News: Suppliers

25 April 2024

IQE’s annual revenue falls 31.2% in 2023, impacted by excess inventory

For full-year 2023, epiwafer and substrate maker IQE plc of Cardiff, Wales, UK has reported revenue of £115.25m, down 31.2% on 2022’s £167.5m.

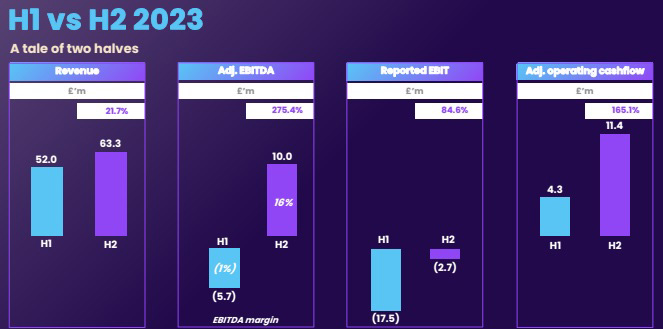

The global semiconductor industry downturn presented a temporary but significant challenge to sales volumes in Q1-Q3/2023 prior to a gradual improvement in market dynamics and customer demand in Q4/2023 (contributing to second-half 2023 revenue of £63.3m returning to double-digit growth, up 21.7% on first-half 2023’s £52m).

Photonics wafer revenue fell by 33.3% from 2022’s £88.7m to £59.1m (51.3% of total wafer sales) in 2023. This was due mainly to a slowdown in Asian telecoms infrastructure programs as well as high inventory levels due to weak demand impacting 3D sensing for the handset market, offset partially by a resilient performance in infrared-related products for aerospace and security markets.

Wireless wafer revenue fell by 29.1% from 2022’s £76m to £53.9m in 2023 (46.7% of total wafer sales). This was due to a decline in wireless gallium arsenide (GaAs) epiwafer sales (impacted by softness in the global smartphone handset market and build-up of inventory in supply chains) as well as weakness in gallium nitride (GaN) epiwafer sales for 5G infrastructure.

CMOS++ revenue fell by 18% from 2022’s £2.8m to £2.3m (2% of total wafer sales) in 2023. This reflected elevated inventory levels caused by weak demand for consumer goods.

Due mainly to the semiconductor industry downturn and the associated reduction in customer sales volumes and revenue, adjusted operating loss rose from £3.6m in 2022 to £20.2m in 2023.

Photonics adjusted operating margin fell from 12.6% in 2022 to –16.9% in 2023, reflecting the significant under-utilization of manufacturing capacity.

Despite the declines in volume and revenue, Wireless adjusted operating margin rose from 6.2% in 2022 to 8.6% in 2023. This primarily reflects the reduction in manufacturing capacity and cost linked to the closure of the Singapore site in 2022, the cessation of manufacturing activities at the Pennsylvania site in 2023, and the positive impact of working capital actions that resulted in the consumption of old inventory and the cash collection of previously impaired trade receivables.

Due to the under-utilization of manufacturing capacity, adjusted EBITDA (earnings before interest, tax, depreciation and amortization) fell from 2022’s £23.4m (14% margin) to £4.3m for 2023 (4% margin) on a reported basis. Positive EBITDA margin was maintained following decisive action to reduce costs, says IQE.

To mitigate the semiconductor industry downturn and reduction in customer volumes and revenues, IQE took “strategic actions to reshape our cost base as part of our ongoing commitment to improving margins and profitability,” says CEO Americo Lemos. Cost-rationalization actions implemented during 2023 include:

- discretionary expenditure savings in areas including travel, marketing, legal and professional;

- the optimization of manufacturing asset utilization (including idling reactors to reduce cost and align capacity with lower customer volumes);

- a restructuring program and associated reduction in headcount (of more than 10%) and hence labour cost; closure of IQE’s Pennsylvania molecular beam epitaxy (MBE) operation and consolidation into its North Carolina manufacturing facility (with customer qualifications now complete and production ramped) and the sale of excess tools; and

- continuing to work with key customers to optimize global footprint.

As part of the cost rationalization and global footprint optimization plan, restructuring costs of £4.7m were incurred. Other significant infrequent costs incurred relate to the new starter bonus, payable over three years, for the CEO and severance and recruitment fees following the departure of the former chief financial officer.

Despite the decline in trading performance and profitability, reported net cash generated from operations rose from £8.9m in 2022 to £10.1m for 2023. This mainly reflects the strong working capital management, particularly in inventory and trade receivable management.

Cash capital expenditure on property, plant and equipment (PP&E) rose from £9.4m in 2022 to £12.2m in 2023 in order to support IQE’s strategic diversification and growth strategy (including strategic investment in GaN capacity). This was focused mainly in Taiwan, Newport and Massachusetts to support future growth opportunities, intangible asset expenditure of £3.1m focused on a combination of intellectual property and IQE’s multi-year strategic IT transformation program, and investment in targeted capitalized technology development of £2.8m.

