News: Suppliers

12 August 2024

Veeco’s record laser annealing sales compensate for declining compound semi revenue in Q2

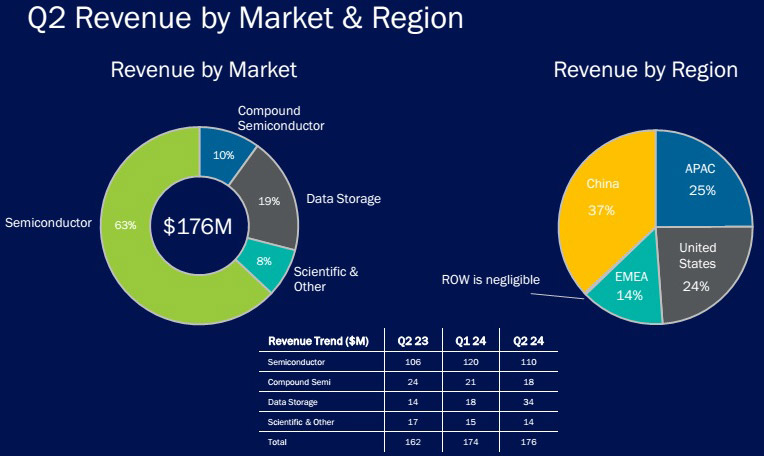

For second-quarter 2024, epitaxial deposition and process equipment maker Veeco Instrument Inc of Plainview, NY, USA has reported revenue of $175.9m, up 1% on $174.5m last quarter and 9% on $161.6m a year ago.

“We delivered solid second quarter results in line with our guidance, led by our Semiconductor business,” says CEO Bill Miller Ph.D.

The Semiconductor segment (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) fell by 9% from Q1’s record $120.4m to $109.9m (63% of total revenue), but this was up on $106.3m a year ago. “Demand for our Laser Annealing systems remains strong, highlighted by record revenue,” says Miller. “We’re also pleased to have received follow-on LSA [laser spike annealing] orders for a leading logic customer’s gate-all-around (GAA) process, as well as follow-on business from our tier-1 DRAM customer to support their planned expansion.”

The Compound Semiconductor sector (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, laser diodes) contributed $18.2m (10% of total revenue), down from $21m last quarter and $24.1m a year ago.

The Data Storage segment (equipment for thin-film magnetic head manufacturing) contributed $34m (19% of total revenue), approximately doubling from $18m last quarter and $13.9m a year ago.

The Scientific & Other segment (research institutions and other applications) contributed $13.8m (8% of revenue), down from $15.1m last quarter and $17.4m a year ago.

By region, China comprised 37% of revenue (level with last quarter and up from 31% a year ago) led by semiconductor sales. The Asia-Pacific (excluding China) has fallen from 36% of revenue a year ago and 37% last quarter to 25%. The USA comprised 24% of revenue, up from 16% last quarter and 22% a year ago. Europe, Middle-East & Africa (EMEA) rebounded from 6% of revenue a year ago and just 5% last quarter to 14%.

On a non-GAAP basis, gross margin was 43.7%, down from 44.2% last quarter but up from 42.7% a year ago, and toward the high end of the 43–44% guidance range.

Operating expenses have risen further, from $44.8m a year ago and $47.8m last quarter to $48.6m, exceeding the expected $46–48m due primarily to the timing of R&D investments.

Net income was $25.4m ($0.42 per diluted share), down from $26.4m ($0.45 per diluted share) last quarter but up from $20.6m ($0.36 per diluted share) a year ago.

Operating cash flow was $8m. Capital expenditure was $3m. During the quarter, cash and short-term investments rose sequentially by $8m to $305m. Long-term debt remains about $249m.

From a working capital perspective, accounts receivable fell by $14m to $92m.

Inventory increased slightly, by $2m to $245m. Accounts payable fell by $7m to $47m. Customer deposits included within contract liabilities on the balance sheet declined by $13m to $59m.

Full-year guidance tightened

For third-quarter 2024, Veeco expects revenue of $170-190m. “By market, we expect growth sequentially in semiconductor and similar levels of revenue for the remaining markets,” says chief financial officer John Kiernan.

Gross margin is again expected to be 43-44%. With operating expenses of $48-50m, net income should be $24-31m ($0.39-0.49 per diluted share).

For full-year 2024, Qorvo has tightened its guidance for revenue from $680-740m to $690-730m and for EPS from $1.60-1.90 per share to $1.65-$1.85 per share.

“Semiconductor is slightly stronger and so we’re now thinking for the full year in semi, when we compare it to last year, to be up high single-digits, low double-digits,” says Kiernan. “On the flip side, we see slightly lower contribution from compound semi space, where we’re now saying, flat to slightly down [versus the prior forecast of flat to slightly up].”

Evaluation program

“We continue to increase investments in our evaluation program for core technologies, focused on solving tier-1 customers’ high-value problems. This is a key element in supporting our long-term growth strategy,” he adds.

“In the compound semi market, we're focused on long-term opportunities within power electronics and photonics,” notes Miller.

“We are very close to meeting all of the market requirements for silicon carbide, and our goal is to place two evaluation systems either end of this year or early in 2025,” says Miller.

“We recently shipped a 300mm GaN-on-silicon evaluation system to a tier-1 power device customer in the compound semi market,” says Miller. “Installation for the 300mm evaluation is progressing very well and we’re in the midst of turning the tool over to the customer for them to start running their qualification wafers,” he adds.

“In the semiconductor market, our nanosecond annealing and ion beam deposition evaluation systems at customer sites are progressing well and we’re targeting additional evaluation system shipments in early 2025,” says Miller. “We’re also making progress towards an LSA evaluation shipment to a second leading DRAM customer in early 2025.”

Veeco’s Q4 semiconductor revenue up 17% sequentially

Veeco’s Q3 revenue and profits exceed guidance

Veeco’s Q2 record semiconductor revenue drives growth