News: Optoelectronics

26 August 2024

Lumentum’s quarterly revenue falls 16% to $308.3m

For its fiscal full-year 2024 (ended 29 June), Lumentum Holdings Inc of San Jose, CA, USA (which designs and makes optical and photonic products for optical networks and lasers for industrial and consumer markets) has reported revenue of $1359.2m, down 23.1% on $1767m in fiscal 2023.

Specifically, Cloud & Networking segment revenue fell by 18% from $1322.5m to $1084.m. Overall demand for telecom products was soft, as expected. Industrial Tech segment revenue fell by 38.3% from $444.5m to $274.3m.

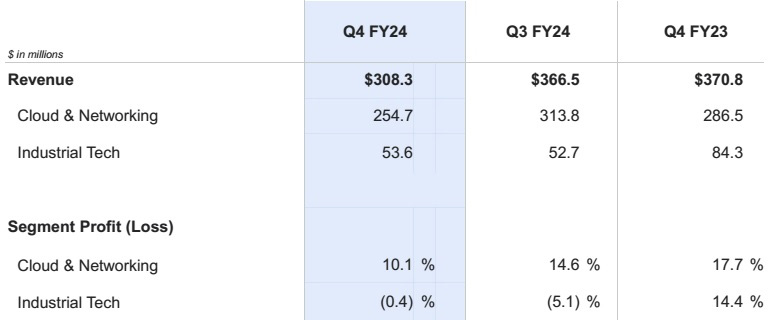

Fiscal fourth-quarter 2024 revenue was $308.3m, down 15.9% on $366.5m last quarter and 16.9% on $370.8m a year ago, albeit above the midpoint of the $290–315m guidance range.

Cloud & Networking segment revenue was $254.7m, down 18.8% on $313.8m last quarter and 11.1% on $286.5m a year ago. Specifically, Telecom revenue fell by $30m sequentially.

Industrial Tech segment revenue was $53.6m, up 1.7% on $52.7m last quarter but down 36.4% on $84.3m a year ago. “Like others in this space, we continue to face challenges due to the weak end-market demand and high levels of customer inventory,” notes president & CEO Alan Lowe.

On a non-GAAP basis, gross margin has fallen further, from 36.7% a year ago and 32.6% last quarter to 32.2%. This contributed to full-year gross margin declining from 43.2% in 2023 to 33% for 2024 due to lower overall demand and factory utilization.

Quarterly operating expenses were $100m (32.4% of revenue), down by $2.4m on a year ago. This is despite R&D spending of $64.9m being up on $61.7m a year ago, driving full-year R&D spending up from $249m in 2023 to $260.4m for 2024, focused on Datacom transceivers due to the strong customer traction. Quarterly SG&A expense has shrunk from $40.7m a year ago to $35.1m, leading to a full-year decline from $175.3m to $150.7m.

“To increase investments in programs that accelerate our exposure to significant new AI opportunities, we decided to stop our in-house development of certain communications ASICs, including coherent DSPs and RFICs,” notes executive VP & chief financial officer Wajid Ali. “We can meet customer needs using ASICs from third-party partners while reallocating significant R&D spending towards new cloud and AI customer programs. Hence, in Q4 we recorded $35.8m of restructuring and related charges, including a $29.1m write-off of in-process R&D intangible assets.”

Full-year operating profit plummeted from $339.2m (19.2% margin) in 2023 to just $37.8m (2.8% margin) for 2024. Compared with an operating profit of $33.7m (9.1% operating margin) a year ago, fiscal Q4 yielded an operating loss of $0.8m (margin of –0.3%, albeit better than the midpoint of the guidance range of between –3% and +1%). Cloud & Networking segment operating margin was 10.1%, down from 17.7% a year ago. Industrial Tech segment operating loss improved from 5.1% last quarter to 0.4%, although this is down on 14.4% a year ago.

Quarterly net income has fallen further, from $40.2m ($0.59 per diluted share) a year ago and $19.6m ($0.29 per diluted share) last quarter to just $4m ($0.06 per diluted share, albeit above the midpoint of the guidance range of between a loss of $0.05 and a profit of $0.10). Full-year net income hence fell from $315.3m ($4.56 per diluted share) in 2023 to $68.7m ($1.01 per diluted share) for 2024.

