News: Microelectronics

17 February 2025

Wolfspeed’s revenue falls 7% in December quarter

For fiscal second-quarter 2025 (for continuing operations, to 29 December 2024), Wolfspeed Inc of Durham, NC, USA — which makes silicon carbide (SiC) materials and power semiconductor devices — has reported revenue of $180.5m, down 7% on $194.7m last quarter and 13% on $208.4m a year ago, but slightly above the midpoint of the $160–200m guidance range.

Materials Product revenue was $89.7m, down 8% on $97.6m last quarter and 10.6% on $100.7m a year ago, driven by customers reducing their inventories to reflect weaker industry demand outlook.

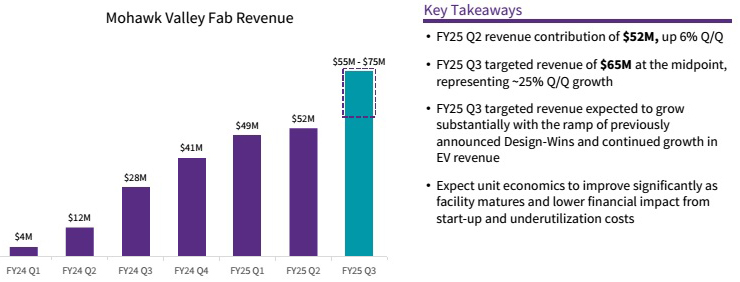

Power Device revenue was $90.8m, down 6% on $97.1m last quarter and down 15.5% on the record $107.7m a year ago, driven largely by ongoing weakness in industrial and energy (I&E) end markets. Of this, the Mohawk Valley Fab in Marcy, NY (the world’s largest 200mm SiC wafer fab) contributed $52m, up just 6% on $49m last quarter but still more than quadrupling from $12m a year ago as it continues to ramp up utilization (after starting revenue-generating production at the end of the fiscal Q4/2023 June quarter). Specifically, revenue from electric vehicle (EV) applications grew year-on-year for a second consecutive quarter by more than 90% (92%).

On a non-GAAP basis, gross margin was just 1.8%, down from 3.4% last quarter and 16.4% a year ago (but above the midpoint of the guidance range of –6% to +6%). This includes a 1600-basis-point impact from under-utilization costs of $28.9m (primarily from production start-up at the Mohawk Valley Fab), down from $35.6m (a 1700-basis-point impact) a year ago, and less than the expected $35m (1900-basis-point impact). Gross margin was also impacted by lower factory production rates in the Durham wafer fab and Durham materials operations as Wolfspeed executed a maintenance shutdown and lowered factory output in line with a lower demand outlook.

Operating expenses have been cut further, from $125.9m a year ago and $120m last quarter to $108m (better than the $110m guidance) as Wolfspeed continues to reduce costs as part of its restructuring and simplification efforts. Factory start-up costs, mainly from constructing the John Palmour Manufacturing Center for Silicon Carbide (The JP) materials production facility in Siler City, North Carolina, have risen further, from $10.5m a year ago and $19.7m last quarter to $22.8m. Excluding start-up costs, operating expenses have been cut by $23m (or 21%) in fiscal first-half 2025.

Net loss has risen further, from $69.6m ($0.55 per diluted share) a year ago and $115.8m ($0.91 per diluted share) last quarter to $122.6m ($0.95 per diluted share), although this is better than the midpoint of the $114–145m guidance range.

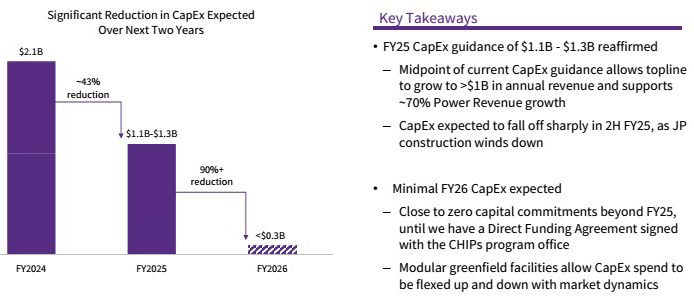

Operating cash flow was –$195.1m, up from –$132m last quarter, impacted by higher net working capital due to the timing of shipments in the quarter, cash restructuring charges and higher cash interest costs. This was partially offset by improved profitability, driven by cost-reduction efforts. Capital expenditure (CapEx) has been cut from $572.3m a year ago to $403m, primarily comprising investment into the JP Materials facility. Free cash outflow has hence improved, from –$755.2m a year ago to –$598.1m.

