News: Optoelectronics

3 March 2025

Lumentum quarterly revenue grows 10% year-on-year despite manufacturing capacity constraints

For its fiscal second-quarter 2025 (ended 28 December 2024), Lumentum Holdings Inc of San Jose, CA, USA (which designs and makes optical and photonic products for optical networks and lasers for industrial and consumer markets) has reported revenue of $402.2m. This is up 19.4% on $336.9m last quarter and 9.7% on $366.8m a year ago, and exceeds the $380–400m guidance range. Growth is being driven by strong demand from cloud customers, particularly in data-center interconnect and networking end-markets.

Cloud & Networking segment

Cloud & Networking segment revenue was $339.2m (84.3% of total revenue), up 20.2% on $282.3m last quarter and 18.3% on $286.7m a year ago. Growth was driven by strong demand from cloud hyperscale customers, and particularly Datacom business (including chips and transceivers). “There are new products ramping up and, while there are some supply chain shortages [on some critical components], demand is strong,” notes chief financial officer Wajid Ali. “The Telecom business is also seeing some inventory drawdowns, contributing to growth,” he adds.

Cloud & Networking segment highlights are cited as:

- starting transceiver shipments to a new hyperscale cloud customer;

- setting a new revenue record in externally modulated laser (EML) shipments and launching 200G lane-speed EML deployments across multiple customers;

- improving demand for coherent transmission and transport solutions.

Industrial Tech segment

Industrial Tech segment revenue was $63m (15.7% of total revenue), up 15.4% on $54.6m last quarter but down 21.3% on $80.1m a year ago, due to weak industrial end-market demand.

Industrial Tech segment highlights are cited as:

- record ultrafast laser shipments;

- ultrafast laser applications broadening into semiconductor, advanced packaging and solar cells.

On a non-GAAP basis, gross margin has fallen from 32.8% last quarter to 32.3%, due to yield issues related to new product ramps. However, this is still up on 31.4% a year ago.

Operating expenses have been cut further, from $108.2m (29.5% of revenue) and $100.4m (29.8% of revenue) last quarter to $98.3m (24.4% of revenue). This is due mainly to R&D sending being cut from $68.4m to $62.4m, while selling, general & administrative spending has declined from $39.8m to $35.9m.

Operating income has risen further, from $6.9m (operating margin of 1.9%) a year ago and $10m (3% margin) last quarter to $31.7m (7.9% margin, above the 5.5–7.5% guidance range). By segment, Cloud & Networking operating margin has risen further, from 10.1% a year ago and 12.9% last quarter to 16.2%. Industrial Tech operating margin was 6.2%, recovering from just 4% last quarter but still down on 15.9% a year ago.

Net income was $30m ($0.42 per diluted share), up from $12.2m ($0.18 per diluted share) last quarter and $16.4m ($0.24 per diluted share) a year ago, and exceeded the guidance range of $0.30–0.40 per diluted share.

Capital expenditure has risen from $638.4m last quarter to $663.4m, primarily for expanding cleanroom capacity and increasing equipment capacity for indium phosphide wafer throughput.

During the quarter, total cash, cash equivalents, and short-term investments fell by $19.4m, from $916.1m to $896.7m.

Outlook

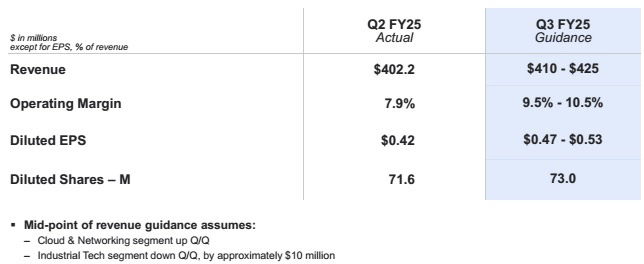

For fiscal third-quarter 2025 (to end-March), Lumentum expects revenue to grow to $410–425m, due to growth in the Cloud & Networking segment counteracting a drop of about $10m in the Industrial Tech segment due to the challenging macro-economic environment and seasonal declines in 3D sensing revenue.

Operating margin should rise to 9.5–10.5%. Diluted earnings per share is expected to grow to $0.47–0.53.

Lumentum is currently still supply constrained. “Supply chain constraints are mainly in telecom products due to worldwide shortages of hermetic packages,” says president & CEO Alan Lowe. In particular, strong EML demand is projected to outpace supply at least into calendar year 2026. This is impacting Lumentum’s ability to meet demand, so it is working with suppliers and qualifying alternatives to mitigate the impact.

The firm is hence expediting tool deliveries to increase capacity. Lumentum is on track for 40% growth in 200G EML capacity from June 2024 to June 2025, then another 40% by the end of 2025, reckons CEO Alan Lowe.

“This is an exciting time for Lumentum as we position ourselves to capitalize on expanding cloud opportunities and the recovery of the broader networking market. Our foundational technologies enable us to win in these markets,” says Lowe. “With our strong market position and improving industry trends, we remain confident in achieving our previously stated goal of reaching $500m in quarterly revenue by the end of calendar year 2025,” he adds.