News: Markets

9 March 2023

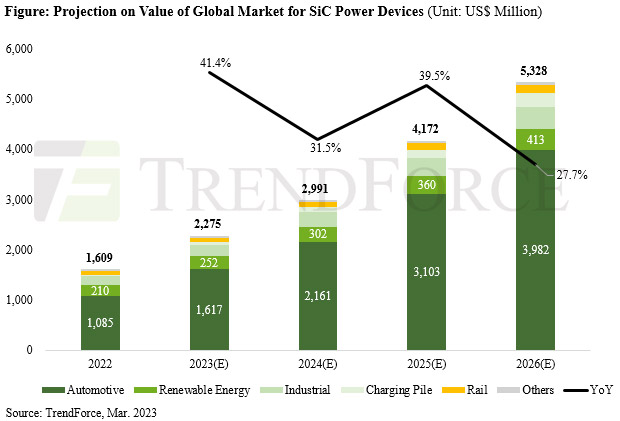

SiC power device market to grow 41.4% to $2.28bn in 2023

According to its latest survey of the market for compound semiconductors, market research firm TrendForce projects that the global market for silicon carbide (SiC) power devices will grow by 41.4% year-on-year to $2.28bn in 2023, highlighted by chipmakers onsemi and Infineon respectively forming collaborative relationships with both carmakers and developers of energy solutions, for the two largest application segments: electric vehicles ($1.09bn in 2022, comprising 67.4% of the market) and renewable energy ($210m in 2022, or 13.1% of the market).

US-based onsemi has entered into a strategic agreement to provide its EliteSiC 1200V power modules to Volkswagen for main traction inverters. Kia has also adopted the EliteSiC series for its latest electric compact crossover SUV, EV6 GT. Also, US-based Wolfspeed has strengthened its partnership with major carmaker Mercedes-Benz, signing an agreement to supply its SiC power devices for use in electric vehicles.

In renewable energy, onsemi has begun collaborating with Ampt to provide power semiconductor devices for solar photovoltaic and energy storage systems. Specifically, Ampt will adopt onsemi’s SiC MOSFET for its DC string optimizers. Likewise, Infineon’s CoolSiC devices have been adopted by Taiwan-based Delta Electronics for its bi-directional inverters, which can serve as a hybrid three-in-one system for the integration of solar photovoltaics, energy storage, and charging of electric vehicles. CoolSiC devices have also been selected by US-based hydrogen platform developer Bloom Energy to further improve the efficiency of its fuel cell system and electrolyzer.

SiC substrates not only account for up to 49% of the cost of a SiC power device but also determine the product’s quality. Currently, Wolfspeed has more than 60% of the market for SiC substrates. Recently, Japan’s Resonac (formerly Showa Denko) secured a long-term agreement with Infineon to first supply mostly 6-inch SiC materials, and then to support Infineon’s transition to 8-inch SiC. Also, France-based Soitec has expanded its collaboration with STMicroelectronics (ST), in which ST will use Soitec’s SmartSiC technology to manufacture 8-inch SiC substrates.

Regarding the growth in SiC substrate production capacity, Wolfspeed currently has a plant for producing 8-inch SiC substrates, and plans to build a second fab for SiC power devices on 8-inch substrates, this time sited in Germany (in which automotive electronics component maker ZF Group is a joint investor, committing hundreds of millions of dollars).

Currently, semiconductor companies worldwide are highly attentive to the transition in SiC substrate diameter. With Wolfspeed being the first to activate production capacity for 8-inch SiC substrates, other suppliers will follow suit and pursue collaborations with player both upstream and downstream in the supply chain, expects TrendForce. The market research firm hence forecasts that the global SiC power device market will climb to about $5.33bn in 2026. The two largest application segments will remain electric vehicles (rising at a CAGR of about 38% from 2023 to $3.98bn in 2026) and renewable energy systems (rising at a CAGR of about 19% from 2023 to $410m in 2026), concludes TrendForce.

The market for third-generation (compound) semiconductors encompasses products based on silicon carbide (SiC) and gallium nitride (GaN). In particular, SiC products account for about 80% of the total market value. SiC is suitable for applications that require high voltages and high current levels. The adoption of SiC power devices will hence further improve the efficiency of electric vehicles and renewable energy systems.

Automotive SiC power component market to grow to $1bn in 2022 then $3.94bn by 2026

Third-generation power semiconductors growing at 48% CAGR from $980m in 2021 to $4.71bn in 2025