News: Microelectronics

3 September 2024

Wolfspeed accelerating shift of device fabrication to 200mm Mohawk Valley Fab, while mulling closure of 150mm Durham device fab

For its fiscal full year (to end-June), Wolfspeed Inc of Durham, NC, USA – which makes silicon carbide materials as well as silicon carbide (SiC) and gallium nitride (GaN) power-switching & RF semiconductor devices – has reported annual revenue growth of 6.4%, from $758.5m in fiscal 2023 to $807.2m for fiscal 2024. Specifically, Materials Products revenue rose by 12.1% from $349.3m to $391.6m, and Power Products revenue by 1.6% from $409.2m to $415.6m.

N.B. All figures are for continuing operations only, after Wolfspeed completed the sale (announced on 22 August 2023) of its radio frequency business Wolfspeed RF to MACOM Technology Solutions Holdings Inc of Lowell, MA, USA.

Fiscal fourth-quarter 2024 revenue was $200.7m, slightly above the midpoint of the $185–215m guidance range, but only level with last quarter and down on $202.7m a year ago.

Materials Products revenue was $96.1m, down on last quarter’s $98.6m (its second highest ever) but up on $95.6m a year ago and exceeding the expected $90–95m, driven by the continued strong execution (better-than-expected yields and output on 150mm-diameter silicon carbide wafers).

Power Products revenue was $104.6m, up on $102.1m last quarter but down on $107.1m a year ago.

- The Durham 150mm-wafer device fab contributed $64m of revenue, above the midpoint of the $55–70m guidance range but down 40% year-on-year due to continued weakness in Industrial & Energy (I&E) markets (which comprise most of the Durham fab’s products) after inventory buildups across many end-market channels, predominantly in Asia.

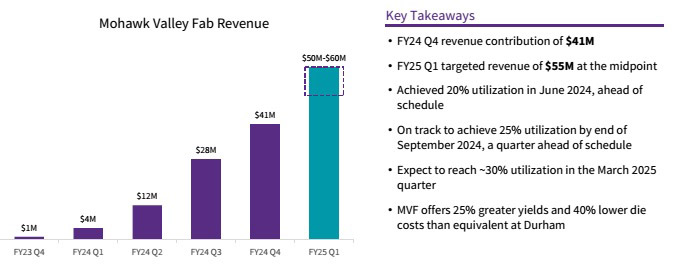

- The Mohawk Valley Fab in Marcy, NY (opened in April 2022 to produce SiC power devices on larger, 200mm wafers) contributed $41m, up 46% from $28m last quarter and just $1m a year ago. However, this was at the lower end of the expected $40–50m range due to an EV customer deferring delivery of several million dollars’ worth of product. “We expect to recognize this revenue in fiscal 2025, and believe we would have landed in line or slightly above the midpoint of our Mohawk Valley revenue guidance, excluding this push-out,” says president & CEO Gregg Lowe. EV-related revenue still more than doubled quarter-on-quarter and tripled year-on-year, to over 50% of total Power Products revenue (up from just 25% a year ago) and 85–90% of Mohawk Valley’s revenue. “EV revenue has grown for three consecutive quarters despite a declining auto semiconductor market.”

On a non-GAAP basis, quarterly gross margin has fallen further, from 31% a year ago and 15% last quarter to just 5%, albeit slightly above the midpoint of the revised 0–8% guidance range. The original guidance had been 8–16%, including the impact of 1200 basis points from $24m of expected under-utilization costs (related mainly to the Mohawk Valley Fab, which reached 20% utilization in June, ahead of schedule). However, there was also an unexpected impact of 500 basis points from an equipment incident at the Durham fab disclosed in June (that resulted in a temporary capacity reduction, leading to under-utilization charges, repair costs and lower yields). Overall, there was a shift in product mix from I&E to EV (which has lower margins).

Full-year gross margin has hence fallen from 35% in fiscal 2023 to 13% for fiscal 2024, including the impact of $124m of under-utilization costs.

Total operating expenses rose from $128.9m last quarter to $148.3m. However, this was partly due to a rise from $14.4m to $20.5m in factory start-up costs related to materials expansion efforts and construction of The JP (John Palmour Manufacturing Center for Silicon Carbide) in Siler City, NC (which activated its initial furnaces before the end of June).

