebounded from 10% to 18% (almost doubling from €43.1m to €83.1m).

Of total annual revenue, 82% came from equipment sales (€380.4m, up 3.8% on 2021’s €366.5m) and the remaining 18% (€82.8m) came from after-sales (consumables, spare parts and services).

Growth was driven by the ongoing strong demand for efficient gallium nitride (GaN)- and silicon carbide (SiC)-based power electronics, particularly for ecologically sustainable applications, notes Aixtron.

Of the equipment revenue, metal-organic chemical vapor deposition (MOCVD)/chemical vapor deposition (CVD) systems for making GaN- and SiC-based wide-bandgap Power Electronic devices again comprised the largest share, at 42% or €160.6m (up from 2021’s 38%, or €139.7m). MOCVD systems for making Optoelectronics devices (solar, telecoms/datacoms and 3D sensing lasers for consumer electronics) comprised 28% or €106.2m (down from 2021’s 37%, or €137m). MOCVD systems for making LEDs comprised 27% or €103.2m (rebounding from 2021’s 23%), driven by growing demand for micro-LEDs.

Full-year gross margin held steady at about 42% (above the original guidance of 41%). Quarterly gross margin was 45%, up from 44% for both Q3/2022 and a year ago, due mainly to improved product mix.

Full-year operating expenses rose from €82.5m in 2021 to €90.6m in 2022 (albeit rising only slightly from 19% to 20% of revenue), driven by higher variable compensation elements and higher personnel costs after increasing staffing by 25% (from 718 at the end of 2021 then 842 at the end of Q3/2022 to 895), combined with slightly higher R&D spending. The already high level of investment in R&D of €56.8m in 2021 was not only maintained but even slightly increased, to €57.7m (12% of revenue) in 2022.

Full-year operating result (EBIT, earnings before interest and taxes) rose from 2021’s €99m to €104.7m in 2022 (with EBIT margin remaining 23%, at the top end of the original 21–23% guidance range). Fourth-quarter EBIT was again very strong at €57.1m, up from €16.2m in Q3/2022 and almost matching Q4/2021’s €57.9m (which had more than doubled year-on-year from Q4/2020’s €24.5m).

Full-year net profit grew from 2021’s €94.8m (€0.85 per share) to €100.5m (€0.89 per share) in 2022. Quarterly net profit was €50.3m (€0.44 per share), up from €19.1m (€0.28 per share) in Q3/2022 but down only slightly from €51.9m (€0.46 per share) a year ago.

Build-up of inventories

Operating cash flow was -€0.1m in Q4/2022, compared with €0.5m in Q3/2022 and €25.9m a year ago. Hence, full-year operating cash flow has fallen from €66.4m in 2021 to €37.1m for 2022.

Capital expenditure (CapEx) has risen further, from just €4.4m a year ago and €8m in Q3/2022 to €12.6m in Q4/2022, taking full-year CapEx from 2021’s €17.7m to €29.5m for 2022, largely comprising investments in new-generation MOCVD tools. In particular, in anticipation of a further increase in demand, Aixtron increased its investments in property, plant and equipment (especially in R&D-related laboratory equipment and expansions) from 2021’s €16.4m to €27.4m in 2022.

Quarterly free cash flow has hence gone from €21.5m in Q4/2021 to –€7.5m in Q3/2022 then –€11.3m in Q4/2022. Full-year free cash flow has fallen from 2021’s €48.7m to €7.7m for 2022, due mainly to temporary working capital effects such as high accounts receivables as a result of the very late shipments in December 2022 as well as further a build-up of inventories from €120.6m at the end of 2021 and €209.2m at the end of September to €223.6m (due to the push-out of shipments and preparation for the large number of shipments hence scheduled for subsequent quarters).

Cash and cash equivalents (including financial assets) has fallen further, from €352.5m at end-2021 and €339.2m at the end of Q3/2022 to €325.2m at the end of 2022.

In view of the very positive business development in 2022, at the Annual General Meeting (AGM) of shareholders on 17 May Aixtron’s Executive Board and Supervisory Board will therefore propose to pay a dividend of €0.31 per share (compared with €0.30 per share in 2021). The total payout of €34.8m (up from €33.7m in 2022) corresponds to a payout ratio of about 35% of net income for the year.

