News: Suppliers

7 April 2022

IQE’s full-year 2021 constant-currency revenue down a less-than-expected 7%

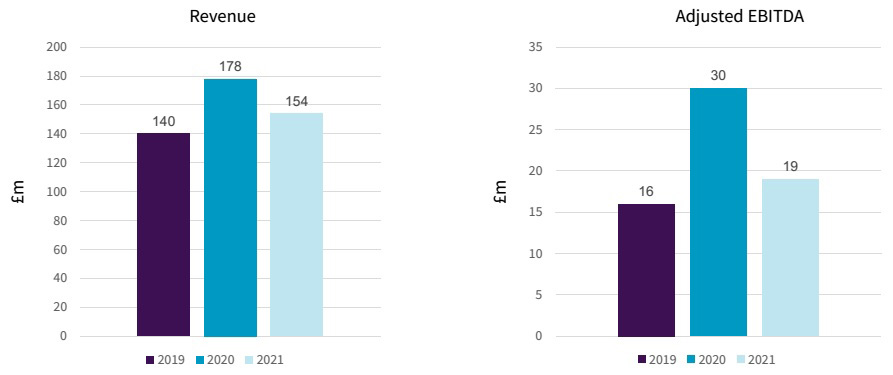

For full-year 2021, epiwafer and substrate maker IQE plc of Cardiff, UK has reported revenue of £154.1m, above the £152m guidance but down 13.4% on 2020’s £178m. However, the firm experienced a foreign exchange (FX) headwind of about £10.6m affecting GBP revenue on a reported basis, caused by the relative strength of Sterling versus the US dollar (in which most of IQE’s revenues are denominated). On a constant-currency basis, revenue was down just 7.3% at £165m (in line with November’s trading update of £164m).

Wireless revenue of £83.2m was down 11.6% on a reported basis and 5.5% on a constant-currency basis from 2020’s £94.2m. Specifically, despite some softening of demand in the broader smartphone supply chain in Q4/2021, revenue grew by 19% for gallium arsenide (GaAs) epiwafers, driven by 5G penetration of the smartphone handset market and WiFi 6/6E as part of a multi-year replacement cycle driven by a macro technological trend. This resulted in high utilization of manufacturing capacity at IQE’s Taiwan facility, where the firm has invested in eight new and refurbished tools - including three new Aixtron G4 metal-organic chemical vapor deposition (MOCVD) reactors - that are currently being commissioned to support further growth in demand in 2022 and beyond. This was offset by a 49% decline for gallium nitride (GaN) epiwafers used in 5G infrastructure. After a strong performance for GaN in 2020 resulting from the initial wave of 5G massive MIMO (multiple-input, multiple-output) base-station deployments (particularly in Asia), delays to further global deployments were experienced in 2021 (including a slow rate of deployments in Western markets). However, a multi-year replacement cycle is still anticipated for 5G infrastructure, including strong anticipated GaN content. Despite the decline in revenue, the Wireless business segment rose from 52.9% of total wafer sales in 2020 to 54% in 2021.

Photonics revenue of £68.1m was down 16.6% on a reported basis and 10.4% on a constant-currency basis from 2020’s £81.6m (falling from 45.9% to 44.2% of wafer sales). Vertical-cavity surface-emitting lasers (VCSEL) revenue for 3D sensing applications was down by 19% as a result of smaller chip design sizes and a softening in smartphone supply chains towards the end of 2021, in line with seasonality and general softening in smartphone supply chains. IQE says that it maintained strong market share in its key supply chain and remains well positioned for future product evolutions. Infrared revenue is down 8%, due to the delay (into 2022) of certain defence aerospace and security orders associated with large programs being re-phased (with no loss of market share expected) as well as the slower introduction of sales of certain new products. InP and other revenues were up by 16%, predominantly due to strength in datacom and telecom markets as well as new growth areas of sensing.

CMOS++ revenue of £2.8m was up by 28% on 2020’s £2.2m (rising from 1.2% to 1.8% of total revenue), adding scale to IQE’s silicon epitaxy operation (important to the integration of compound semiconductors on silicon, the firm notes).

IQE is in the process of improving its profitability through a global site optimization program and growing margins (in the medium to long term) by achieving higher volumes and hence economies of scale (improving production efficiency) at its strategic site locations. The global site optimization program involves:

- closure of IQE’s Pennsylvania site and the associated consolidation of US-based molecular beam epitaxy (MBE) capacity into its larger and more scalable North Carolina site by 2024, incurring employee-related restructuring costs of £0.66m in 2021 (up from £0.16m in 2020);

- closure of IQE’s Singapore site by mid-2022 (realising about £4.8m per annum of cash savings as part of the MBE consolidation plan), incurring restructuring costs of £3m in 2021 (£1.54m employee-related, plus £1.48m from site decommissioning);

- completion of the acquisition of minority interests in IQE Taiwan Corp in December 2021.

