News: Markets

15 September 2025

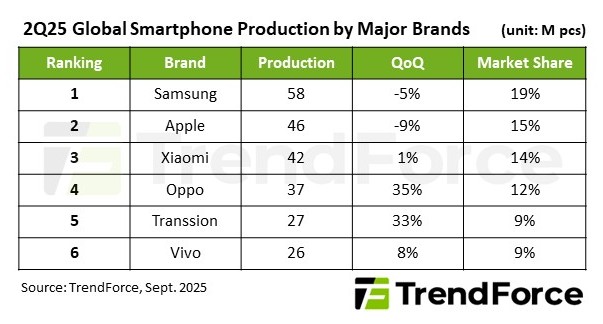

Smartphone production rises 4% in Q2 to 300 million units

Global smartphone production reached 300 million units in second-quarter 2025, up 4% quarter-on-quarter and 4.8% year-on-year, driven by seasonal demand and the recovery of brands such as Oppo and Transsion following inventory adjustments, according to market analyst firm TrendForce.

While macroeconomic headwinds continue to dampen demand for consumer electronics, the upcoming peak season and e-commerce promotions are expected to support sequential growth through second-half 2025.

China’s smartphone subsidy program in first-quarter 2025 provided a short-term boost to mid- and low-end sales and helped to accelerate inventory clearance, notes TrendForce. However, given the limited size of the subsidies and the narrow range of eligible products, the impact on full-year 2025 sales is expected to remain modest.

Looking at brand performance in Q2/2025, the top six vendors collectively maintained around 80% market share.

Samsung remained the largest producer, but output fell by 5% quarter-on-quarter to 58 million units (falling from 22% market share to 19%) as momentum for new flagship models eased.

Apple ranked second with 46 million units, down 9% quarter-on-quarter (falling from 17% market share to 15%) due to seasonal weakness between model transitions, but still up 4% year-on-year thanks to the iPhone 16e’s strong performance earlier in the year. To revive sales in China, Apple introduced deeper discounts than in other regions in May which, combined with local subsidies, allowed its performance in the market to hold steady year-on-year.

Xiaomi (including Redmi and POCO) ranked third with 42 million units maintaining 14% market share), supported by expansion in Latin America and Africa along with China’s subsidy policy.

Oppo (including OnePlus and Realme) rebounded strongly after completing inventory adjustments, with production climbing by 35% quarter-on-quarter to nearly 37 million units, holding fourth place but increasing market share from 9% to 12%).

Transsion (including TECNO, Infinix, and itel), focused on emerging markets, also saw production recover to over 27 million units, up 33% quarter-on-quarter (growing from 7% to 9% market share, rising to fifth rank) and up 15.7% year-on-year.

Vivo (including iQOO) benefited from overseas growth and China’s subsidy support, raising output by 8% quarter-on-quarter to 26 million units (growing from 8% to 9% market share, but falling behind Transsion to sixth rank).