News: Markets

30 July 2021

VCSEL market growing at 13.6% CAGR, doubling from $1.2bn in 2021 to $2.4bn in 2026

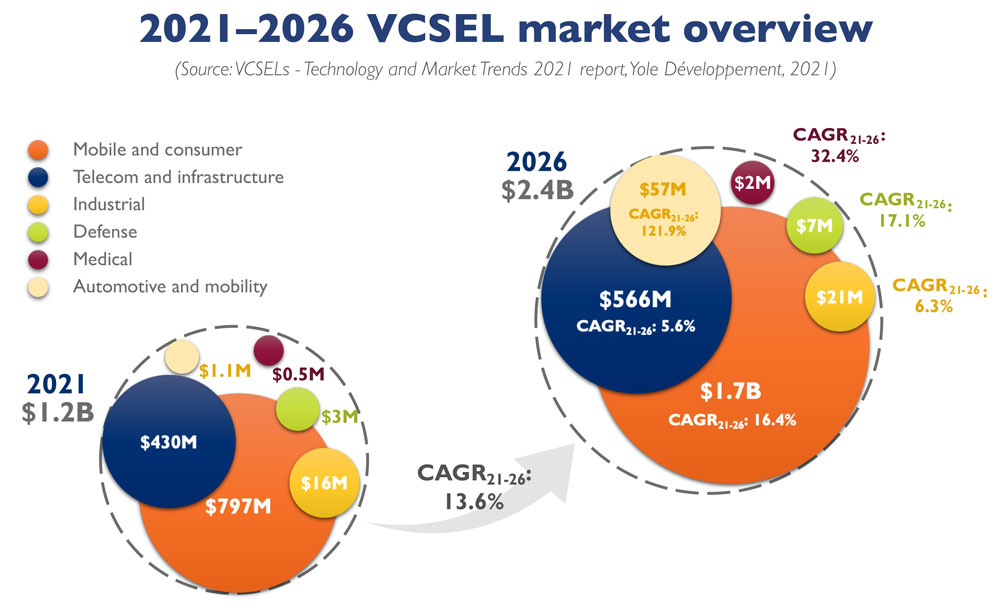

The global vertical-cavity surface-emitting laser (VCSEL) market is rising at a compound annual growth rate (CAGR) of 13.6% from $1.2bn in 2021 to $2.4bn in 2026, driven by datacom and mobile applications, forecasts Yole Développement in its report ‘VCSEL - Technology and Market Trends 2021’.