Due to the site closures, total restructuring-related exceptional costs of £3.68m have been recognized (classified as selling, general & administrative expenses).

Also, to focus the business, longer-term developments such as cREO (crystalline rare-earth oxide) filter technology and QPC (Quasi Photonic Crystal) are being de-prioritized in the short term to focus development programs on market-driven solutions. IQE says that it will retain the technology, capability and IP, enabling redeployment if and when appropriate commercial opportunities arise. IQE has hence recognized (in its reported operating loss): an exceptional intangible asset-impairment charge of £7.4m (including a non-cash impairment charge of £4.7m related to cREO development costs and patents); and a non-cash impairment charge of £2.7m for QPC and diffusers.

Excluding the exceptional charges totaling £13.5m, the adjusted operating loss (on a constant-currency basis) was £6.5m (compared with an operating profit of £5.4m in 2020).

Adjusted EBITDA (earnings before interest, tax, depreciation and amortization) has fallen from 2020’s £30.1m to £18.7m on a reported basis. However, on a constant-currency basis this is equivalent to £25m, an EBITDA margin of 15% (down from 2020’s 17% due mainly to IQE’s operational gearing.

Net cashflow from operations has fallen from £35.5m to £18.9m, representing 96% conversion of adjusted EBITDA.

Capital expenditure on property, plant & equipment (PP&E) has tripled from £5m in 2020 to £15.1m in 2021 (below the prior guidance of £20-30m due to the phasing of payments for certain tool purchases into 2022), focussed on the deployment of additional tools to meet growing wireless GaAs epiwafer demand for 5G handset and WiFi 6 products in Taiwan.

This has resulted in a net debt position (excluding lease liabilities) of £5.8m at the end of 2021 (compared with net cash of £1.9m at the end of 2020).

IQE renewed a $35m revolving credit facility with HSBC bank in December and had a cash position at the end of 2021 of £10.8m.

IQE reckons that operations remain resilient in 2022 to the challenging macro-economic and geopolitical backdrop. The firm adds that it continues to monitor and work to mitigate potential headwinds in global semiconductor supply chains.

Business development progress during 2021 is listed as:

- a long-term strategic collaboration agreement signed with GlobalFoundries in Q4/2021 to develop vital gallium nitride on silicon (GaN-on-Si) technologies for mobile and wireless infrastructure applications;

- a multi-year strategic partnership signed in Q3/2021 with a major semiconductor foundry to develop epiwafers for 5G small cells in Asia.

Technology developments during 2021 include:

- expansion of the VCSEL portfolio with the turnkey IQVCSEL product line (with initial deliveries made to multiple customers);

- the achievement of key power and reliability milestones for IQDN-VCSEL technology for advanced sensing applications at longer wavelengths on 150mm GaAs substrates (relevant to future LiDAR technologies);

- scaling of VCSEL-on-Ge technology (IQGeVCSEL) to 200mm, enabling a step-change in industry economics in support of the broader adoption of 3D sensing.

“As the only global outsourced epitaxy provider and a leader in our field, IQE is uniquely placed to capitalize on major technological trends while navigating a challenging external environment,” believes CEO Americo Lemos. “To secure this growth, we must first build a commercial engine that is orientated to our end markets, focussed on our customers and aligned with our technology innovation,” he adds. “My vision is to grow IQE through multiple strategic and long-term customer relationships. We will be developing this strategy more fully during 2022.”

IQE expects to grow revenues by a low single-digit % in 2022 (at constant currency), with growth weighted towards second-half 2022. At this level, IQE anticipates a similar adjusted EBITDA margin to 2021 (at constant currency). Capital expenditure of £10-15m is expected on PP&E and £6-8m on capitalized intangibles relating to development costs and IT transformation.

IQE says that in 2022 it aims to focus on building a platform for growth to deliver further progress in 2023 and beyond. The firm is confident that this refreshed strategy will enable a multi-year cycle of growth, driven by the macro trends of 5G, IoT and the Metaverse, as the global economy and semiconductor markets recover from current risks and disruption.

IQE’s full-year 2021 constant-currency revenue to be down 8%

IQE appoints Americo Lemos as CEO

IQE’s first-half 2021 GaAs revenue grows 30%, offsetting drops for GaN-on-SiC and Photonics

IQE reaches milestones with IQDN-VCSELs for long-wavelength sensing on 150mm GaAs

IQE’s revenue grows 25% in 2020, exceeding guidance of 20%

IQE develops IQGeVCSEL 150 technology