“We exceeded our guidance midpoints for both revenue and EPS in the fourth quarter,” notes Lowe.

In fiscal Q4, capital expenditure (CapEx) was $24m, driven mainly by adding high-speed transceiver production capacity at the firm’s manufacturing site in Thailand. Cash flow from operations for fiscal full-year 2024 was $24.7m. Total cash, cash equivalents and short-term investments rose by $16.1m during the quarter from $870.9m to $887m, due primarily to improved working capital performance after a $22m sequential reduction in overall inventory levels.

“We booked record orders for datacom chips and are investing in additional production capacity to help us meet customer demand,” says Lowe. “We have made excellent progress with multiple new high-speed optical transceiver customer engagements, including securing a major transceiver award with one new customer. We are actively working to secure additional awards from other new customers,” he adds. “We saw emerging positive trends in the broader traditional networking market,” says Lowe.

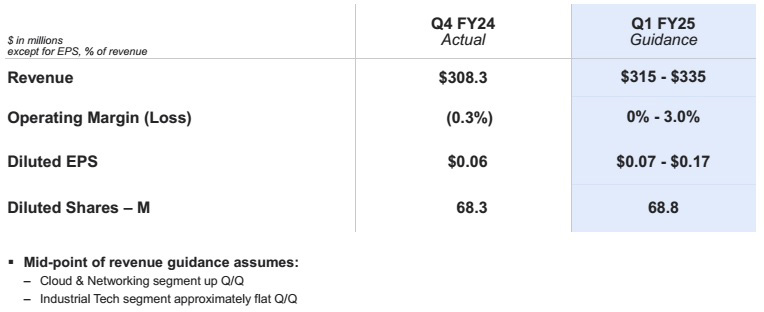

For fiscal first-quarter 2025, Lumentum expects revenue growth to $315–335m. Cloud & Networking should rise sequentially, driven mainly by a recovery in telecom networking demand from the low in fiscal Q4/2024. Industrial Tech revenue is expected to be flat to down sequentially, due to decreased industrial laser shipments (continued weak end-market demand and ongoing customer inventory adjustments) offset by a modest seasonal uptick in 3D sensing revenue.

“In future quarters, we anticipate gross margin will sequentially increase as manufacturing utilization improves due to an improved telecom outlook, as well as an increase in datacom laser shipments,” says executive VP & chief financial officer Wajid Ali. Operating margin should improve to 0–3%. Diluted earnings per share should rise to $0.07–0.17.

“We are making significant progress executing our strategy to broaden our cloud and AI customer base, which will lead to accelerated growth in calendar year 2025,” says Lowe.

To achieve its cloud and AI goals, Lumentum is implementing a three-pronged strategy.

1. Expanding its customer base to include multiple data-center operators and AI infrastructure providers as they migrate to higher speeds.

“Within data centers, the shift to 200G lane speeds, particularly in 1.6T optical transceivers, plays to our strengths,” says Lowe. “The growing importance of single-mode optics and indium phosphide lasers, driven by the limitations in multi-mode optics, aligns well with our market and technology leadership positions. Our industry-leading 100G EML transmitter components have established a strong reputation for performance, quality and reliability, and are currently shipping in record volumes,” he adds. “Our proven capabilities position us favorably as the industry adopts 200G-per-lane technologies. Our 200G EMLs are being qualified by multiple customers for integration into their transceivers and subsequent deployment in a wide range of cloud and AI infrastructures. We anticipate being a key laser supplier in initial 1.6T transceiver deployments as we ramp up 200G EMLs later this fiscal year.”

“In Q4, we achieved record volume shipments of EMLs and secured substantial bookings, which we will be working to fulfill throughout fiscal 2025. This includes initial orders for 200G EMLs from leading AI customers. Based on this momentum, we foresee continued strong EML shipments throughout fiscal 2025 and into fiscal 2026.”

