News: Suppliers

8 May 2024

Aixtron grows Q1 revenue and profit significantly year-on-year

For first-quarter 2024, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €118.3m (near the top end of the €100–120m guidance range). This was down 45% on last quarter’s record €214.2m but up 53% on €77.2m a year ago (although the latter was reduced by delays in the issue of export licenses, pushing €70m worth of shipments out of the quarter).

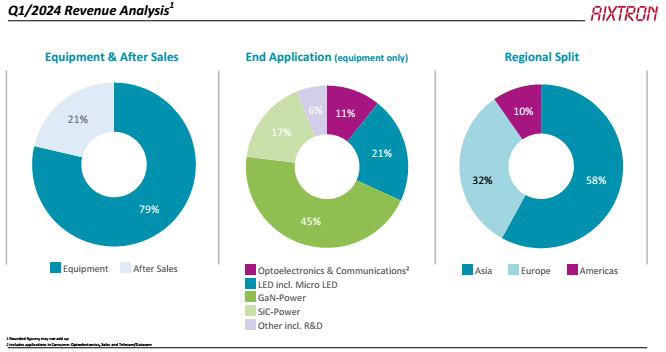

On a regional basis, 58% of revenue came from Asia (up from 47% a year ago, almost doubling from €36.2m to €68.6m), 32% from Europe (up from 28%, growing by 77% from €21.6m to €38.2m) and 10% from the Americas (down from 25%, shrinking by 41% from €19.4m to €11.5m).

Of total revenue, 79% came from equipment sales (up from 73% a year ago), growing by 65% year-on-year from €56.3m to €93m, driven largely by systems for applications in silicon carbide (SiC)- and gallium nitride (GaN)-based power electronics. The remaining 21% of total revenue came from after-sales (consumables, spare parts and services).

Of the equipment revenue, metal-organic chemical vapor deposition (MOCVD)/chemical vapor deposition (CVD) systems for making GaN- and SiC-based power electronics devices comprised 45% and 17%, respectively, and 62% collectively (€57.7m, up 59% on €36.3m a year ago).

Growth was driven by further technical advances to the G10-SiC CVD system for the production of silicon carbide-based power electronics, which have already been confirmed by numerous customers and will be implemented in systems already delivered in the course of the year. Aixtron has hence been able to win further new customers in the SiC segment, in particular an additional customer from the ‘top-five’ SiC manufacturers (meaning that three of the top-five SiC-players now rely on the G10-SiC for their 200mm volume ramp), as well as a large volume order from China and several customers in Japan.

In addition, gallium nitride-based power electronics continue to expand into new application areas, with the new G10-GaN MOCVD system (launched in September 2023) proving very popular among both new and repeat customers, based on performance and cost per wafer.

MOCVD systems for making LEDs (including micro-LEDs) comprised 21% of equipment revenue (up from just 12% a year ago), almost tripling year-on-year from €6.9m to €19.6m. R&D activities in the micro-LED segment continue to be highly dynamic, which has led to increased demand for Aixtron technology and orders from numerous customers.

MOCVD systems for making other optoelectronics devices (telecoms/datacoms and 3D sensing lasers for consumer electronics, solar, and wireless/RF communications) comprised 11% of equipment revenue (down from 23% a year ago), falling year-on-year from €13m to €10m, mostly comprising systems for producing lasers for optical data communications.

Investing in R&D and staffing

Gross margin was 37%, down from 46% last quarter and 40% a year ago, and below the 43–45% guidance for full-year 2024. However, this corresponds to the strong revenue and the change in product mix, plus fixed-cost effects.

Operating expenses have risen from €27.6m a year ago to €33.8m. This was due partly to R&D spending rising by 19% from €19.2m to €22. 9m, following €27.9m last quarter. As well as implementing further improvements to its new G10 product family, Aixtron is simultaneously already investing in future tool generations.

Accordingly, full-time equivalent staffing has grown further, by 16% year-on-year from 974 to 1132.

Also, after breaking ground in Q4/2023, work on the new Innovation Center in Herzogenrath is on schedule and within budget. Involving an investment of about €100m, Aixtron is creating a new cleanroom where it will work with customers on the development and testing of the next generation of systems.