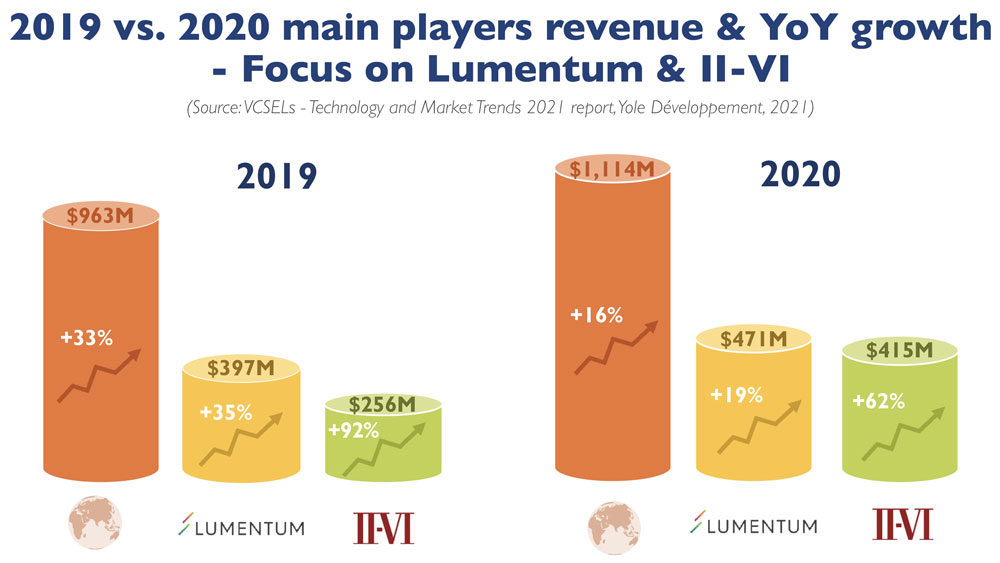

The two companies Lumentum and II VI dominate VCSEL manufacturing, collectively taking about 80% market share. However, there are many VCSEL suppliers, with fewer than ten big players and many medium or small players.

The dominant mobile & consumer market segment will grow at a 16.4% CAGR from $797m in 2021 to $1.7bn in 2026. “Revenues linked to smartphones are expected to remain stable in 2021 and 2022,” says Pierrick Boulay, technology & market analyst, Solid-State Lighting. “This is explained by the decreasing adoption of 3D sensing modules by Android players. In 2021, only Apple is implementing VCSELs and developing AR applications. This will create a relatively flat market for two years. Growth could be back after that with Android players,” he adds.

“VCSEL technology is continuously evolving. It has already occurred in the past with the transition from 850nm-based VCSELs for datacom applications to 940nm-based VCSEL arrays for 3D sensing applications,” says Pierrick Boulay, technology & market analyst, Solid-State Lighting. “A few years ago, smartphones embedded a notch in the front display to implement the selfie camera and the face recognition module,” he adds. “These elements take up space and are unsightly. The goal is to hide these elements under the display. To enable this, a transition in the wavelength used for 3D sensing would be necessary for the light to penetrate the display.”

The second biggest market segment of data communications will rise at a CAGR of 5.6% from $430m in 2021 to $566m in 2026.

The VCSEL market for automotive & mobility applications is quite small in 2021, with revenue of $1.1m, but will grow at a 122% CAGR to $57m in 2026, with applications in light detection and ranging (LiDAR) and driver monitoring.

Industrial applications are expected to grow at a 6.3% CAGR from $16m in 2021 to $21m in 2026. Yole reckons that industrial revenue could take-off in the mid-term with the emergence of applications using 3D LiDAR, related to smart infrastructure and logistics.

Since it appears that organic light-emitting diode (OLED) displays are transparent to short-wavelength infrared (SWIR) light around 1300-1400nm, the shift from 940nm to such SWIR wavelengths will deeply impact components and the supply chain, says Yole. For 940nm, VCSELs are made from 6”-diameter gallium arsenide (GaAs) wafers. However, SWIR VCSELs should be based on indium phosphide (InP), which is much more difficult to process, and manufacturing is currently done on 2” and/or 3” InP wafers.

“The impact is not limited to the light source but also to the receiver, where silicon-based single-photon avalanche detectors (SPADs) are used in the near-infrared (NIR) region,” notes Pars Mukish, business unit manager, Solid-State Lighting & Display. “Silicon can no longer be used in the SWIR region. SPADs will have to be based on indium gallium arsenide (InGaAs) material or using quantum dots. In both cases, the technology is still emerging, manufacturing yields are low, and availability of components is limited. This will lead to higher component costs for both the emitter and the receiver”.

Only Apple, whose smartphones have average selling prices (ASPs) higher than $1000, can afford such a technology change, belives Yole.

Smartphones are not the only application where technology is evolving. Automotive applications, and LiDAR in particular, will benefit from recent developments. Multi-junction technology represents the next leap forward for the VCSEL industry, reckons Yole. Multi-junction VCSELs offer many significant benefits to users. In a back-side emitting configuration, they have several advantages over their conventional siblings. In particular, eliminating wire bonds would improve VCSEL performance and allow the use of micro-lenses, enabling the use of more compact packages, concludes Yole.

VCSEL market to grow at 18.3% CAGR from $1bn in 2020 to $2.7bn in 2025

www.i-micronews.com/products/vcsels-technology-and-market-trends-2021