Second largest order intake in company's history

Fourth-quarter 2022 order intake was €160.3m, up 12.3% on €142.8m in Q3/2022 and up 34% on €119.7m in Q4/2021. Full-year order intake grew by 18% from 2021’s €497.3m to €585.9m in 2022 (the second highest in the firm’s almost 40-year history, after 2010, and exceeding the original guidance range of €520–580m and above the mid-point of the revised guidance range of €540–600m).

Aixtron says that this demonstrates the enduring trend towards efficient GaN and SiC power electronics, which grew from under 45% of order intake in 2021 to well over half in 2022. In particular, orders related to SiC power electronics devices more than tripled year-on-year, boosted from Q3 onwards by Aixtron’s new G10-SiC multi-wafer (9x6” or 6x8”) CVD system — launched in mid-September — which already comprises the vast majority of SiC orders, having a strong impact on overall growth.

Driven by the overall positive order development, equipment order backlog grew by 64% from €214.6m at the end of 2021 to €351.8m at the end of 2022.

Indicating the higher levels of shipments that are expected to be made, advance payments received from customers have risen further, from €121.8m at the end of Q3/2022 (almost a third of the order backlog) to €141m at the end of Q4/2022 (about 40% of the order backlog), almost doubling year-on-year from €77m at the end of 2021.

Double-digit growth expected for 2023

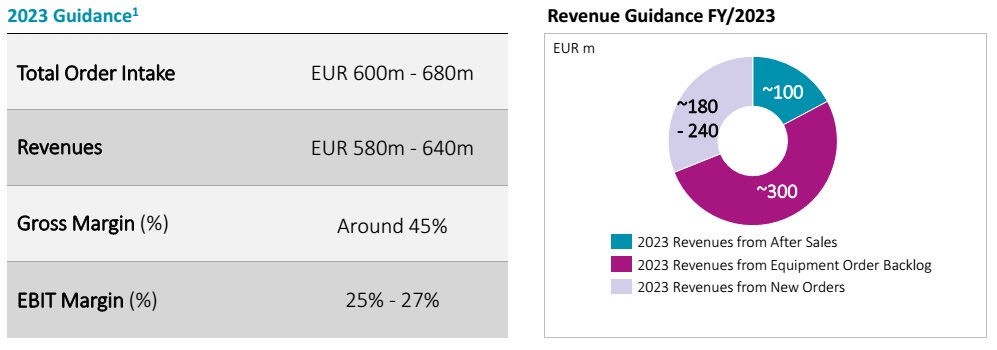

Based on the budgeted exchange rate of $1.15/€ (versus $1.20/€ in 2022), for full-year 2023 Aixtron expects over 9% year-on-year growth in order intake to €600–680m.

Based on the equipment order backlog (convertible into 2023 revenue) of about €300m as of 1 January, joined by a forecasted €180–240m in new order intake that should be convertible into revenue during 2023, plus a forecasted €100m in after-sales revenue, Aixtron expects double-digit growth in full-year revenue to €580–640m in 2023 (including the shift of some units assembled in 2022 and shipped in 2023). The firm also expects full-year gross margin of about 45% and EBIT margin of 25–27% for 2023.

“The order situation, especially for GaN and SiC power electronics, is developing very positively,” notes Grawert. “Since the third quarter of 2022, our new G10-SiC deposition tool has made a significant contribution to this as it generated very strong demand. And it is providing a key to the transition to electro-mobility and CO2 reductions in the mobility sector,” he adds.

“We are also already receiving very positive feedback on our new system for optoelectronics and micro-LEDs, the new G10-AsP,” continues Grawert, who describes it as a “major step forward in both the area of micro-LEDs but also in the segment of high-performance lasers and VCSELs… We are convinced that micro-LED displays will be the next generation of display technology”.

ams OSRAM qualifies Aixtron’s G5+ C and G10-AsP systems on 200mm wafers for micro-LEDs

Aixtron launching G10-AsP system at Photonic West

Aixtron shipment pushouts in Q3 to lead to record revenue in Q4

Aixtron launches G10-SiC 200mm CVD system

Aixtron’s Q2 revenue up 51% year-on-year, driven by demand from SiC and GaN power electronics

Aixtron expands MOCVD market share to 75% in 2021

Aixtron grows revenue 59% and orders 65% in 2021, driven by power electronics