News: Markets

4 March 2024

LED lighting industry to see 5.8 billion units of secondary replacement demand for LED lamps and luminaires in 2024

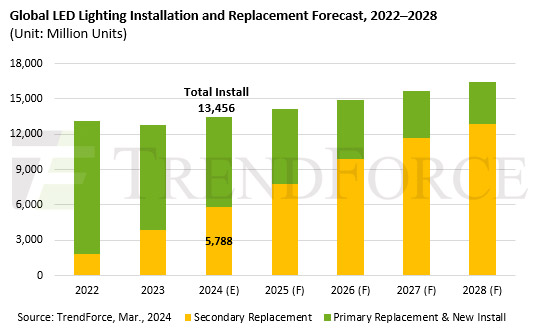

Market research firm TrendForce’s latest reports indicate a significant turning point for the LED lighting market in 2024, as an estimated quantity of 5.8 billion LED lamps and luminaires reach the end of their lifespan. This is set to trigger a substantial wave of secondary replacements, breathing new life into the market and boosting total LED lighting demand to 13.4 billion units, the firm adds.

Currently, LED lamps and luminaries account for about 70% of all lighting solutions in use worldwide, narrowing the scope for replacing traditional fixtures with LED alternatives. Only specific, unique applications continue to rely on non-LED lighting, making the cost of transition increasingly expensive and suggesting that the first wave of replacement may have largely concluded. Despite a dip in shipments of LED lighting products in 2023, the decline has not been drastic, thanks to the rising tide of secondary replacement demand, which has now become the LED market’s key driver.

Secondary replacement demand for LED lighting to peak between 2025 and 2028

LEDs are generally designed to last 25,000–40,000 hours, translating to a real-world service life of 7–10 years. TrendForce posits that LED lamps and luminaires installed between 2014 and 2016 have begun to hit their lifespan limit from 2023, propelling demand for secondary replacement year after year. This trend is expected to fuel the lighting market’s growth over the next five years, making secondary replacement the dominant force by 2025, and by 2028 they are projected to account for as much as 78% of LED lighting demand.

However, the road to realizing the potential of secondary replacement demand is fraught with challenges, notes TrendForce. Many households lack awareness about the need for replacements, with concepts like health-conscious lighting and environmental considerations not yet mainstream. Some potential users are hesitant, adopting a wait-and-see approach. Additionally, a general lack of understanding about the science of lighting and its commercial and artistic value persists in some regions, preventing full appreciation of what modern lighting technology can offer, the firm adds.

Last but not least, product quality varies in the market, and presently consumers often prioritize price over quality. In future, the LED lighting market will progressively step into a more stable, cyclically developing period. In this evolving landscape, brand significance is increasingly highlighted as a key factor in attracting consumer interest in repeat purchases.