News: Suppliers

15 May 2023

Veeco’s semiconductor-related revenue up 20% year-on-year in Q1

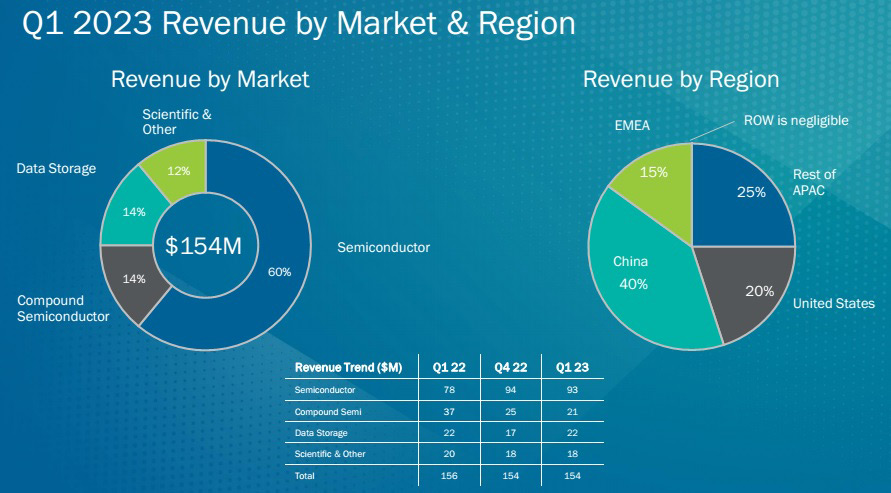

For first-quarter 2023, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $153.5m, roughly level with $153.8m last quarter but down slightly on $156.4m a year ago. However, this was above the $130–150m guidance range, driven by sales to semiconductor customers.

The Semiconductor segment (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) contributed $93m (60% of total revenue). This is up 20% on $78m (49% of revenue) a year ago, led by laser spike anneal (LSA) systems. “Our laser annealing business is gaining momentum, as demonstrated by recent orders for additional annealing steps at leading logic customers,” says CEO Bill Miller. “We’re also seeing traction within the memory market for advanced nodes, which represents a significant long-term growth opportunity for the company.”

The Compound Semiconductor segment (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, Laser Diodes) contributed $21m (14% of total revenue). This is down on $25m last quarter and $37m (24% of revenue) a year ago. System shipments for photonics applications were the primary contributor.

The Data Storage segment (equipment for thin-film magnetic head manufacturing) contributed $22m (14% of total revenue), level with a year ago but up on $17m (11% of revenue) last quarter.

The Scientific & Other segment (research institutions and other applications) contributed $18m (12% of total revenue), level with last quarter but down on $20m (13% of revenue) a year ago.

By region, revenue from China comprised 40% of total revenue (up on 19% last quarter) driven primarily by LSA systems to trailing-edge semiconductor nodes; the Asia-Pacific region (excluding China) 25% (down from 42%) led by Semiconductor system sales; the USA 20% (down on 25%); and Europe, Middle-East & Africa (EMEA) 15% (up slightly on 14%).

On a non-GAAP basis, gross margin has fallen further, from 43.1% a year ago and 42.3% last quarter to 41.5%. However, this is above the 39–41% guidance range, boosted by a favorable product mix and operation spending.

Operating expenses were $43.3m. “We continue to be cautious in adding expenses in the current macroeconomic environment, while funding our growth initiatives to expand our served available market,” says senior VP & chief financial officer John Kiernan.

Net income was $16.9m ($0.30 per diluted share), down on $21.9m ($0.38 per diluted share) last quarter. However, this outperformed the $6–15m ($0.12–0.28 per diluted share) guidance range.

Cash flow from operations was $14m (down from $33m last quarter). Capital expenditure (CapEx) was $7m.

Veeco ended the quarter with cash and short-term investments of $253m, down by $50m from $303m after using $30m for the acquisition of silicon carbide (SiC) chemical vapor deposition (CVD) system maker Epiluvac AB of Lund, Sweden and paying $20m for extinguishing the remaining 2023 convertible senior notes. Long-term debt was $254.7m, represents the carrying value of the outstanding $258m in convertible notes (comprising $133m due 2025 and $125m due 2027).

During the quarter, inventory rose by $19m from $207m to $226m (from 196 days to 213 days of inventory). This was driven by an increase in inbound materials to support higher expected revenue in second-half 2023 and to build the level of safety stock that was depleted as a result of supply chain challenges.

“Our team did an excellent job of managing the supply chain,” comments Miller. “While material lead-times remained elevated, our suppliers’ on-time deliveries have improved. We’re starting to see some signs that material lead times could improve in the second half of the year.”

“As we look ahead in 2023, we remain committed to investing in the semiconductor and compound semiconductor markets with differentiated solutions positioning Veeco for long-term growth,” says Miller.

For second-quarter 2023, Veeco expects revenue to be roughly level at $145–165m. Specifically, the firm expects growth in the Semiconductor segment to about $105m and in the Compound Semiconductor segment to $25m, while the Data Storage segment drops back to about $15m and Scientific & Other revenue will almost halve to about $10m. Gross margin is expected to be about 42%. With operating expenses of $44–46m, net income should be $14–20m ($0.26–0.34 per diluted share).

“While China revenue in Q2 is forecasted to remain elevated, we expect a sequential decline from Q1 and a further decline in the second half of the year,” says Kiernan. “In the second half of the year, we expect revenue growth to be led by tier-1 advanced semiconductor and data storage customers.”

Based on current backlog and visibility, Veeco’s revenue outlook for full-year 2023 remains relatively flat on 2022 at $630–670m, with revenue in the second half exceeding that of the first half, based on the scheduled shipments of order backlog. The firm continues to target diluted earnings per share of $1.15–1.35.

“Our wet-processing business has been weak over the last 6–9 months due to softness in the smartphone market. Timing of the market recovery is not yet clear. However, the power electronics and photonics markets offer promising opportunities for growth,” says Miller.

“In power electronics, we’re focused on GaN with our legacy MOCVD technology and with CVD silicon carbide [Epiluvac], which we recently acquired,” he adds.

“Integration of the acquired CVD technology is progressing well [having shipped the demo tool from Sweden to Veeco’s demo lab in Somerset, New Jersey], with our system expected to be demo ready in the second half of 2023. Our system represents a significant opportunity for a differentiated solution to address growing power electronics demand in the electric vehicle market. We’ll continue to engage our customers through evaluation system shipments and remain focused on penetrating the rapidly growing silicon carbide market. We would expect to have eval systems for some tier-1s in 2024 and then also start selling directly to some tier-2 customers as well. So, we're planning for some modest revenue in 2024, but I think we have more meaningful revenue in 2025,” Miller says.

“We do have an evaluation system for GaN power electronics. It’s for the transition from 6-inch to 8-inch. The product is running. Our customers asked us to extend that evaluation through this year. So it's a little slower taking off than we had originally planned. We probably won’t see any meaningful GaN-on-silicon power activity beyond where we are today until the 2024 time-frame,” he adds.

“We also have GaN-on-silicon for micro-LED, where we’re working with a few customers on opportunities there. Our epitaxy equipment to address micro-LED applications continues to display promising long-term growth potential,” continues Miller. “We’re making ongoing investments in this area, including R&D, supporting customer demos and evaluations to penetrate these market opportunities.”

Veeco grows revenue 11% in 2022, despite 10.5% dip in Q4 driven by smartphone-related 5G RF weakness

Veeco acquires silicon carbide CVD system maker Epiluvac

Veeco grows revenue 4.9% in Q2, despite supply chain constraints