News: Markets

11 May 2021

Edge-emitting laser market growing at 15% to $6.6bn in 2026, driven by historical applications

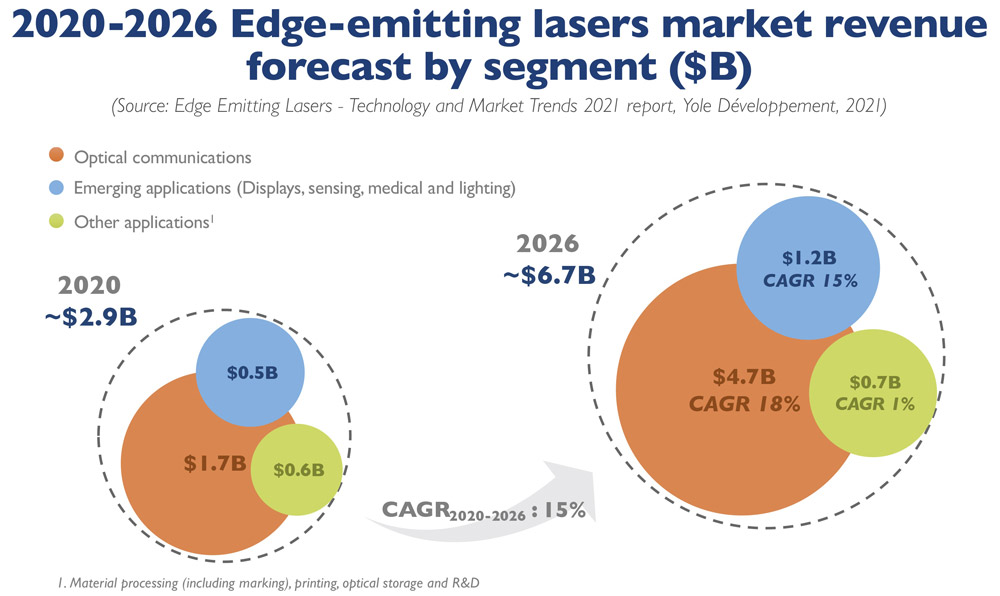

The edge-emitting laser (EEL) market is rising at a compound annual growth rate (CAGR) of 15% from $2.9bn in 2020 to $6.6bn by 2026, driven by optical communications, while emerging applications (such as display, sensing, medical and lighting, which are also growing at 15%) are now outpacing traditional material processing, forecasts Yole Développement in its report ‘Edge Emitting Lasers - Technology and Market Trends 2021’.

“Since the development of lasers in the 1960s, they have been increasingly used in a large number of applications,” says Martin Vallo PhD, technology & market analyst, solid-state lighting technologies, in the Photonics, Sensing & Display division. “The unique properties of coherent light have helped replace conventional manufacturing methods and have advanced fiber-optic communication. This has propelled the laser market to a trillion-dollar business since the 1990s,” he adds.

Contributing $2.2bn of revenue in 2020 (more than 75% of the edge-emitting laser market), material processing and optical communication applications collectively continue to be the main driver.

Laser technologies are also ubiquitous in many emerging applications, mostly spanning semiconductor manufacturing, 3D sensing, spectroscopy, medical, display and lighting applications.

“Edge-emitting lasers can be used as ‘direct’ lasers but also coupled with optical fibers or crystals to make fiber lasers or diode-pumped solid-state lasers (DPSSLs),” notes Pars Mukish, business unit manager, Solid-State Lighting & Display. “The advanced laser technologies then provide advantages such as better beam quality, improved stability in terms of laser noise, and increased power output,” he adds.

Optical sensing, mainly light detection & ranging (LiDAR), will play an increasingly important role in the evolving automotive landscape, notes Yole.

Material processing, which is currently the second largest market for edge-emitting lasers, will remain an attractive business in terms of value but growth will be limited to a CAGR of only 3% over 2020-2026, particularly due to the US-China trade war and COVID-19 pandemic, reckons Yole. On the other hand, some traditional applications such as printing and optical storage will continue to decline rapidly due to trends in digitization and cloud storage.

