News: Markets

17 December 2024

Silicon PIC market growing at 45% CAGR from $95m in 2023 to $863m in 2029

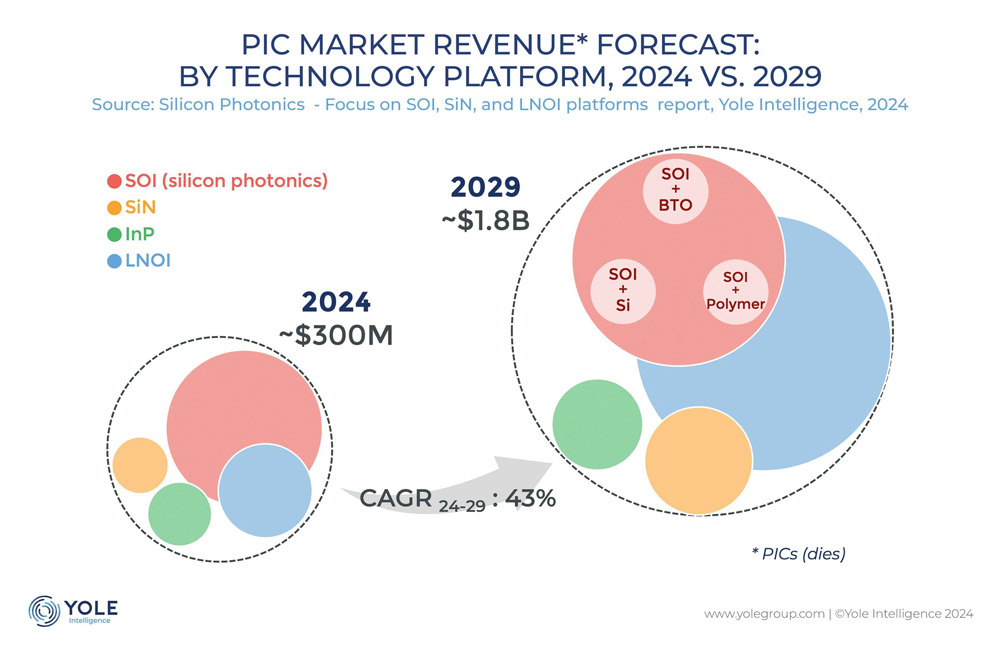

Silicon photonics continues to evolve rapidly, with diverse applications signaling significant opportunities ahead, notes market analyst firm Yole Group. Specifically, the market for silicon photonic integrated circuit (PIC) die is estimated to be increasing at a compound annual growth rate (CAGR) of 45% from 2023 to at least $863m by 2029, notes the firm in its annual report ‘Silicon Photonics 2024 – Focus on SOI [silicon-on-insulator], SiN [silicon nitride], and LNOI [lithium niobate-on-insulator] platforms’, which this year explores the photonics landscape, emphasizing materials for PICs, optical interconnects, and other applications.

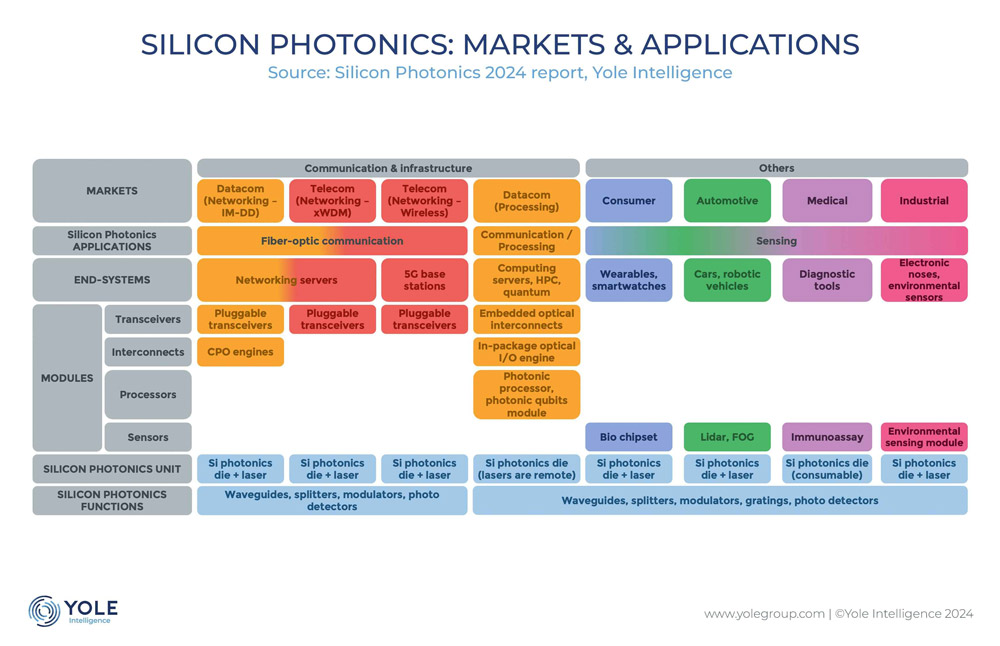

While silicon photonics plays a pivotal role in the semiconductor industry and is widely used in communication and sensing applications, the photonics market remains challenging for both established players and new entrants, notes Yole. Over the next decade, Yole expects key players to emerge, driving industry consolidation. However, the wide range of use cases will provide ample room for growth and innovation.

“This growth will be driven mainly by high-data-rate pluggable modules for increased fiber-optic network capacity,” says Martin Vallo, senior technology & market analyst, Photonics, at Yole Group. “Additionally, projections of rapidly growing training data-set sizes show that data will need to use light for scaling machine learning (ML) models, using optical I/O in ML servers.”

Data centers are the primary application for silicon photonics, with new Chinese leaders emerging daily. Telecoms is another key area that leverages silicon’s superior performance. Optical LiDAR systems also show promise but face cost and beam-scanning hurdles, notes Yole.

In healthcare, advanced photonic components could revolutionize diagnostics, treatment, and monitoring, though regulatory challenges must be addressed. Silicon photonics holds strong potential across these fields, it is reckoned.

This year’s report provides an analysis of data-center networks (with detailed market forecasts between 2023 and 2029 for datacom, telecom, and sensing applications), and examines the supply chain and market shares of the datacom and telecom sectors. A special focus on technologies and innovations addresses challenges in CMOS-foundry-compatible devices, circuits, integration, and packaging. There is also a dedicated chapter on the Chinese photonics ecosystem. China has made notable strides in silicon photonics and is aiming for global leadership, notes Yole.

The 2024 report highlights key technologies shaping the photonics landscape, including LNOI/TFLN (lithium niobate-on-insulator/thin-film lithium niobate) and InP (indium phosphide). “For instance, the LNOI market is projected to reach nearly $1bn by 2029, with an impressive 98% CAGR,” says Eric Mounier, chief analyst, Photonics & Sensing, at Yole Group. “TFLN and LNOI stand out for their low optical loss and high bandwidth. The InP PIC market is expected to grow at a 22% CAGR, while the SiN segment shows strong potential with a 43% CAGR during the same period.”