News: Suppliers

7 November 2025

Aixtron’s Q3 revenue and margin impacted by volume shifts into Q4

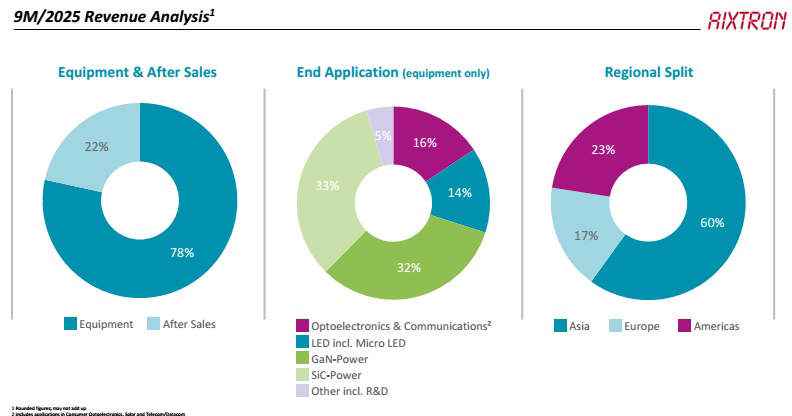

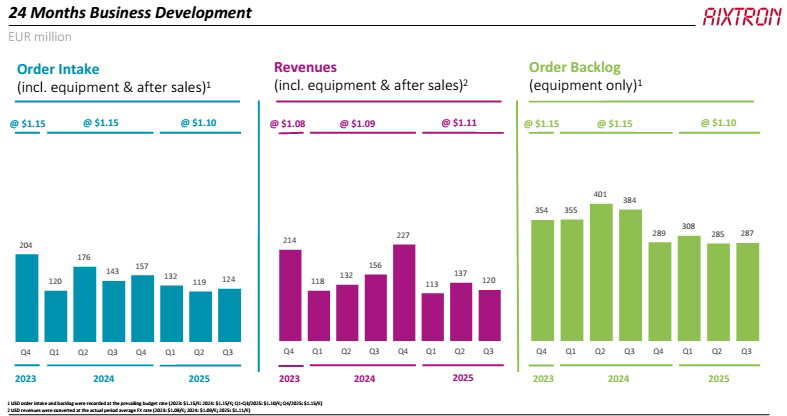

For third-quarter 2025, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €119.6m. This is down 13% on €137.4m last quarter and down 23.5% on €156.3m a year ago, and in the lower half of its guidance range of €110–140m, reflecting the continued soft market environment.

Due to the negative impacts of volume shifts from Q3/2025 into Q4/2025 (€8m) and foreign exchange (FX) effects (€2m), gross margin is down from 43% in Q3/2024 to about 39% in Q3/2025.

While automotive demand remains soft for silicon carbide (SiC) power devices, Aixtron says that it reached a significant milestone in Q3/2025 with the shipment of its 100th G10-SiC chemical vapor deposition (CVD) system since the product’s launch.

At the same time, GaN power customers are seeing increased utilization from data-center demand, for both mid- and low-voltage applications.

The continued AI data-center build out also remains the driver for tool demand in the Optoelectronics segment. The pick up in demand for datacom lasers seen in Q2 has been confirmed in Q3 (and is expected to continue into 2026). Aixtron’s G10-AsP metal-organic chemical vapor deposition (MOCVD) platform continued to gain market share, successfully replacing legacy systems at leading customer accounts.

Profits more than halved year-on-year

Operating expenses were €30.9m in Q3/2025, up 4% on Q3/2024’s €29.6m, driven primarily by R&D expenses rising by 12% from €21.2m to €23.7m.

The operating result (EBIT) has more than halved from Q3/2024’s €37.5m (EBIT margin of 24%) to a lower-than-expected €15.4m in Q3/2025 (EBIT margin of 13%) due to the FX effects as well as quarter-on-quarter shifts. Net profit has likewise more than halved, from €30.9m to €13m.

Operating cash flow almost triples year-on-year

Cash flow from operating activities has almost tripled from €15.4m a year ago to €43.4m, driven primarily by continued working capital optimization more than compensating for the decrease in net profit. Also, capital expenditure has been slashed from €17m a year ago to just €4.2m. Hence, free cash flow has continued to improve, from –€1.5m to €39.2m. This has contributed to an improvement of €168.3m year-on-year for the first nine months of the year, from –€58m in 2024 to €110.3m in 2025.