Diverse market segments and supply chains

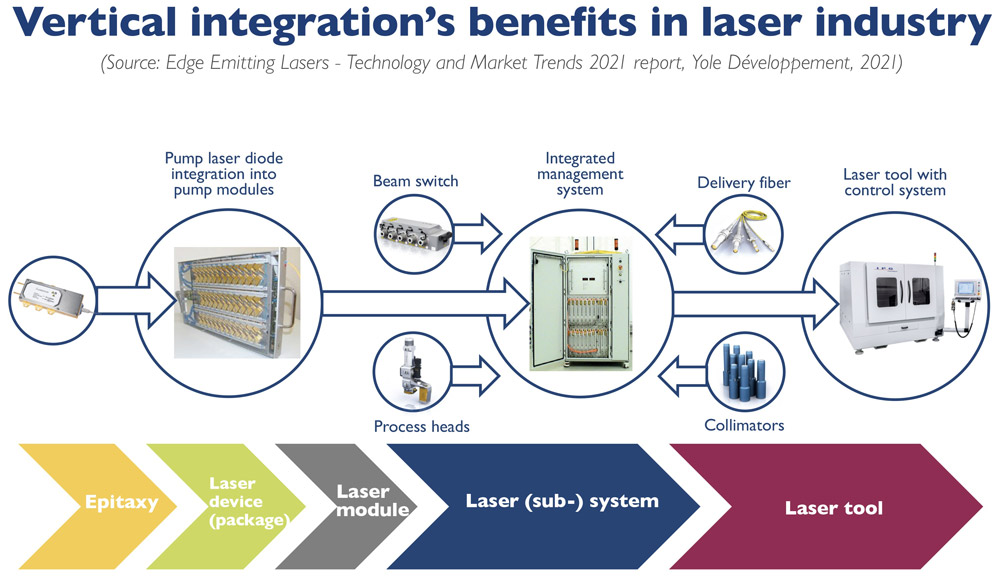

Each market segment addresses its own value chain due to their highly specific demands on laser technology. Most edge-emitting laser manufacturers are therefore vertically integrated, doing in-house epitaxy and front-end-of-line (FEOL) processing.

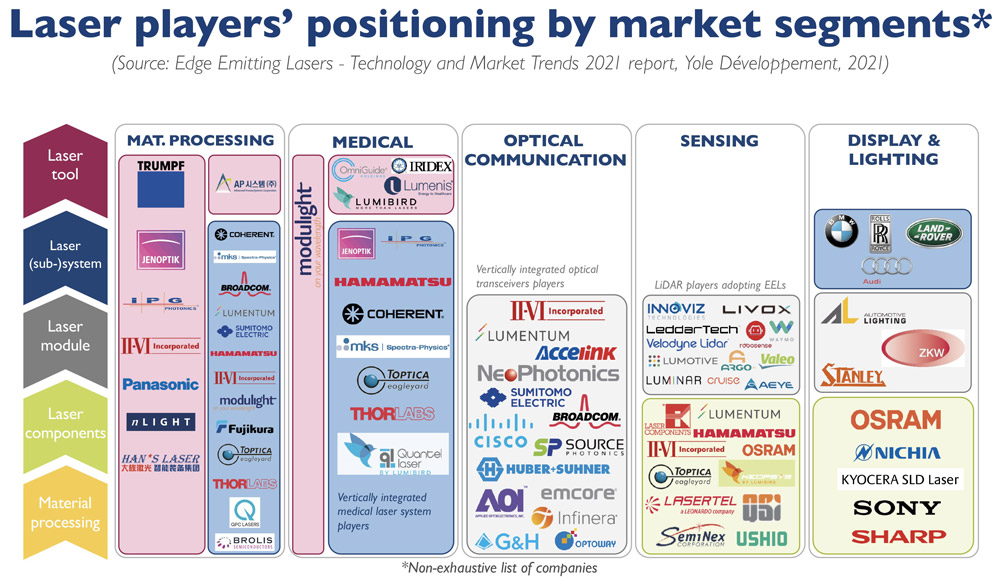

Such diversified laser technologies, coupled with the wide spectrum of laser applications, create different leaders for each market segment of the highly fragmented edge-emitting laser industry, Yole notes. The firm’s market research has identified more than 100 edge-emitting laser manufacturers, but key semiconductor laser players in the material processing, medical, optical communication, sensing, and display and lighting market segments are as follows:

- Material processing: Trumpf, IPG Photonics, Coherent, Han’s Laser, Raycus;

- Medical: Modulight, Coherent, Jenoptik, MKS, Hamamatsu;

- Optical communications: II-VI, Lumentum, Broadcom, Neophotonics, Cisco;

- Sensing (LiDAR): Lumentum, II-VI, Osram, Hamamatsu, Laser Components;

- Display and Lighting: Osram, Nichia, Sony, Sharp, Kyocera SLD Laser.

There is hence no overall leader in the laser industry. The vast majority of laser suppliers come from the USA, Japan, Germany and Canada. Chinese laser suppliers focus on assembly laser machines such as automated cutting/welding tools, optical transceivers, LiDAR etc. However, the Chinese government is investing significantly in core laser technologies, notes Yole. As tension between the USA and China escalates, China wants to maintain its economic growth by ensuring a secure and controllable technology supply chain as well as building domestic technology sectors in order to be independent of US parts impacted by tariffs, the market research firm concludes.

www.i-micronews.com/products/edge-emitting-lasers-technology-and-market-trends-2021