News: Suppliers

24 March 2025

Veeco’s Q4 revenue and income exceed midpoints of guidance

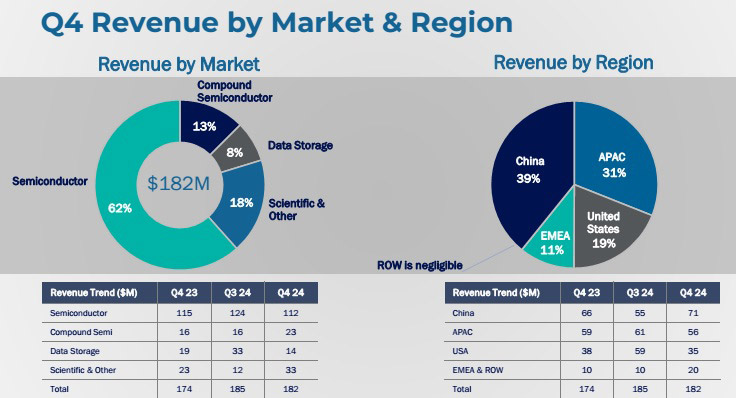

For fourth-quarter 2023, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $182.1m, down 1% on $184.8m last quarter but up 5% on $173.9m a year ago, and well above the midpoint of both early November’s original guidance of $165–185m and mid-January’s revised guidance of $175–185m.

In line with the forecast, the Semiconductor segment (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) declined sequentially by 9.7% after a quarterly record of $124m (67% of revenue) in Q3 to $112m (62% of revenue) in Q4, down 2.6% on $115m (66% of revenue) a year ago. However, semiconductor business was highlighted by record laser annealing revenue, including shipments to two leading-edge customers for gate-all-around nodes.

Revenue from the Compound Semiconductor segment (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, laser diodes) rebounded by 43.7% from Q3’s $16m (8% of revenue) to $23m (13% of revenue) in Q4, up on $16m (10% of revenue) a year ago.

The Data Storage segment (equipment for thin-film magnetic head manufacturing) fell by 57.6% from Q3’s $33m (18% of revenue) to just $14m (8% of revenue) in Q4, down by 26.3% on $19m (11% of revenue) a year ago.

The Scientific & Other segment (research institutions and other applications) has almost tripled from Q3’s $12m (7% of revenue) to $33m (18% of revenue), up 43.5% on $23m (13% of revenue) a year ago, boosted by shipments for quantum computing and research applications.

By region, China comprised 39% of revenue (up from 30% last quarter and 38% a year ago) due to increased semiconductor sales. The Asia-Pacific (excluding China) fell further, from 34% a year ago and 33% last quarter to 31%. The USA fell from 32% last quarter to 19%, down on 22% a year ago. Europe, Middle-East & Africa (EMEA) rebounded from just 6% a year ago and 5% last quarter to 11%, as revenue doubled from $10m to $20m.

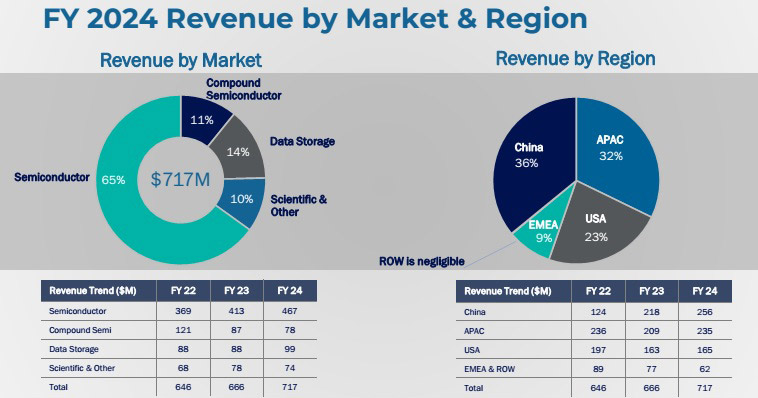

Full-year revenue has grown by 8% from $666.4m in 2023 to $717.3m for 2024, above the midpoint of both the original guidance of $680–740m and mid-January’s revised guidance of $710–720m.

This was led by the Semiconductor segment growing by 13% (outperforming wafer fab equipment market growth for a fourth consecutive year) from $413m (62% of total revenue) in 2023 to another record of $467m (65% of total revenue) in 2024. Growth was driven by record laser annealing revenue, including growth in laser spike annealing (LSA) system shipments to mature-node customers as well as leading-edge shipments for high-bandwidth memory and gate-all-around (GAA). Another key driver was advanced packaging wet processing systems, where Veeco’s system is the production tool of record in 3D packaging for AI.

The Compound Semiconductor segment fell by 10.3% from $87m (13% of total revenue) in 2023 to $78m (11% of total revenue) in 2024.

The Data Storage segment grew by 12% from $88m (13% of total revenue) in 2023 to $99m (14% of total revenue).

The Scientific & Other segment fell by 5.1% from $78m (12% of total revenue) in 2023 to $74m (10% of total revenue).

