News: Suppliers

18 November 2024

Aixtron’s revenue rebounds in Q3 as red LED resurgence compensates for SiC market dip

For third-quarter 2024, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €156.3m (up 18.6% on €131.8m last quarter but down 5% on €165m a year ago). This is in the lower half of the guidance range of €150–180m, as the delivery of a major micro-LED-related project was postponed from Q3 to Q4/2024 at the customer’s request.

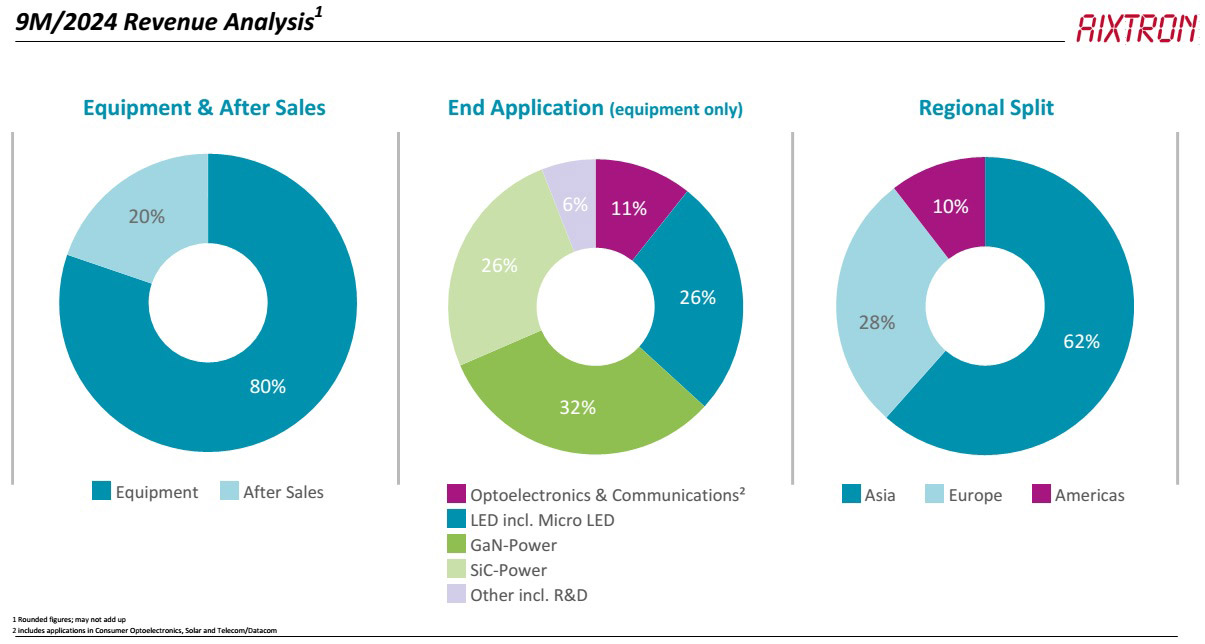

For the first nine months of 2024, revenue was €406.4m, down by just 2% on €415.7m in 2023 despite the weak market environment. However, this was aided by growth in revenue from Spare Parts & After-sales Services growing by 18% from $68.1m (16% of total revenue) to $80.3m (20% of total revenue). Revenue from equipment sales fell by 6% from $347.6m (84% of total revenue) to $326.1m (80% of total revenue), segmented as follows:

- Metal-organic chemical vapor deposition (MOCVD)/chemical vapor deposition (CVD) systems for making gallium nitride (GaN)- and silicon carbide (SiC)-based power electronics devices fell from 82% of equipment revenue in the first nine months of 2023 to 58% in the first nine months of 2024, with GaN rising to 32% whereas SiC has fallen to 26% as silicon carbide manufacturing capacity that has been built now exceeds the current demand.

- MOCVD systems for making optoelectronics devices (telecoms/datacoms and 3D sensing lasers for consumer electronics, solar, and wireless/RF communications) comprised 11% of equipment revenue (level with the first nine months of 2023).

- MOCVD systems for making LEDs comprised 26% (rebounding from just 6% in 2023), as companies that have been delivering only to the blue LED market for lighting or backlighting are now also investing in traditional red LED capacity.

On a regional basis for the first nine months of 2024, 62% of revenue came from Asia (rebounding year-on-year from 44%), 28% from Europe (down from 33%) and just 10% from the Americas (down from 23%).