“Additionally, we are supplying differentiated laser sources for silicon photonics-based transceivers, further broadening our content opportunity within the data-center market. We have also made significant progress on our newest 800G and initial 1.6T transceiver product developments. We are deeply engaged with multiple customers and we have received favorable feedback after providing product samples to these customers. We have secured a major award with one new customer and are actively working to finalize additional awards with multiple customers.”

2. Scaling up manufacturing capacity for both optical transceiver modules and components at established Lumentum facilities outside China.

“This expansion is critical to supporting our cloud customers growing AI and cloud workloads while ensuring supply chain security,” notes Lowe. “Indium phosphide lasers are essential for scaling data-center infrastructure. Due to overwhelming demand for our critical technology, our indium phosphide capacity is fully subscribed to at least the end of calendar 2025. Therefore, we can only meet this demand by growing capacity,” he adds. “In the current fiscal first quarter, we have already invested $43m in our indium phosphide wafer fab facilities and we expect to continue to invest in our indium phosphide capacity over the next several quarters to keep up with the growing demand of these enabling laser technologies. Although the industry faces a broad shortage of indium phosphide lasers, over time our capacity additions will help mitigate these constraints. However, we anticipate that our production output will remain on allocation through at least the end of calendar 2025.”

“Our significant capacity expansion for optical transceivers in our facility in Thailand is progressing as planned, with the first production line scheduled to start operations [and begin shipping its first sample products] this quarter [with qualifications then volume production ramp-up beginning in calendar first-quarter 2025]. Based on current engagements with multiple hyperscale cloud operators and AI infrastructure customers, we expect to complete additional phases of our manufacturing capacity expansion over the next 18 months to keep up with the expected strong demand.”

3. Executing on the firm’s differentiated technology roadmaps to support the evolving challenges of data-center compute scaling across future generations of optical interconnect technologies and data-center architectures, encompassing both increased data-link capacity and enhanced energy efficiency.

“We are actively collaborating with leading-edge customers to deliver breakthrough technologies that will support multi-year cloud and AI infrastructure roadmaps,” says Lowe. “Optical switching, a critical component of future cloud and AI networking architectures, presents a significant opportunity for us. Our optical switch products in development offer advantages in power efficiency, increased bandwidth, reduced latency, flexibility and agility. We have shipped evaluation units to multiple customers and the initial feedback has been overwhelmingly positive,” he adds.

“Another key technology area is enabling the transition to high-density, low-power optical links for future generations. Our ultra-high-power laser technologies have attracted considerable interest from cloud and AI infrastructure customers developing high-density optical interconnects. Our heritage of delivering high-performance, high-reliability lasers in high-volume production environment position us favorably for this emerging market.”

“Lastly, we are focused on enabling the shift to speeds beyond 200G per lane, such as the 400G-per-lane generation. Our advanced indium phosphide and photonic integrated circuit capabilities honed through years of experience in data-center and high-performance telecom applications are essential to meeting future demands.”

“While the deployment of these products and technologies is a few years away, these are long-term developments requiring early investment and close customer collaboration,” notes Lowe. “We are actively engaged with customers and their R&D teams.”

On target to grow quarterly revenue to $500m by end 2025

“As we move through fiscal 2025 and beyond, we are focused on expanding our high-speed transceiver capabilities and capacity in Thailand to support 800G, 1.6T and eventually 3.2T transceivers,” notes Ali. “We anticipate an elevated level of capital expenditures in fiscal 2025 to proactively meet the anticipated surge in demand for high-speed transceivers and datacom components,” he adds.

“Our robust pipeline of cloud customer engagements and improving trends in the traditional networking market reinforce our confidence in the target to grow quarterly revenue to $500m by the end of calendar 2025,” says Lowe. “We foresee continued significant growth into 2026 and 2027. We are executing on new cloud and AI opportunities that we expect will elevate our cloud business to a multi-billion dollar annual run rate in the coming years.”

Lumentum’s quarterly revenue falls due to inventory correction at networking customers

Lumentum completes acquisition of Cloud Light for $750m

Lumentum’s quarterly revenue falls 3.3% as customer inventory digested