By region, China rose from 33% of revenue in 2023 to 36% in 2024, and Asia-Pacific (excluding China) rose from 31% to 32%, driven by sales to semiconductor customers. The USA fell further, from 24% to 23% of revenue (which came mostly from data storage customers). EMEA and the Rest of the World fell from 12% to 9%.

On a non-GAAP basis, gross margin has fallen further, from 45.4% a year ago and 43.8% last quarter to 41.5% in Q4/2024 (below the 43–44% guidance), driven by a shift in product mix and additional spending for evaluation programs. Full-year gross margin fell slightly from 43.5% to 43.3%.

Quarterly operating expenses were $48.1m, up from $46.9m a year ago but cut from $49.9m last quarter, and at the low end of the $48–51m guidance range. However, full-year operating expenses have still risen by 8% from $180.6m to $194.4m, driven primarily by increased R&D investment.

Operating income has fallen further, from $32.1m a year ago and $31m last quarter to $27.4m. However, full-year operating income grew by 6% from $109.6m in 2023 to $116.1m.

Likewise, net income has fallen further, from $29.8m ($0.51 per diluted share) a year ago and $28.3m ($0.46 per diluted share) last quarter to $24.2m ($0.41 per diluted share, but exceeding the midpoint of the $0.36–0.44 guidance). However, full-year net income has risen from $98.3m ($1.69 per diluted share) in 2023 to $104.3m ($1.74 per diluted share, slightly below the midpoint of the original guidance of $1.60–1.90 but above that of the revised guidance of $1.69–1.76). This excludes a $28m impairment charge, resulting from Veeco’s silicon carbide business not meeting market expectations.

“We achieved several strategic milestones, grew the top-line and delivered solid profitability, all while continuing to allocate capital toward our largest growth opportunities,” says CEO Bill Miller Ph.D.

Cash flow from operations was $28m in Q4 (up from $18m in Q3, and almost matching the $29m a year ago). This brought full-year operating cash flow to $64m for 2024 (up from $61.7m in 2023).

Quarterly capital expenditure has been more than halved from $11m a year ago to $5m in Q4. Full-year CapEx was just $18m for 2024 (cut from $28m in 2023).

During the quarter, cash and short-term investments hence rose by $24m from $321m to $345m.

From a working capital perspective, accounts receivable fell by $35m from $132m in Q3 to $97m in Q4, primarily due to the timing of when customer payments were due. Inventory has risen further, by $5m to $247m. Accounts payable fell by $6m to $44m.

Order backlog is down to $410m at end-2024, down by $80m on end-2023, due primarily to the data storage business.

Guidance and outlook

For first-quarter 2025, Veeco expects revenue to drop back to $155–175m.

“As we see lower revenues coming from China customers and data storage customers, that gives us a mix headwind to gross margins because they typically have higher gross margins for those product lines,” notes chief financial officer John Kiernan. “Then we see additional business coming from the advanced packaging area, and the back end typically has a bit lower margins.” Gross margin should hence fall to about 42%, for both Q1 and full-year 2025.

With operating expenses steady at $47–49m, operating income is expected to fall to $18–25m and net income to $16–22m ($0.26–0.36 per diluted share) in Q1/2025.

“Based on market conditions and our visibility, we expect Q2 revenue to be in a similar range to Q1 levels,” says Kiernan.

“In the semiconductor market, we continue to expect a decline in investment for mature-node customers in China,” says Kiernan. Veeco expects China to fall to 25–30% of total revenue in first-half 2025 and below that in second-half 2025, down from about 36% in full-year 2024. “We see business slowing down for China as equipment purchases over the last couple of years get digested,” he adds.

“Outside of China, growth in AI and high-performance computing is driving an increase in leading-edge investment in areas such as gate-all-around, high-bandwidth memory and advanced packaging.” Veeco hence expects AI revenue to grow to 20% or more of revenue in 2025 from about 10% in 2024.

“Looking ahead, we continue to advance our roadmaps in laser annealing, ion beam deposition and advanced packaging, and are well-positioned to take advantage of growth in leading-edge investment in the coming years,” reckons Kiernan.

“In the compound semiconductor market, we continue to see opportunities in solar and photonics, which provide potential for revenue growth beginning in late 2025 into 2026. We also remain excited for the potential to expand in GaN power with our 300mm GaN-on-silicon solutions,” says Kiernan. In Q4/2024, Veeco shipped a 300mm GaN-on-silicon evaluation system to tier-1 power device customer, with this customer having since provided positive feedback.

In data storage, Veeco expects a $60–70m decline in revenue in 2025.

“In scientific, we are continuing to see strength in research areas like quantum computing, which have the potential to provide growth in 2025,” concludes Kiernan.

Veeco tightens revenue and EPS guidance ranges for Q4 and full-year 2024

PlayNitride qualifies Veeco’s Lumina MOCVD system for micro-LED production

Veeco’s record laser annealing sales compensate for declining compound semi revenue in Q2