News: Markets

22 April 2024

EV DC charging system market to reach $23.7bn by 2029

Due to the continual expansion of charging infrastructure and the coming need for infrastructure replacements, the emergence of electric vehicle direct current (EV DC) charging holds long-term market viability and presents a promising business venture for companies specializing in power electronics, reckons market analyst firm Yole Group. Meanwhile, alternating current (AC) chargers will persist alongside onboard chargers (OBCs) in vehicles until DC infrastructure becomes universally established, a process anticipated to take 10–15 years, says the firm in ‘DC Charging for Automotive 2024’, an update of its annual report.

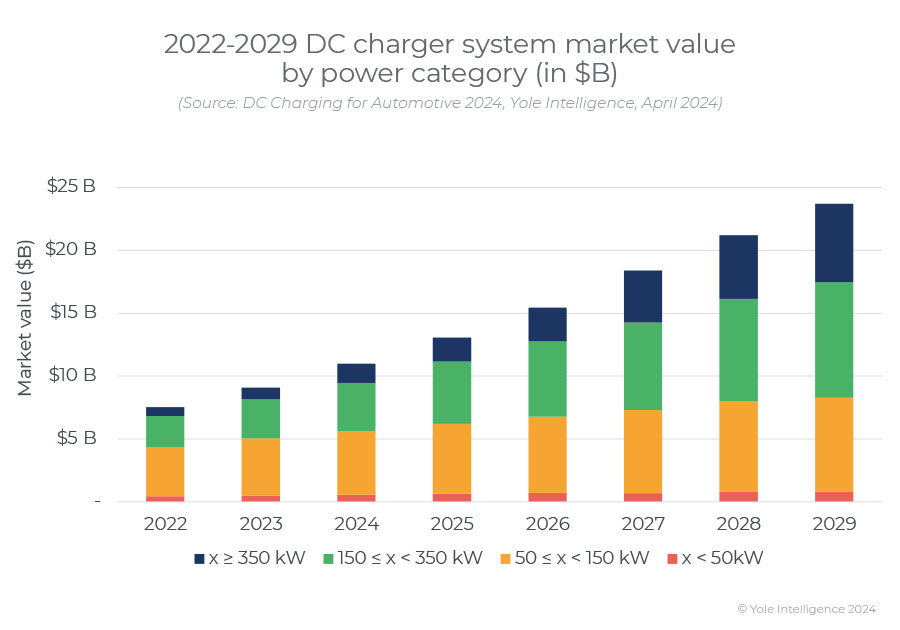

The total EV DC charging system market is expected to soar to $23.7bn by 2029. While chargers 50–150kW dominated the market in 2023, there is a noticeable surge in demand for higher-power chargers, particularly those exceeding 150kW. By 2029, the highest market value, estimated at $9.2bn, will be attributed to very high-power chargers (150kW≤x≤350kW).

“The integration of 1000V chargers is expected. The objective is clearly to simplify the charging experience for EV owners, irrespective of their battery pack voltage (400V or 800V), thereby streamlining the process of ‘plug and go.’,” says Milan Rosina Ph.D., principal analyst, Power Electronics & Battery at Yole Group. “This advancement will alleviate concerns for OEMs with EVs utilizing 800V battery systems. Indeed, it will eliminate the need to adapt batteries to 500V chargers. Ultimately, this technological shift promises reductions in volume, weight and cost at the vehicle level.”

“The primary trends observed in EV DC chargers involve two key advancements: the increase in maximum charger voltage from 500V to 1000V to accommodate both 400V and 800V batteries and an escalation in power levels to above 350kW for exceedingly rapid charging. However, chargers with nominal power exceeding 350kW exceed the current charging capabilities of most electric vehicles,” says Hassan Cheaito Ph.D., technology & market analyst, Power Electronics.

“These ultra-fast chargers are increasingly engineered to charge multiple vehicles concurrently through dynamic power allocation features,” notes Yu Yang, Ph.D., principal analyst, Automotive Semiconductors. “Bidirectional chargers are not anticipated to become mainstream until V2G [vehicle-to-grid] technology gains traction.”

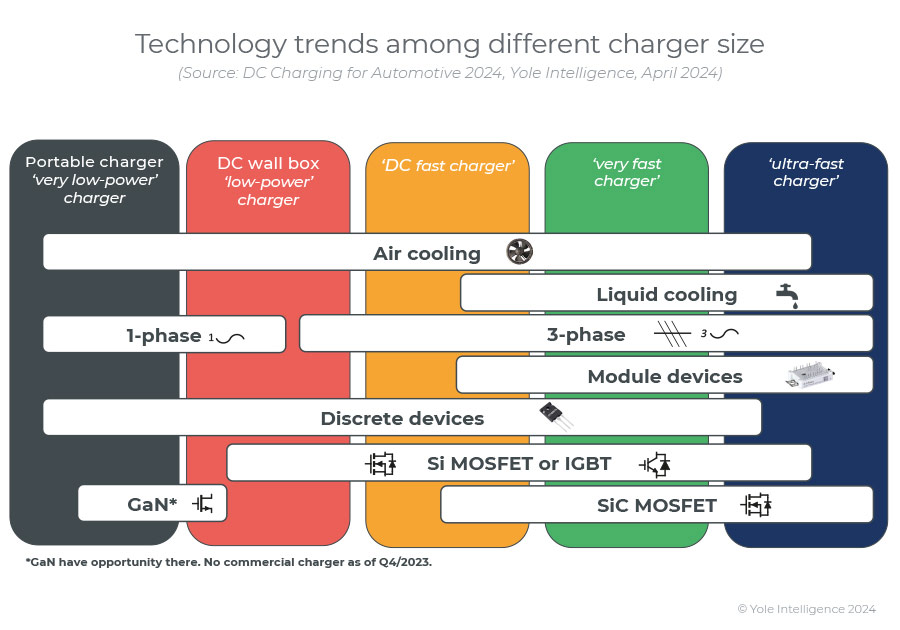

Silicon transistors, specifically discrete insulated-gate bipolar transistors (IGBTs) and metal-oxide-semiconductor field-effect transistors (MOSFETs), remain prevalent in EV DC chargers. The adoption of silicon carbide (SiC) MOSFET devices is driven by factors such as a smaller charger footprint, enhanced thermal capabilities (resulting in simpler and more cost-effective cooling systems), and a higher breakdown voltage of 1200V. The collective impact of these parameters, coupled with a favorable return on investment particularly in high-utilization charging stations, is promoting the widespread adoption of SiC technology.

In addition, since liquid cooling systems are increasingly utilized in ultra-fast chargers, there is growing interest extending even to lower-power applications in residential or enclosed settings where noise reduction is a critical consideration.