Net loss has hence risen further, from $44.9m ($0.36 per diluted share) a year ago and $77.7m ($0.62 per diluted share) last quarter to $112m ($0.89 per diluted share). This exceeds the original guidance of $91–109m ($0.72–0.86 per diluted share) due to the Durham fab’s equipment incident, but it is slightly better than the midpoint of the revised guidance given in June of $122–105m ($0.96–0.83 per diluted share). Full-year net loss has increased from $153.7m ($1.24 per diluted share) in fiscal 2023 to $325.9m ($2.59 per diluted share) for fiscal 2024.

Quarterly adjusted EBITDA has worsened further, from –$25.4m a year ago and –$32.3m last quarter to –$73.9m (leading full-year adjusted EBITDA to more than double from –$83m to –$162.5m).

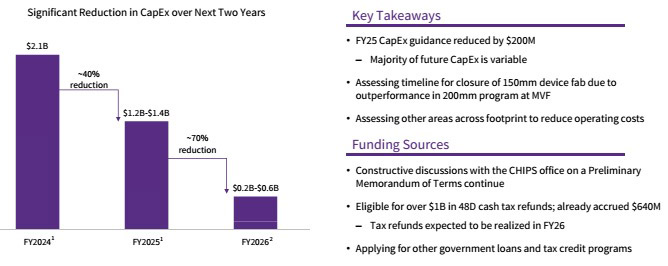

Net cash used in operating activities has risen further, from $38.7m a year ago and $136.2m last quarter to $239.5m (driving full-year operating cash outflow up from $102.2m in fiscal 2023 to $671.3m for fiscal 2024). Capital expenditure (CapEx) has increased further, from $400.2m a year ago and $480m last quarter to $644.2m (raising full-year CapEx from $794.1m in fiscal 2023 to a peak of $2095.5m in fiscal 2024).

Free cash flow was hence worsened from –$440.2m a year ago and –$615.8m last quarter to –$885m (tripling full-year free cash flow from –$901.2m in fiscal 2023 to –$2772.7m for fiscal 2024).

Wolfspeed ended the quarter with about $2.175bn of cash and liquidity on hand to support facility ramps and growth plans (down from $2.5bn last quarter and $2.955bn a year ago).

Power device design-ins were $2bn in fiscal Q4, contributing to over $9bn for full-year fiscal 2024 and $21bn cumulatively to date. “While there has been some near-term reductions in the projected EV adoption rate estimates, the adoption of silicon carbide in EVs has remained strong,” notes Lowe. “About 70% of our $2bn design-ins from this quarter were related to 800V applications, underscoring our belief that this shift to higher-performing and more efficient architectures [from traditional 400V systems] will serve as a major tailwind for both silicon carbide generally and Wolfspeed specifically.”

About $0.5bn of design-ins converted to design-wins in fiscal Q4, reflecting the initial ramp of production for those programs. The design-win backlog supports more than 125 different car models across more than 30 OEMs over the next several years.

September-quarter guidance

For its fiscal first-quarter 2025 (to end-September), Wolfspeed expects revenue to be roughly flat at $185–215m. Revenue will be lower from both I&E market headwinds and the Durham fab (impacted by about $20m due to the equipment incident). However, revenue from the Mohawk Valley Fab will grow by more than 34% quarter-to-quarter to $50–60m (up from just $4 a year previously), 95% of which will be EV-related (tripling year-on-year, to more than 60% of total Power Products revenue). “While the ramp of EVs is slower than previously projected, and many companies in the semiconductor industry are still confronting automotive headwinds, our revenue in the EV market continues to be strong because we are just at the beginning of the ramp of our automotive business across several geographies,” says Lowe.

Gross margin is expected to be –2% to +6% (with a midpoint of +2%). This includes $24m of under-utilization costs from the Mohawk Valley Fab and about 1000 basis points of under-utilization, repair costs and yield impact in the Durham fab, related partly to the fab facility incident but also to lower utilization due to the weaker I&E market demand, where Wolfspeed aims to reduce inventory levels. “If you look at the underlying [level], we actually have a little bit of a margin pickup quarter-over-quarter, just as we start to see more volume flow through Mohawk Valley,” says chief financial officer Neill Reynolds.

Targeted operating expenses are $124–129m, including factory start-up costs related to The JP rising to $25m. “As Mohawk Valley utilization increases [to 25% by end-September, a quarter ahead of schedule] and The JP starts to come online, we will start to see incrementally less under-utilization out of Mohawk Valley, but incrementally more start-up costs from The JP, which hit different lines of our profit & loss,” notes Reynolds. Net loss is expected to rise to $138–114m ($1.09–0.90 per diluted share).

