News: Markets

17 May 2024

Micro-LED IP plateaus after seven years of exponential growth

Apple effectively pioneered the micro-LED industry, thrusting it into the spotlight back in 2014 with the acquisition of micro-LED startup Luxvue. However, in February, Apple pulled the plug on its smartwatch micro-LED project despite a decade-long investment totaling $3bn, reports market analyst firm Yole Group in ‘Micro-LED Display Intellectual Property Landscape 2024’.

“With approximately $7bn poured into micro-LED development by various entities independently of the Apple ecosystem, the industry has gathered enough momentum to persist in its endeavor to establish micro-LED as a credible, top-tier display technology capable of rivaling OLED [organic light-emitting diode] and LCD [liquid-crystal display] across multiple sectors, including automotive and augmented reality,” believes Eric Virey Ph.D., principal analyst, Display, at Yole Group.

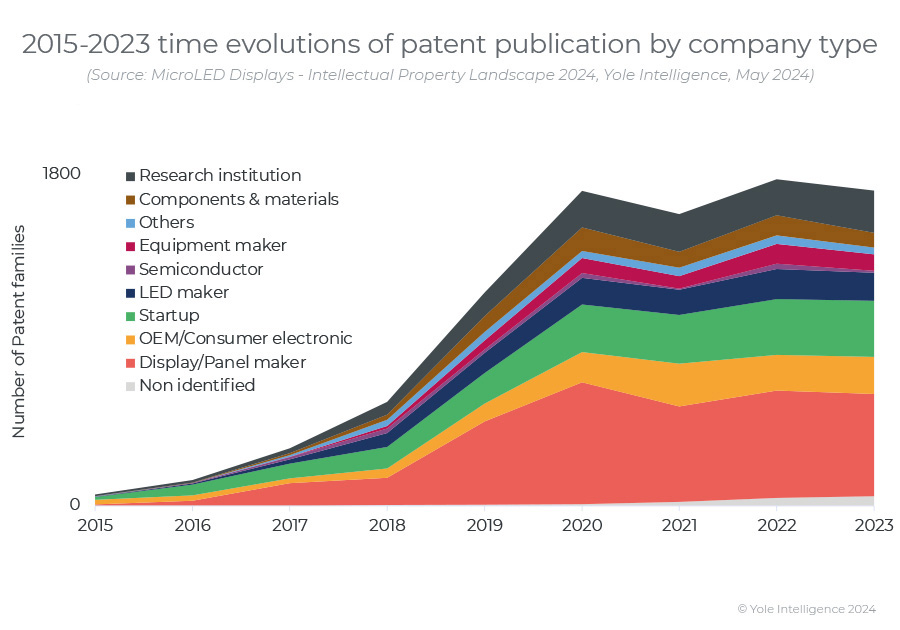

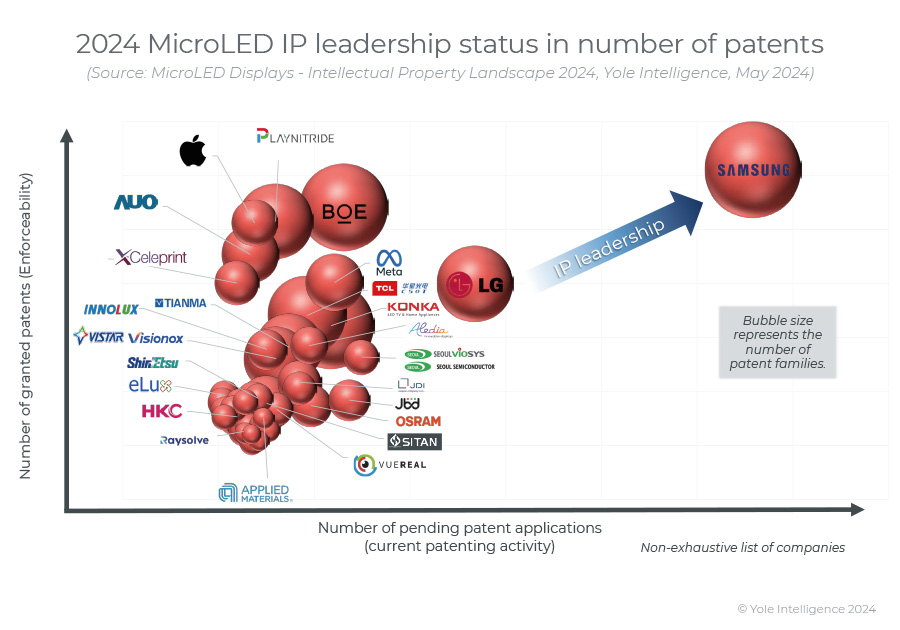

After seven years of rapid expansion, activity surrounding micro-LED intellectual property has stabilized since 2021 and reached a plateau. While some organizations are scaling back, others are ramping up their efforts. Chinese firms currently lead in this domain, with South Korea holding a strong second position.

