News: Markets

4 December 2024

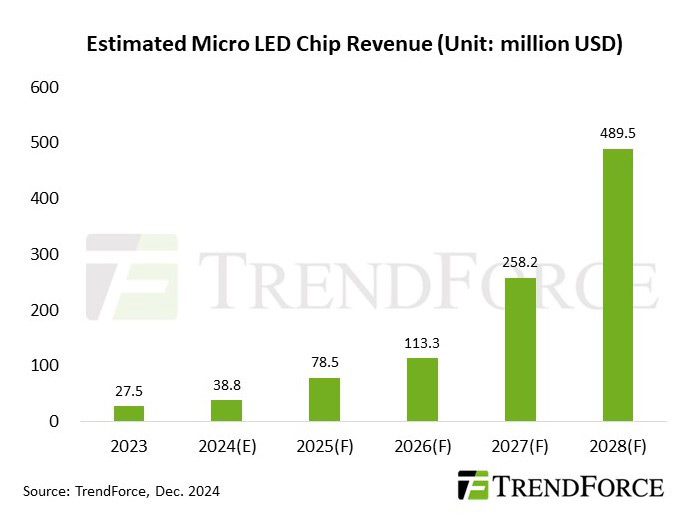

Micro-LED chip market to grow from $38.8m in 2024 to $489.5m by 2028

Revenue from micro-LED chips will reach about $38.8m in 2024, with large displays remaining the primary contributor, forecasts market research firm TrendForce. Looking ahead, breakthroughs in technical bottlenecks are on the horizon, while applications in automotive displays and the increasing maturity of full-color augmented-reality (AR) glasses solutions are expected to drive the micro-LED chip market to $489.5m by 2028.

TrendForce highlights several challenges confronting the micro-LED industry in 2024. First, the slow progress in chip miniaturization has hindered cost-reduction efforts. Second, the high price of micro-LED displays has resulted in weak end-user demand, limiting the shipments of large-sized displays already in production. Third, the focus in the wearable device market has shifted to software optimization and hardware–software integration. This has reduced the incentive for brands to innovate hardware and slowed the adoption of new display technologies like micro-LEDs. Lastly, while automotive applications remain a key area of promise for micro-LEDs, they are still in the early stages of adoption and validation, making it difficult to contribute significantly to revenue in the short term.

From a technical perspective, addressing the challenge of seamless large-sized display assembly is crucial. In the short term, improving backplane production yield through different driving schemes can enhance efficiency and reduce costs. Over the medium to long term, increasing backplane size to minimize the number of required assemblies could eliminate complex manufacturing steps such as side wiring and TGV (through-glass vias).

Additionally, maximizing light extraction efficiency is becoming increasingly important in micro-LED display design and production. Techniques such as microstructure and reflective structure design can reduce light loss and improve brightness by optimizing reflected light.

TrendForce points out that, as the yield rate of mass transfer technology improves, new challenges are emerging in inspection processes. Although the LED industry already has established testing methods, these solutions require refinement to handle the extreme miniaturization and high volume of micro-LED chips. Addressing these inspection challenges is currently a critical priority for the industry.

The micro-LED’s standout characteristics — high brightness, high contrast, and high transparency — continue to attract investment from manufacturers. These features enable micro-LED to integrate into transparent displays for automotive windows or as part of AR-HUD or P-HUD systems, meeting the growing demand for seamless integration of virtual- and real-world information for drivers and passengers. Additionally, combining micro-LEDs with silicon substrates offers a robust solution for near-eye displays in AR glasses, positioning micro-LEDs as a benchmark for next-generation metaverse-focused head-mounted devices.

TrendForce emphasizes that the commercialization of micro-LED technology should not depend overly on the mature consumer electronics market. Instead, manufacturers should capitalize on the unique capabilities of micro-LEDs for displays, pairing them with diverse sensor solutions to empower devices with new functionalities and uncover imaginative niche applications. This strategy is expected to accelerate the penetration of micro-LEDs across various markets, further driving growth and innovation.

Micro-LED chip market growing at 84% CAGR to $579m by 2028

Micro-LED chip market to almost double to $27m in 2023, driven by large displays and wearables