News: Suppliers

29 July 2020

Aixtron’s revenue rebounds by 37% in Q2

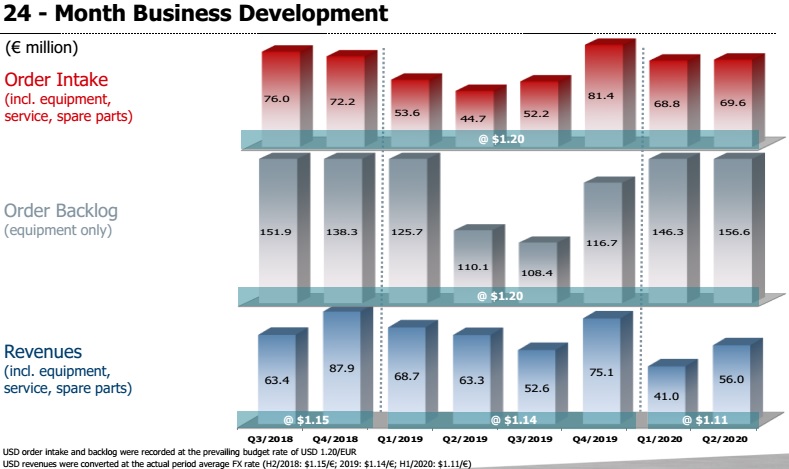

For first-half 2020 deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue (including spare parts and service) of €97m, down 27% on €132m a year ago as expected, remaining on track despite the COVID-19 pandemic as operations continued running without interruption due to early counter-measures and a stable supply chain. In fact, second-quarter 2020 revenue was €56m, down 11.5% on €63.3m a year ago but up 37% on €41m in Q1. The main drivers of demand are the growing markets for gallium nitride (GaN) and silicon carbide (SiC) power electronics, lasers for ultra-fast optical data transmission, and specialty LEDs for display and disinfection applications.

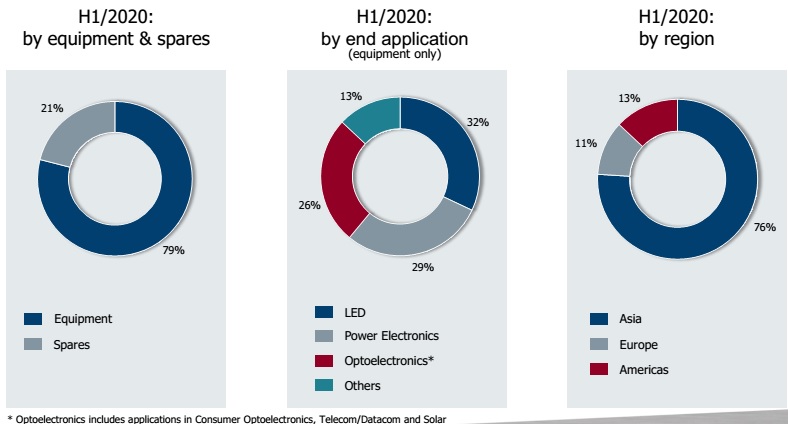

Equipment revenue in particular (excluding spare parts and service) has fallen by 28% from €106.5m (81% of total revenue) in first-half 2019 to €76.4m (79% of revenue) in first-half 2020. However, although still down on €50.3m (79% of revenue) in Q2/2019, quarterly revenue has rebounded by 56% from €29.9m (73% of revenue) in Q1/2020 to €46.5m (83% of revenue) in Q2.

On a regional basis, 76% of first-half 2020 revenue came from Asia, 13% from the Americas and 11% from Europe.

Despite regional coronavirus-related lockdowns (first in China and later in Europe and the USA) which led to the postponement of delivery and commissioning of a few systems at the request of customers, Aixtron has continued to show strong profitability and return on investment.

Gross margin fell only slightly from first-half 2019’s 40% to 39% in first-half 2020, as the dip in Q1 to 36% (following delayed final acceptances of metal-organic chemical vapor deposition systems, due mainly to pandemic-related travel restrictions) was compensated by a rebound to 41% in Q2/2020 (level with Q2/2019), aided an improved higher-margin product mix.

The significant increase in revenue and margins between April and June resulted in a significantly improved operating result (earnings before interest and taxes) from -€1.1m in Q1 to €3.3m in Q2. Overall, first-half 2020 EBIT of €2.2m (EBIT margin of 2% of revenue) compared with first-half 2019’s €19.1m (margin of 14%).