During the quarter, cash, cash equivalents and short-term investments have hence fallen further, from $2635.7m a year ago and $1687.6m last quarter to $1404.8m. This included about $91m of the total $200m at-the-market (ATM) equity offering that was completed in January. Including the remaining $109m raised in January after the quarter closed, starting quarterly cash balance is now over $1.5bn to support the firm’s ramp and growth plans.

Fiscal Q2/2025 saw $1.475m of design-ins and $795m of design-wins. Cumulative design-ins are now over $30bn and design-wins are now $12.2bn.

Start-up and under-utilization costs

Factory start-up costs have risen further, from $10.5m a year ago and $19.7m last quarter to $22.8m in fiscal second-quarter 2025. However, under-utilization costs of $28.9m are down on $35.6m a year ago, and less than the expected $35m.

For fiscal third-quarter 2025 (to 30 March), operating expenses are expected to include about $26m of factory start-up costs primarily in connection with materials expansion efforts at The JP. Cost of revenue (net) should include about $31m of under-utilization costs from the Mohawk Valley Fab.

Business outlook:

For its fiscal third-quarter 2025 (to 30 March), Wolfspeed targets revenue of $170–200m. This includes Mohawk Valley Fab revenue rising by 25% sequentially to $55–75m, driven by continued growth in EV-related revenue (of 20–30% quarter-to-quarter and again over 90% year-on-year) and the ramp of previously announced design wins. Power device revenue will continue to grow through fiscal second-half 2025, driven largely by companies such as General Motors investing in their EV programs to support the long-term transition taking place in automotive. However, Materials revenue is expected to fall over the next several quarters until end-market demand improves.

Gross margin should be between –3% and +7%. Operating expenses are expected to be cut to $99–104m, despite the start-up costs from The JP.

Net loss is expected to be $138–119m ($0.88–0.76 per diluted share). However, this includes the impact of issuing about 27.8 million shares of common stock under the firm’s ATM program.

“On the CHIPS Act, an important milestone is the certificate of occupancy for Siler City [The JP], which we expect to happen by middle of this year. Despite close to zero new capital commitments, we will complete Siler City,” notes Werner. “We are extremely pleased with the yields of our 200mm wafers and the performance of our devices from these wafers. This is a key competitive advantage as we are the first to begin commercial production on 200mm substrates,” he adds.

Wolfspeed expects to continue to reduce start-up costs during fiscal second-half 2025. “As these new facilities mature, and we see less impact from start-up and under-utilization costs on our financials, unit economics will improve significantly.”

“As we wind down the construction phase [of The JP], we expect capital expenditures to fall-off sharply in the second half of fiscal 2025,” says chief financial officer Neill Reynolds. Full-year CapEx should fall by about 43% from $2.1bn in fiscal 2024 to about $1.2bn in fiscal 2025, then more than halve to $200–600m in fiscal 2026. “We’re at the low end of that range or lower from a gross perspective, and we have the flexibility to continue to take that down,” adds Reynolds. “These levels provide us adequate runway to deliver sustained revenue growth [to over $1bn in fiscal 2025, including 70% Power Device revenue growth],” he adds. “Existing capital commitments we made can satisfy meaningful demand increase and can satisfy our customers’ demand,” says Werner. “We expect further CapEx commitments to be close to zero.”