Year-on-year increase in profit

In Q1/2024, operating profit (earnings before interest and taxes, EBIT) was €9.9m (EBIT margin of 8%), almost tripling from €3.5m (5% EBIT margin) a year ago.

Net profit was €10.8m (€0.10 per share), more than tripling from €3.5m (€0.03 per share) a year ago.

CapEx and inventory building still exceeding cash generation

Operating cash flow was €7.4m (up from €5.8m a year ago). Capital expenditure (CapEx) was €25.7m (up from just €3.9m).

Free cash flow was hence –€33.1m, compared with €1.9m a year ago. This was due mainly to the investments related to the Innovation Center, plus a further increase in inventories of €41.4m (from €394.5m to €436.4m) in preparation for a correspondingly high business volume in the following quarters.

Cash and cash equivalents (including other current financial assets) have correspondingly fallen further, from €327.5m a year ago and €181.7m last quarter to €148.5m.

However, underlining the firm’s financial strength, the equity ratio has risen further, from 72% a year ago and 75% last quarter to 76%.

At the Annual General Meeting on 15 May, the Executive Board and the Supervisory Board are proposing a dividend payout of €45m from accumulated profit for 2023, i.e. €0.40 per entitled share (up from 2022’s €0.31 per share).

Balanced order intake across all end markets – strong momentum from micro-LED

Order intake was distributed relatively evenly across all addressed end-markets and amounted to €120.3m, down 41% on €204.5m last quarter and 14% on €139.9m a year ago.

There was strong new momentum from business with systems for micro-LED applications, which accounted for 37% of equipment order intake. This was boosted by the continued development activities of micro-LED customers, who are continuing to invest in development and pilot lines for the commercialization of micro-LED technology.

Equipment order backlog at the end of March was €355m, down 15% on €417.9m a year ago but roughly stable with €353.7m last quarter.

Full-year growth guidance confirmed

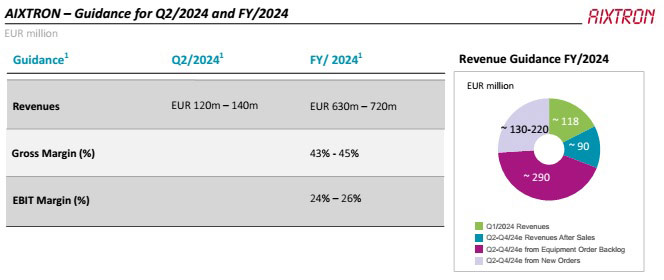

Based on the current corporate structure, the estimated development of the order intake, and the budget exchange rate of $1.15/€), Aixtron’s executive board has confirmed that, for full-year 2024, it expects revenue of €630–720m, gross margin of 43–45% and EBIT margin of 24–26%. Second-quarter 2024 revenue is expected to be €120–140m.

“Our recent technological achievements in SiC have further strengthened our position in this area and helped us to win new customers and follow-up orders. These successes are the result of our continuous work on innovative solutions that not only meet our customers’ needs but exceed their expectations,” says Aixtron’s CEO & president Dr Felix Grawert. “We are committed to long-term partnerships with our customers, with whom we work together on the innovations of the future. The Gold Supplier Award from the leading micro-LED player BOE HC SemiTek is further proof of the success of our strategy,” he adds.

“Our strategy’s success is rooted in a long-term perspective,” says chief financial officer Dr Christian Danninger. “We persistently invest in innovative solutions that address current technological challenges, whether it’s electrification, energy efficiency, or fast data transfer with growing volumes.”

Vishay selects Aixtron’s G10-SiC multi-wafer batch technology

Wolfspeed orders multiple Aixtron G10-SiC systems to support ramp-up of 200mm epi production

Aixtron wins German Innovation Award

Aixtron receives Gold Supplier Award from BOE HC SemiTek

Aixtron’s Q4 revenue grows to record €214.2m, aiding full-year growth of 36%

Aixtron begins constructing new €100m innovation center

Aixtron’s Q3 revenue and earnings up significantly year-on-year

Aixtron’s Q1 shipments roughly halved by delays in export licensing