News: Microelectronics

13 May 2024

Wolfspeed quarterly revenue hit by weak industrial and energy markets

For its fiscal third-quarter 2024 (to end-March 2023), Wolfspeed Inc of Durham, NC, USA — which makes silicon carbide (SiC) materials and power semiconductor devices — has reported revenue of $200.7m, down 4% on $208.4m last quarter but up 4% on $192.6m a year ago.

N.B. All figures are for continuing operations, after Wolfspeed completed the sale (announced on 22 August) of its radio frequency business Wolfspeed RF to MACOM Technology Solutions Holdings Inc of Lowell, MA, USA for $75m in cash plus 711,528 shares of MACOM common stock (valued at $50m).

Materials product revenue was the second highest ever at $98.6m, down on $101m last quarter but up on $91m a year ago and exceeding the $90–95m guidance, driven by better-than-expected yields and output on 150mm-diameter silicon carbide wafers.

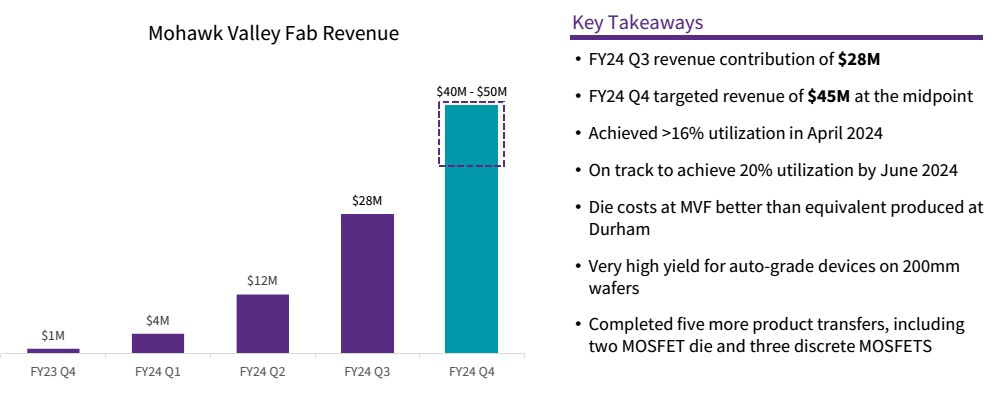

Power Device product revenue was $102.1m, up only slightly from $101.6m a year ago and down on $108m last quarter. “The Industrial and Energy [I&E] market remains challenged and remains weaker than our original expectations, primarily due to inventory buildups across many end-market channels, predominantly in the Asian markets,” says CEO Gregg Lowe. This has mainly affected the Durham fab, whose products are primarily I&E-related. However: “We continue to see growth from our EV [electric vehicle] customers, as EV device revenue increased approximately 48% year-over-year,” notes chief financial officer Neill Reynolds. The new Mohawk Valley Fab, which uses 200mm-diameter SiC wafers and currently serves almost entirely EV customers, contributed $28m in revenue, more than doubling from $12m last quarter and up from just $1m a year ago, and near the top of the $20–30m guidance range. During the quarter, Mohawk Valley Fab completed five more product transfers, including two MOSFET die and three discrete MOSFETs.

“We are pleased with the significant operational milestones achieved in the quarter for Wolfspeed as we continue to be the world’s first fully, vertically integrated 200mm silicon carbide player at scale,” says Lowe. “We are making progress on our Mohawk Valley ramp, more than doubling revenue sequentially in the quarter and reaching more than 16% wafer start utilization in April, giving us confidence in our ability to achieve our 20% utilization target in June.”

The new Building 10 in Durham is already consistently producing high-quality 200mm automotive-grade MOSFET substrates, yielding more than the existing 150mm wafer production in Durham and surpassing internal expectations. Building 10 is hence on track to support ~25% utilization at Mohawk Valley.

“Construction continues at The JP [John Palmour Manufacturing Center for Silicon Carbide], our 200mm materials factory in [Siler City] North Carolina. During the quarter, we started installing furnaces and connected the facility to the power grid [facilitated by general contractor Whiting-Turner], and we recently hosted our topping out ceremony [attended by US Senator Thom Tillis as well as state and local officials, community partners, and employees],” Lowe says.

“Mohawk Valley will be the flywheel of growth for Wolfspeed, and The JP will be instrumental in supplying it with high-quality materials,” says Lowe. “We are encouraged by the operational progress these facilities have made and how it will support our long-term growth trajectory.”