Financing

“Since stepping into the executive chairman role in November, I have been acutely focused on aggressively pursuing our plans to achieve our financial and operational targets,” says executive chair Thomas Werner. “Myself, the board and the management team have aligned on an operating plan driven by three key immediate priorities designed to put us on a path toward long-term growth and profitability: improving the financial performance of the company to accelerate the path to operating free cash flow generation, taking aggressive steps to strengthen our balance sheet, and raising cost-effective capital to support our growth plan. We have already made significant progress on these initiatives, evidenced by our completion of our $200m at-the-market equity offering, which puts us one step closer to finalizing our CHIPS funding.”

Last quarter, Qorvo outlined its financing and liquidity plans in conjunction with the announcement of a $2.5bn funding package in line with preliminary memorandum of terms for a grant under the US CHIPS Act. This included a $750m grant, $750m of additional private secured term loan financing, and about $1bn in 48D tax credits. “To receive the funding tranches of the grants, we are required to achieve both financial and operational milestones,” notes chief financial officer Neill Reynolds. “We are required to raise $300m of non-debt capital and a portion of that to receive the first funding tranche, which we achieved by executing the $200m ATM equity offering. In addition, we will need to address our convertible debt, which will be our next primary focus. Also, we will need to achieve operational milestones, which we remain on track to achieve,” he adds.

“As it relates to the 48D tax credits, we have already accrued $865m as of fiscal Q2, and we have already submitted returns for $186m of cash refunds from the federal government. We expect to request significantly more cash tax refunds under the 48D program in calendar 2025 when The JP goes into service this year, which we expect to receive in calendar 2026,” continues Reynolds.

“Also tied to improving financial performance, we continue to execute on our company's simplification and restructuring efforts that we expect to contribute to $200m of annual cash savings as well as driving approximately $150m of liquidity in conjunction with non-core asset sales.”

Restructuring and facility closure

During fiscal Q1/2025, Wolfspeed initiated a facility closure and consolidation plan to optimize its cost structure and accelerate its transition from 150mm to 200mm silicon carbide devices.

The Durham 150mm wafer fab remains on track to close in calendar second-half 2025. The Farmers Branch 150mm epitaxy facility was closed at the end of December and is being prepared for sale. The non-factory workforce reductions contributing to a 20% reduction in total company employment, along with the factory closures, remains on track, with most of the reductions already completed at the end of fiscal Q2. “Lastly, we continue to work on our divestiture of non-core assets, which we expect to generate approximately $150m of cash proceeds in calendar 2025,” says Reynolds.

Restructuring costs are expected to total $400–450m in fiscal 2025, including $188.1m in fiscal Q2/2025 (comprising employee severance and benefit costs, voluntary termination benefits and asset impairment costs including write-offs related to the Farmers Branch facility and the proposed Saarland facility [in Germany], accelerated depreciation, and asset disposition costs), plus a forecasted $72m in fiscal Q3.

“We continue to expect restructuring activities to be cash neutral in fiscal 2025 and start generating a significant amount of the annualized $200m of cash savings in fiscal 2026,” says Reynolds. “Collectively, these measures allow us to improve our unit economics, deliver substantial annualized cash savings and enhance cash-generation capabilities, reducing our non-GAAP EBITDA breakeven point to under $1bn on an annualized revenue basis.”

“We expect to see significant improvement in our operating cash flow as we move into the second half of fiscal 2025 as we anticipate our cost-cut measures, improved revenue linearity, stricter cash management and inventory reduction efforts will result in improved profitability and working capital performance,” says Reynolds.

Wolfspeed completes $200m at-the-market equity offering

Gregg Lowe departs Wolfspeed as president & CEO

ZF said to be withdrawing from Wolfspeed’s German silicon carbide device fab project

Wolfspeed announces $750m in proposed funding from US CHIPS Act plus $750m from investment group

Wolfspeed’s Mohawk Valley 200mm SiC fab reaches 20% utilization

Wolfspeed quarterly revenue hit by weak industrial and energy markets

Wolfspeed’s quarterly revenue grows 20% year-on-year, as design-wins hit a record $2.9bn