Cash & equivalents have hence fallen from £11.6m to £5.6m.

During 2023, adjusted net debt was cut from £15.2m to £2.2m. This was after IQE took steps to strengthen its balance sheet including:

- an equity fundraise (completed on 18 May 2023) of £31.1m (£29.8m net);

- refinancing (on 16 May 2023) of HSBC Bank plc’s £27.3m ($35m) multi-currency revolving credit facility, which has been extended to 1 May 2026 (with quarterly leverage and interest cover covenant tests applicable to the facility, commencing December 2023), with an undrawn balance of $30m (£23.4m) available at end-2023.

These steps, combined with cost rationalization and cash preservation actions, provide the necessary liquidity to navigate the semiconductor market downturn and allow IQE to continue investing in its growth and diversification strategy, reckons the firm.

“We made good progress against our diversification strategy following our investment into GaN capacity, with new customer design wins in the Power Electronics and Automotive sectors,” says Lemos.

Strategic highlights

Specifically, IQE is making strategic progress to maintain and grow its position in the Connect and Sense markets alongside diversifying into higher-growth Power and Display markets:

Connect

- protected existing Wireless business while expanding the Connect customer base, engaging tier-1 OEMs in Asia serving the Android ecosystem;

- successful qualification of products for WiFi and 4G & 5G handset applications for emerging markets;

- launched new vertical-cavity surface-emitting laser (VCSEL) capability for high-speed optical interconnects used in artificial intelligence (AI) data-center applications.

Sense

- High-volume production ramp of new VCSEL for advanced 3D sensing applications with a tier-1 handset maker;

- successfully qualified second-generation VCSEL products with consumer smartphone leaders, developing new high-performance 3D sensors;

- expanded 3D sensing portfolio to include new longer-wavelength products for higher-performance imaging applications in handset and AR/VR platforms.

Power

- deployed GaN power capacity in the USA and UK to serve the global power electronics market utilizing proceeds from the placing in May 2023;

- expansion of diverse customer pipeline, consisting of market leaders across fabless, foundries and OEMs serving automotive and emerging data-center server power markets, with qualifications ongoing.

Display

- continued development of RGB micro-LED portfolio through engagement with multiple tier-1 display manufacturers;

- developed new disruptive 8-inch germanium-based platform for use as a red emitter in micro-LED displays;

- delivery of the first display-grade 8-inch GaAs- and silicon-based wafer products will commence in first-half 2024, complementing engagements with customers developing AR/VR format displays.

IQE says that it remains committed to executing its growth and diversification strategy as it builds on the good progress made in 2023 by expanding the customer pipeline and focusing on GaN power product qualification with tier-1 suppliers into automotive OEMs.

There are increasingly positive signs that the global semiconductor industry is recovering from what has been an unprecedented cyclical downturn in terms of both its extent and duration, notes IQE. The firm saw recovery in second-half 2023, which has continued into Q1/2024, with inventory levels beginning to normalize and customer demand recovering. Trading during Q1 has been in line with expectations and the order book for the remainder of first-half 2024 is strengthening. “We expect to see this improvement continue through 2024, despite persisting uncertainties in the global economy,” says IQE.

“Buoyed by the ongoing industry recovery, IQE is well positioned within the global value chain to deliver sustainable growth and capture opportunities in 2024 and beyond,” reckons Lemos.

Full-year 2024 results are expected to be within the range of analyst forecasts of £133.7–153.7m for revenue and £11.1–16.6m for adjusted EBITDA.

Market dynamics and customer demand is expected to continue to improve, aligned with external market views, in 2024, ahead of a full market recovery by 2025.

Board update

Jutta Meier joined the board as chief financial officer in January 2024. Also, following the retirement of Sir Derek Jones, Bami Bastani and Maria Marced joined as non-executive directors during 2023, bringing experience from firms including Intel, GlobalFoundries and TSMC. Also joining was Harmesh Suniara of major shareholder Lombard Odier, adding significant capital markets experience. Female representation on the board is now an above-average 44%.

Senior management update

During 2023, IQE’s executive leadership team was strengthened with the appointment of key individuals with significant industry experience. Peter Rabbeni was appointed as senior VP, Communications Infrastructure & Security. He was joined in January by Rina Pal-Goetzen as VP of Government Affairs, focusing on engagement with the US Government, specifically in regards to CHIPS Act funding.

Environmental, Social and Governance (ESG) update

IQE is developing frameworks and processes to adopt and align with the Task Force on Climate-Related Financial Disclosures (TCFD) and will publish its first TCFD Statement in its 2023 Annual Report. The firm is also focused on developing emissions targets in accordance with the Science Base Targets initiative (SBTi), and is on track to submit targets within the 24 month commitment window.

IQE appoints chief financial officer

IQE appoints VP of government affairs

IQE expecting full-year 2023 of £115m after 20% growth from first half to second half

IQE appoints new board members from TSMC and GlobalFoundries

IQE’s first-half revenue down about 40% year-on-year

IQE appoints senior VP, Communications Infrastructure and Security