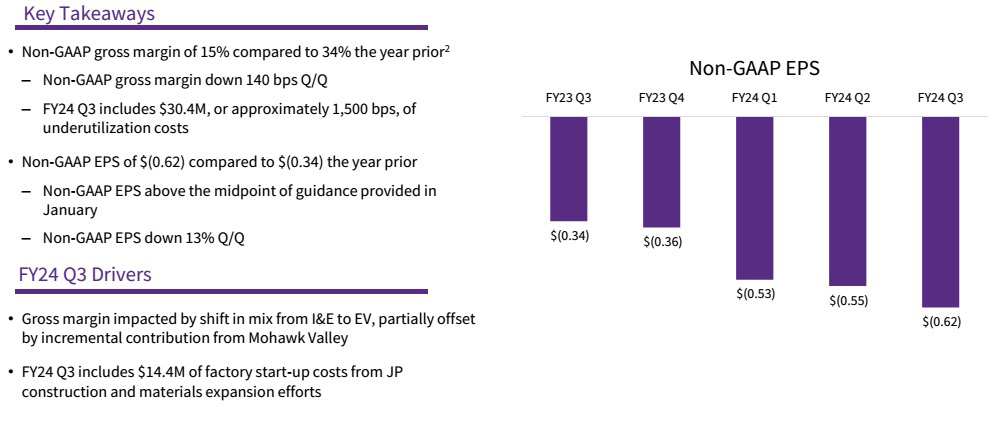

On a non-GAAP basis, gross margin has fallen further, from 34% a year ago and 16.4% last quarter to 15% (below the midpoint of the 13–20% guidance). However, this includes an impact of about 1500 basis points from $30.4m of under-utilization costs, impacted by the shift in mix from I&E to EV (which has lower margins), partially offset by the incremental contribution from the Mohawk Valley Fab.

“Unit costs at Mohawk Valley continued to improve, driven by increasing yields and lower cycle times as we ramp the fab,” notes Reynolds. Die cost from 200mm substrates at Mohawk Valley, even including the full burden of Mohawk Valley fab under-utilization, is now lower than that of the same product produced out of the Durham fab at 150mm.

Operating expenses have risen further, from $125.9m last quarter to $128.9m, due partly to a rise from $10.5m to $14.4m in factory start-up costs from construction of The JP and materials expansion efforts.

Driven by the significant increase in both under-utilization costs at Mohawk Valley and start-up costs at The JP, net loss has risen further, from $42.6m ($0.34 per diluted share) a year ago and $69.6m ($0.55 per diluted share) last quarter to $77.7m ($0.62 per diluted share, slightly better than the midpoint of the $71–87m ($0.57–0.69 per diluted share guidance).

Adjusted EBITDA has worsened slightly from $30.5m a year ago to $32.3m.

Operating cash flow was –$136.2m (versus +$6.4m a year ago). Capital expenditure (CapEx) was $480m (more than doubling from $230.5m a year ago). Free cash flow was hence –$615.8m (increasing from –$225.4m a year ago).

Wolfspeed ended the quarter with over $2.5bn of cash and liquidity on hand to support facility ramps and growth plans.

In fiscal Q3, Power device design-ins were the second highest ever, at $2.8bn (about 80% of which were for EV applications), totaling more than $7bn of design-ins for fiscal 2024 so far (and $25.2bn cumulatively). Device demand for EVs continues to outstrip supply, despite broader market headwinds, notes Wolfspeed.

Design-wins in fiscal Q3 were $0.87bn (70% for EV applications). “Design-wins typically mature over the next 5–7 years, which provides ample revenue visibility for the foreseeable future,” notes Lowe. “Our backlog of design-wins now support more than 125 car models across more than 30 OEMs over the next 3–5 years,” he adds.

“Unlike I&E, we continue to see a ramp of EVs that have adopted our silicon carbide devices. While this is a disruptive time in the industry and we continue to see OEMs adjusting and modifying their near-term EV production plans, we remain substantially supply constrained for our silicon carbide devices,” says Lowe. “As demand remains well above our current supply, we can be nimble and shift much of our supply to other customers to accommodate for these near-term changes. Underscoring this continued EV demand is our strong design-in and design-win performance this quarter,” he adds. “Our second highest quarter of design-ins to date, and more than $5bn of design-wins so far this fiscal year [of which 80% are for EV applications], tell a compelling story.”

“While the industrial & energy end-markets pose short-term headwinds to our results, we firmly believe in the strength of our long-term prospects,” says Lowe. “We currently have more than $4.7bn of design-ins for the industrial & energy applications, representing more than 6000 opportunities ramping in the next several years. We see even further potential coming from industrial segments as the electrification of all things continues across the broad set of applications and, as such, are undeterred by the short-term fluctuations in demand,” he adds.

“In recent months, in materials, key customers such as Infineon and ROHM have come back to Wolfspeed for expansion of multi-year, 150mm wafer supply agreements,” notes Reynolds. “In addition, last year, after surveying the materials landscape, Renesas selected Wolfspeed for a 10-year supply agreement, including 200mm substrates that included a $2bn capacity reservation deposit, which we believe is the largest CRD in the history of semiconductors.”

Shift of product mix from I&&E to EV to impact revenue and margins

For fiscal fourth-quarter 2024 (to end-June), Wolfspeed expects revenue to be steady, at $185-215m. Specifically, Materials product revenue should fall back slightly to $90–95m. The Mohawk Valley Fab’s contribution to Power Device product revenue should rise to $40–50m. Meanwhile, Power Device product revenue from the Durham fab is expected to fall further to $55–70m (down from $106m a year previously) as its product mix shifts significantly from Industrial & Energy (I&E) to EV.