Accelerating path to profitability

“From an operating perspective, we are undertaking several initiatives that accelerate our path to profitability and ensure we slow our operating cash burn, achieve positive EBITDA in the second half of this fiscal year, and drive to positive operating cash flow by early fiscal 2026,” says Reynolds.

“We have two priorities we are focused on: optimizing our capital structure for both the near term and long term and driving performance in our state-of-the-art 200mm fab,” says Lowe.

“Our 200mm device fab [Mohawk Valley] is currently producing solid results at lower costs than our Durham 150mm fab, while also presenting significant die cost advantages. This improved profitability gives us the confidence to accelerate the shift of our device fabrication from our 150mm fab to the 200mm fab in Mohawk Valley, while we assess the timing of the closure of our 150mm device fab in Durham,” says Lowe. “We passed internal qualification for nearly all automotive powertrain products in late July and now have only a handful of customer qualifications left to complete, giving us the confidence that those products can be serviced out of Mohawk Valley sooner than we originally anticipated… By the March quarter, we plan to move nearly all EV powertrain production to Mohawk Valley,” he adds.

“On the material side, our progress on our 200mm platform has been substantial. Crystal growth and substrate processing out of Building 10 in Durham continues to scale and we expect to be able to support a 25% wafer start utilization at Mohawk Valley in the September quarter, one quarter ahead of plan. As a result of continued productivity improvements, we are also now expecting Building 10 to support 30% wafer start utilization at Mohawk Valley in the March quarter of 2025. These productivity improvements allow for a more measured ramp and, therefore, measured spend on The JP,” says Lowe.

“We have already processed the first silicon carbide boules from The JP [through the Durham fab line] and the quality is in line with the high-quality materials coming out of Building 10,” he adds. The JP is expected to qualify furnaces by the end of September, produce initial silicon carbide boules by the end of calendar 2024, and have the full flow qualified and delivering wafers to Mohawk Valley by summer 2025.

“At the same time, we are taking proactive steps to slow down the pace of our CapEx by approximately $200m in fiscal 2025 and identify areas across our entire footprint to reduce operating costs,” says Lowe. Reflecting the significant improvement in yields and efficiency in 200mm materials and device facilities, Wolfspeed has cut its forecasted fiscal 2025 CapEx from $1.4–1.6bn to $1.2–1.4bn (down from fiscal 2024’s $2.1bn). “We have the flexibility to take this estimate down even lower, based on the demand and revenue outlook throughout the year,” says Reynolds. “This level of CapEx ensures that we complete The JP Siler City materials factory on time and on budget, so that we deliver wafers to Mohawk Valley mid-next calendar year,” he adds.

“Looking at fiscal year 2026, our CapEx will fall off sharply, as our facility expansion projects will be complete and the vast majority of our CapEx will be related to the production tools to fill those facilities and increase capacity,” says Reynolds. “We expect our gross fiscal year 2026 CapEx to be in the range of $200–600m [supporting 50–60% utilization in Mohawk Valley], which does not include offsets for federal incentives, which could lower that number significantly. This would include some of the approximately $640m of Section 48D tax credits as part of the CHIPS Act that we have already accrued on our balance sheet… We expect to have more than $1bn of 48D tax credits that will help fund the business,” he adds. “Our long-term CapEx plan is expected to generate more than $1bn in cash refunds from Section 48D tax credits from the IRS,” notes Lowe. “We also remain in constructive talks with the CHIPS office on a Preliminary Memorandum of Terms for capital grants under the CHIPS Act… We are now down to negotiating the final terms and conditions,” he adds.

“In addition to CHIPS, we are working closely with our lenders on plans to raise additional capital,” says Reynolds. “We are also applying for other government lending and tax credit programs that may provide us with additional access to capital. Therefore, in addition to lowering CapEx and driving towards profitability, we expect to have access to several options that would enable us to end fiscal year 2025 above our $1bn minimum cash target.”

Wolfspeed’s Mohawk Valley 200mm SiC fab reaches 20% utilization

Wolfspeed quarterly revenue hit by weak industrial and energy markets

Wolfspeed orders multiple Aixtron G10-SiC systems to support ramp-up of 200mm epi production

Wolfspeed tops out construction of John Palmour Manufacturing Center for Silicon Carbide

Wolfspeed’s quarterly revenue grows 20% year-on-year, as design-wins hit a record $2.9bn

Wolfspeed completes sale of RF business to MACOM for $75m cash plus $60.8m in stock

Wolfspeed reports quarterly revenue, gross margin and EPS at high-end of guidance ranges

Wolfspeed’s margins fall further while 200mm SiC device fab ramp-up lags