R&D spending was €28.6m (30% of revenue) in first-half 2020, up 13% from first-half 2019’s €25.3m (just 19% of revenue). R&D for leading-edge technologies is focused on the development and improvement programs for next-generation MOCVD systems - for all application markets - and the organic light-emitting diode (OLED) qualification project, where Aixtron has achieved some critical specifications and is working intensively on achieving further specs. In parallel, the firm is commencing discussions with the customer on the next steps in the joint OLED program.

As a result of the lower revenue and margin in first-half 2020, net profit was just €2.5m, down from €15.8m in first-half 2019. However, the quarterly net result recovered from -€0.8m in Q1 to €3.3m in Q2/2020.

However, due to Aixtron’s further build-up of inventories by €12.2m in first-half 2020 (from €79m to €85m during Q1 then €91.2m during Q2) in preparation for increasing shipments in second-half 2020, operating cash flow was -€7.9m in Q2 and hence -€3.2m in first-half 2020 (compared with +€1.8m in first-half 2019). Capital expenditure (CapEx) was €3.4m in Q2 and hence €5.2m in first-half 2020 (cut from €6.6m in first-half 2019). Free cash flow in first-half 2020 has therefore worsened from -€4.8m in first-half 2019 to -€8.4m in first-half 2020 (with -€11.3m in Q2 outweighing +€3m in Q1).

Cash and cash equivalents including short-term financial investments (bank deposits with a maturity of at least three months) hence fell during Q2, from €300.8m to €288.6m.

Total orders (including spares & services) have risen further, from €68.8m in Q1 to €69.6m in Q2/2020 (up 56% on €44.7m in Q2/2019), taking first-half orders to €138.4m (up 41% on €98.3m a year ago) driven by continued strong demand from the power electronics, optical data communications and LED sectors.

Consequently, Aixtron enters second-half 2020 with strong order backlog (equipment only) of €156.6m, up 7% on €146.3m at the end of Q1/2020 and up 42% on €110.1m at the end of first-half 2019.

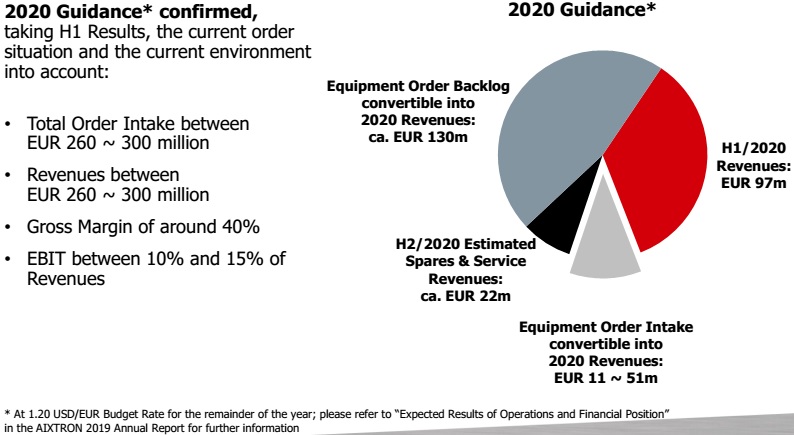

Based on (1) the solid order backlog, (2) the currently estimated low impact of the COVID-19 pandemic and (3) the budget exchange rate of $1.20/€, Aixtron expects order intake for full-year 2020 to grow to €260-300m (up from €231.9m in 2019).

Based on equipment order backlog (convertible into 2020 revenue) of €130m at the end of first-half 2020, joined by €11-51m of expected order intake shippable during 2020 plus an estimated €22m of spares & services revenue, for full-year 2020 Aixtron still expects revenue of €260-300m, with gross margin of about 40% and EBIT margin of 10-15% of revenue.

“In the second half of the year, our business should grow much more dynamically again,” comments president Dr Bernd Schulte. “We expect revenues to grow strongly in the third quarter and then again in the final quarter,” he adds.

“The renewal of our product portfolio is making good progress,” believes president Dr Felix Grawert. “With our new products we will be able to better support our customers in their growth in future markets such as 5G mobile network expansion and e-mobility”.

Aixtron changes composition of Executive Board

Aixtron’s Q1 revenue falls 40% year-on-year to €41m

Aixtron year-to-date revenue grows despite export license delays hitting Q3