News: LEDs

2 January 2026

Panel maker TCL CSOT acquires LED chip maker Prima

TCL Technology’s Shenzhen-based subsidiary TCL China Star Optoelectronic Technology Co Ltd (TCL CSOT) recently acquired an 80% equity stake — along with creditor rights — in Fujian Prima Optoelectronics Co Ltd (also known as Fujian ZhaoYuan Optoelectronics). This transaction marks TCL CSOT’s formal entry into the LED chip segment. It represents a critical step toward completing a vertically integrated supply chain spanning from LED chips to mini-LED video wall applications, notes market analyst firm TrendForce.

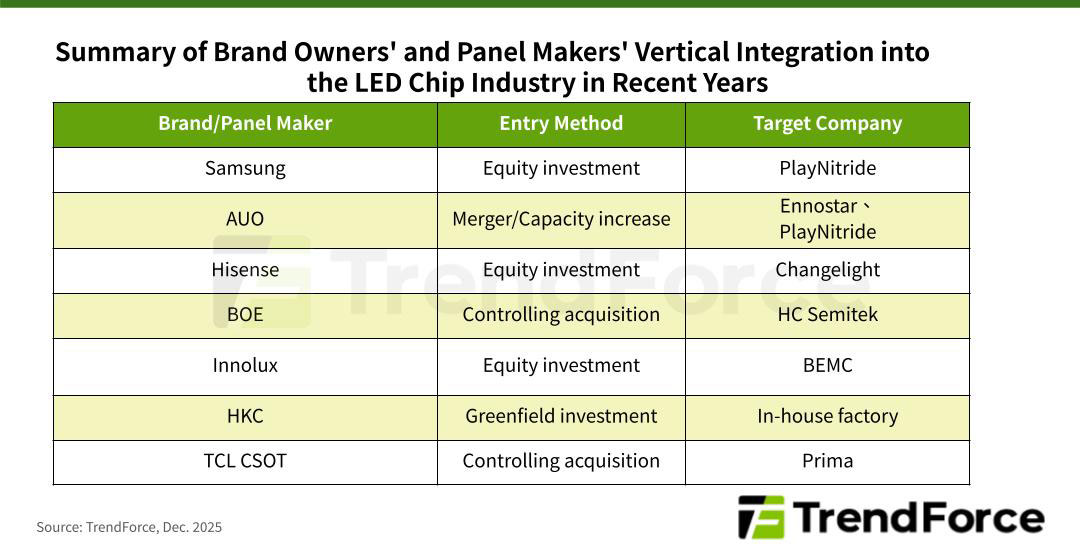

The acquisition underscores the increasing trend of brand owners and panel manufacturers venturing into the upstream LED chip market. Since 2018, companies like Samsung, AUO, Hisense, BOE, Innolux, and HKC have been progressively expanding their involvement in this sector.

TrendForce estimates that the global merchant market value for LED chips (external sales) will reach US$2.841bn in 2025. Ranked ninth by revenue, Prima derives most of its LED chip sales from lighting, backlight, and mini-LED video wall applications.

TrendForce’s analysis indicates that, as brand owners and panel makers advance critical integration in the LED chip industry, coordination costs between chip supply and end-product development are being significantly reduced. A strategy of leveraging economies of scale and closer technological cooperation is likely to speed up the adoption of micro/mini-LED technologies in both display and non-display sectors, helping to sustain growth in the overall LED chip market.

TCL CSOT’s recent acquisition of an 80% stake in Prima for CNY490m (about US$70m) highlights the growing trend of brand owners and panel makers extending upstream into LED chip manufacturing. Similar moves have been observed across the industry: Samsung launched micro-LED TV products following its investment in PlayNitride; AUO, after investing in Ennostar and PlayNitride, has entered mass production of micro-LED smartwatches and automotive communication displays; and Hisense introduced TVs featuring RGB mini-LED backlight after acquiring a stake in Changelight.

Meanwhile, BOE introduced glass-based mini-LED video walls after acquiring a controlling stake in HC Semitek, while HKC achieved mass production of mini-LED video walls in 2023. TCL CSOT’s Suzhou mini-LED video wall production line commenced operations in 2025 and currently has a monthly capacity of 6000m2. With the added support of Prima’s LED chip capabilities, TCL CSOT is expected to strengthen its product competitiveness and further emerge as a leading player among brand and panel makers.

BOE becomes largest shareholder in HC Semitek with RMB2.1bn investment