“Our ability to shift our production from I&E to EV speaks to the flexibility that our business model provides us,” says Lowe.

“It will be at least the second half of this calendar year before we see inventory levels return to normal [after rising to $421.2m (213 days of inventory) in fiscal Q3/2024, up from $370.2m or 199 days in fiscal Q2/2024 and just $284.9m or 162 days in fiscal Q3/2023]. But much of the product we had already produced and slated to ship has a match elsewhere in our pipeline and we are continuing to work to find the best match for that inventory now,” says Reynolds.

“In the short-term, as demand shifts away from I&E, we will see an impact on revenue and gross margin. We will shift as much production capacity as possible [in both Durham and Mohawk Valley] to EV products in the near-term, although the same underlying production will not generate the equivalent revenue or gross margin results,” says Reynolds. “We anticipate this to be the case until we start to see a recovery in I&E markets in the first half of calendar year 2025. This does not, however, change our view that I&E products will be a substantial and important part of our product portfolio and capacity investment over the longer term.”

Gross margin should be just 8–16% in fiscal Q4. However, at the 12% midpoint, this includes $29m (1450 basis points) of under-utilization costs, mainly from the Mohawk Valley Fab.

Operating expenses are expected to fall to $116–122m. This is despite a rise to $20m in factory startup costs related to materials expansion efforts at The JP (which is expected to fire up its initial furnaces by the end of June, qualify furnaces by the end of September, and produce initial silicon carbide boules by the end of calendar 2024).

“As Mohawk Valley fab utilization increases and The JP starts to come online, we will start to see incrementally less under-utilization, but incrementally more startup costs, which hit different lines of our P&L,” notes Reynolds.

Net loss is hence expected to rise to $91–109m ($0.72–0.86 per diluted share).

Including the final draw of the Renesas customer deposit, Wolfspeed now expects to end fiscal 2024 with $2.2–2.4bn of cash from liquidity.

CapEx to dip until return to cash flow break-even after fiscal 2025

“Looking at CapEx, we expect to spend about $2bn in fiscal 2024, our peak year,” says Reynolds. This includes $2.2bn of gross CapEx, offset by about $200m of government incentives.

In fiscal 2025, Wolfspeed expect a $600–800m reduction in gross CapEx to $1.4–1.6bn, focused primarily on The JP and Mohawk Valley. This does not include potential government incentives, grants and subsidies that would further lower net CapEx and potentially be received within fiscal 2025.

“Government funding meets our minimum requirements, and liquidity and financing plans are clearly in place,” says Reynolds. “We continue to work with the [US] CHIPS [Act] program office… our interactions with the CHIPS office have been very constructive and we look forward to completing our work with them in the near future. Depending on the timing of when these incentive payments are approved and then funded, it will be very important for the company to maintain flexibility on the financing front. This may include some interim financing under current financing facilities or otherwise that would allow us to enhance our balance sheet and cash position as we proceed with the Siler City [JP] construction and add more tools in the Mohawk Valley fab,” he adds. “We expect the initial phase of The JP facility to be largely complete by the end of calendar 2024, closing out the vast majority of our fixed facility spend. At that point, our CapEx will be much more flexible and variable as we will be able to modulate how we invest in tools capacity to match our demand outlook.”

Planned CapEx also does not include any CapEx for a new greenfield facility, e.g. the proposed fab in Saarland, Germany (announced in February 2023). “We will not begin another greenfield facility expansion until we have achieved our cash flow objectives from our facilities in the US,” stresses Reynolds. “Given that outlook and the number of liquidity options at our disposal, we expect to maintain a minimum cash balance greater than $1bn for the foreseeable future and we will continue to evaluate that need as we complete our US facility expansion plan.”

Wolfspeed targets positive EBITDA exiting fiscal year 2025 and operating cash flow breakeven shortly after that. The existing US capacity expansions can generate about $3bn in annual revenue with greater than 40% EBITDA margins.

“In combination with The JP, Mohawk Valley will be able to produce more than $2bn of device revenue in addition to the $400m of device capacity currently installed in our Durham device fab. In addition, with The JP online, we have the potential to grow the material substrate business to greater than $600m,” says Reynolds.

“Our strong design-in and design-win trajectories this year, notwithstanding the current gyrations of the EV market, gives us confidence in the future and the longevity of silicon carbide, and we look forward to continuing our momentum, particularly at Mohawk Valley through the close of fiscal 2024 and beyond,” concludes Lowe.

Wolfspeed orders multiple Aixtron G10-SiC systems to support ramp-up of 200mm epi production

Wolfspeed tops out construction of John Palmour Manufacturing Center for Silicon Carbide

Wolfspeed’s quarterly revenue grows 20% year-on-year, as design-wins hit a record $2.9bn

Wolfspeed completes sale of RF business to MACOM for $75m cash plus $60.8m in stock

Wolfspeed reports quarterly revenue, gross margin and EPS at high-end of guidance ranges

Wolfspeed’s margins fall further while 200mm SiC device fab ramp-up lags

Wolfspeed’s revenue growth constrained by 200mm SiC material capacity ramp