News: Markets

20 June 2024

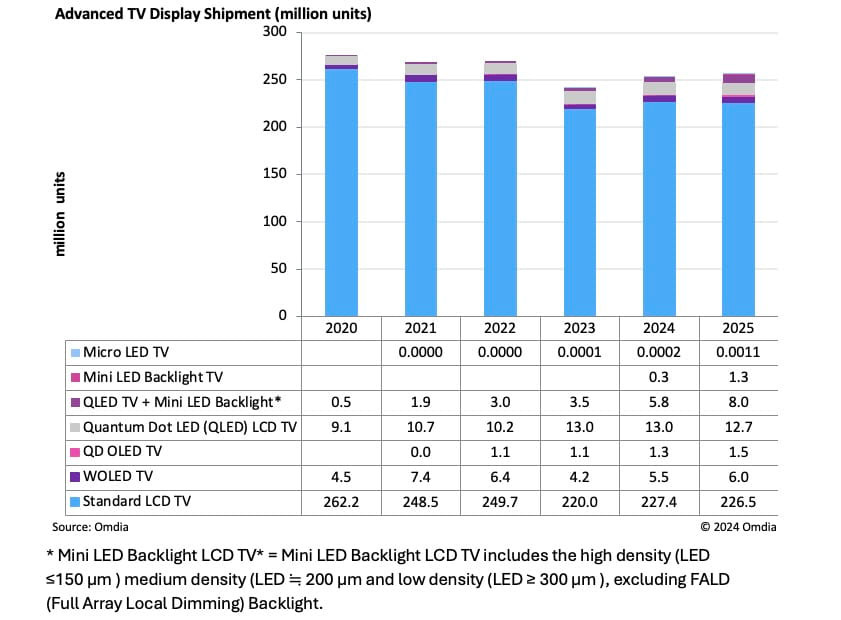

Shipments of mini-LED backlight LCD displays to surpass OLED displays in 2025

According to the latest ‘Mini-LED Backlight Market Tracker’ from market research firm Omdia, LCD TV displays equipped with a mini-LED backlight unit will reach 6.2 million units in 2024, while Samsung Display and LG Display will produce 6.8 million units of OLED TV displays (including both WOLED and QD OLED TV variants). However, by 2025 the mini-LED backlight TVs are forecasted to reach 9.3 million units, surpassing the 7.5 million units of OLED TVs for the first time.

Specifically, Samsung, LG Electronics, Sony, TCL and Hisense are all targeting double-digit growth in their mini-LED backlight TV display shipments in 2024 and 2025.

Picture: OLED TV display shipments have outpaced mini-LED backlight displays for the past decade, but this trend is set to change from 2025.

Since 2022, the market for LCD TV displays with mini-LED backlights and quantum dot materials has seen substantial growth. This is driven by continuous cost reductions through effective supply chain management of the mini-LED backlight and advances in quantum dot materials. While OLED TV displays are celebrated for their infinite contrast ratio, exceptional color gamut and fast response times, the combined mini-LED backlight and quantum dot-equipped LCD TV display is now challenging OLED TV’s dominance. The mini-LED backlight enhances dimming functions and HDR capabilities while quantum dots boost color gamut performance, leading LCD TV OEMs and panel makers to adopt both technologies to raise their product specifications.

“OLED TV panels offer significant advantages in the high-end TV market, such as higher brightness, better environmental friendliness due to fewer components and materials, no halo effect on the screen since there is no mini-LED grouping for dimming zones, and a strongly established premium TV image among consumers,” comments David Hsieh, senior research director in Omdia’s Displays practice. “However, mini-LED backlights are now competitive in several aspects: a mature supply chain, the shift to larger LCD TV displays, the cost-effective 500– 2000 dimming zones, the production of super larger size like 85-inches and above, and ample capacity for LCD TV open cells,” he adds. “Therefore, there will be intense competition between mini-LED backlight LCD TVs and OLED TVs moving forward, which will help expand the high-end TV segment and align with the trends towards larger sizes,” Hsieh concludes.