Samsung has emerged as a formidable leader in the micro-LED industry’s IP landscape, with prominent Chinese display manufacturers BOE and TCL CSOT also exerting significant influence. Additionally, Tianma and Vistar (the micro-LED-focused spin-off from OLED producer Visionox) are steadily gaining traction in terms of both quality and quantity. Meanwhile, startup PlayNitride has maintained a high level of activity throughout 2021–2023 and continues to compete alongside established display manufacturers.

“Primarily, Chinese companies tend to focus their patent coverage within the country. However, when considering the breadth of geographic coverage, startups such as Aledia and X-Display are notable,” says Virey. “Since the 2021 edition of this report, over 370 newcomers have entered the scene, with a majority hailing from China and Korea. These newcomers are highly active and accounted for 20% of the new patent families published during the 2021–2023 period.”

Following the trend set by equipment makers since 2018, many material companies have entered the race in the last three years. Nearly 20 patent families have changed hands during this period, with Samsung, LG and others acquiring patents from companies such as Intel and Ultra Display.

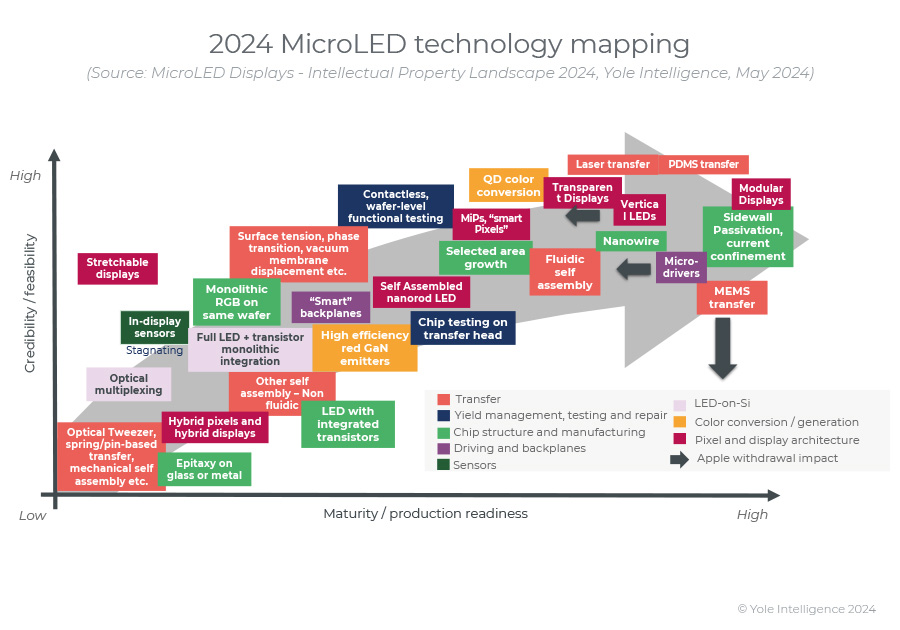

While some patents may lack originality, overall technology is advancing, with recent patents showing increased maturity and addressing final-stage challenges. Multi-step transfer processes, predominantly using laser and stamp methods, are becoming widespread, alongside a resurgence of fluidic self-assembly. However, the departure of Apple may signal a decline in MEMS-based transfer due to cost concerns.

There’s a surge in creativity, particularly from Chinese players proposing innovative transfer methods. Improvements in chip and backplane architectures are crucial for enhancing transfer and interconnectivity, with designs focusing on breakage resilience. The MiP (micro-LED in package) concept and related display architectures are gaining momentum, along with growing interest in micro-drivers. Patents are also exploring transparent and flexible displays, tiling, and modular displays. However, efforts towards in-display sensors appear to be stalling temporarily.