Cash and cash equivalents (including other current financial assets) has hence risen from €64.6m at the end of 2024 to €153.4m. The equity ratio increased from 83% to 85%, underscoring the firm’s strong financial position, Aixtron says.

“We are progressing as planned with our working capital optimization measures,” notes chief financial officer Dr Christian Danninger. “We are well on track to rebuild a strong cash position after the construction of our new 300mm facility, the InnoCenter at our headquarters in Herzogenrath. This brings us again in a good position to master the next wave of growth, once market demand picks up again.”

Order intake and order backlog

Order intake in Q3/2025 was €124m, down 13.5% on €143.5m a year ago but 4.6% up on €118.5m last quarter. The book-to-bill ratio is 1.04.

Equipment order backlog of €286.5m is down by 25% on €384.5m a year ago, but virtually unchanged from €289.3m at the end of 2024 and €284.6m at the end of last quarter.

Full-year guidance

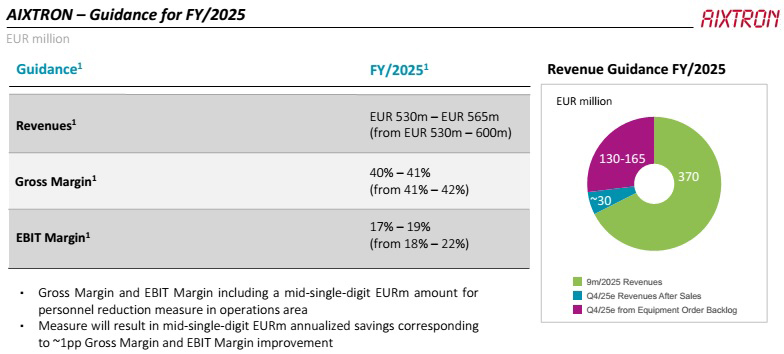

Based on the current soft market environment and assuming an adjusted exchange rate of US1.15/€ for the rest of 2025 (rather than US$1.10/€ previously) due to the currency headwinds, on 17 October Aixtron hence narrowed its full-year 2025 guidance for revenue to €530–565m (down 10.8–16.3% on 2024’s €633.2m), which corresponds to the lower half of its initial guidance of €530–600m. Of this, Q4/2025 revenue is expected to be up sequentially to €160–195m (comprising €130–165m from the equipment order backlog and €30m in after-sales revenue).

“We are on track with respect to our operational metrics for the full-year 2025, besides the loss of gross profit due to FX effects,” says Grawert.

Foreign exchange effects have led to a reduction of about 1 percentage point in full-year guidance for both gross margin (from 41–42% previously to 40–41%) and EBIT margin (from 18–22% previously to 17–19%).

These amounts include one-off expenses in the mid-single-digit million € range related to staffing cuts implemented in the operations area in first-half 2025. However, this is expected to result in annualized savings in the mid-single-digit million € range, corresponding to an improvement in gross margin and EBIT margin of about 1 percentage point.

Market recovery

“The demand upturn has not yet materialized in Q3/2025,” says CEO Dr Felix Grawert. “But, as AI continues to reshape the semiconductor landscape, our platforms are ideally positioned to support this upcoming transformation. The G10-AsP has become the tool of record in the laser segment, and the shipment of our 100th G10-SiC system marks a major milestone in power electronics,” he adds. “While broader market recovery is still pending, our strong execution and focus on diversified end markets keep us firmly on track.”

Initial indications of re-investment in solar, ROY (red-orange-yellow) LED, and augmented-reality (AR) micro-LED applications are emerging. These developments have the potential to positively contribute to Aixtron’s business in the coming year.

“Our medium- and long-term growth drivers, e.g. with the introduction of new 800V architectures for AI data centers using both SiC [silicon carbide] and GaN [gallium nitride], remain intact,” says Grawert. “By expanding our market position, we will benefit disproportionately from the next upturn,” he reckons.

Aixtron ships its 100th G10-SiC system

Aixtron’s revenue grows 22% in Q2, driven by AI data-center communications

Aixtron’s revenue rebounds in Q3 as red LED resurgence compensates for SiC market dip