Gross margin rebounds in Q3

For the first nine months, gross margin has fallen from 43% in 2023 to 39% in 2024. This includes Q3/2024 gross margin of 43%, down from 46% in Q3/2023 (due mainly to a less favorable product mix, which included a high proportion of lower-margin traditional LED systems). However, this was a strong rebound from just 37% in both Q1 and Q2/2024.

Investment in R&D peaks as development of G10 family is finalized

Operating expenses decreased slightly in third-quarter 2024 to €29.6m, down 4% from €30.9m a year ago. However, OpEx for the first nine months still rose by 14% from €87.4m in 2023 to €99.7m in 2024. This was due mostly to R&D spending rising by 15% from €59.8m to €68.7m. R&D costs were at a peak level due to Aixtron finalizing development of the G10 family (the first product of which was launched in September 2022) while, in parallel, starting development of the next-generation (300mm) GaN platform.

Technical progress in silicon carbide

At the International Conference on Silicon Carbide and Related Materials (ICSCRM 2024) in Raleigh, North Carolina in early October, Aixtron presented significant improvements to the 200mm G10-SiC system, achieving what is now claimed to be market-leading across-wafer layer thickness and doping uniformity, as well as the lowest cost per wafer due to the high productivity of the multi-wafer tool.

First 300mm GaN prototype systems used in pilot lines during transition from 200mm

“The potential of GaN-based efficient power electronics is enormous due to energy-intensive artificial intelligence and other applications,” says CEO & president Dr Felix Grawert. “Based on the expected high volumes, the first customers are now planning to switch to the next wafer size and are using our first 300mm GaN prototype systems [named Hyperion] in their development and pilot lines. Aixtron is transferring the wealth of experience and core elements of the proven 200mm technology to the next product generation [with volume production shipments expected in 2026-2027],” he adds.

“In addition, we can build on 25-plus years of Showerhead technology in our 300mm single-wafer reactor. With this, we are in a unique position and therefore we have started work on 300mm GaN early and built a dedicated cleanroom, our Innovation Center for our 300mm technology.”

First 300mm tool in new Innovation Center

After breaking ground in Q4/2023, Aixtron is investing about €100m in building a new Innovation Center for 300mm technology, comprising an R&D complex with over 1000m² of cleanroom space to work with customers on developing and testing next-generation systems. The first Aixtron system was recently moved into the new cleanroom. The official opening of the Innovation Center is scheduled for the end of 2024. “We expect first wafers out in Q4 this year, and first joint customer projects are already scheduled for Q1/25,” says Grawert.

Operating profit rebounds in Q3

The operating profit (earnings before interest and taxes, EBIT) for the first nine months has fallen from €93.4m (EBIT margin of 22%) in 2023 to €60.3m (15% margin) in 2024. Q3/2024 EBIT was €37.5m (24% margin), down from €45.3m (27% margin) in Q3/2023, due mainly to the lower gross margin resulting from the less favorable product mix and the higher R&D expenses. However, Q3 EBIT is much improved from first-half 2024’s €22.8m (9% margin), due to better volume and product mix.

Net profit for the first nine months has fallen from €83.5m in 2023 to €52.9m in 2024. Q3/2024 net profit was €30.9m, down from €39.6m in Q3/2023, but up from €11.2m in Q2/2024.

Positive cash flow

Operating cash flow significantly improved year-on-year: For Q3/2024, it was €15.4m, more than tripling from €4.9m in Q3/2023 and greater than the €12.8m in first-half 2024. In the first nine months of 2024 it improved by €94m, from –€65.6m in 2023 to €28.2m in 2024. This was positively impacted by inventory being reduced, from the peak of €447.9m last quarter (built up to meet the expected high volume of shipments) to €427m at the end of Q3/2024. This should be followed by even stronger inventory reductions in Q4/2024 and throughout 2025. “The aim is to reduce inventories to a normal level within the next 12 months,” says chief financial officer Dr Christian Danninger.

Capital expenditure for the first nine months rose from €16.6m in 2023 to €86.2m in 2024, including €17m in Q3/2024 (up from just €7m a year previously). This was driven primarily by investment in the Innovation Center for 300mm technology as well as the expansion of production capacities in Italy.

In June, Aixtron said that it had spent a single- digit-million euro amount to buy a building on a brownfield site near Turin, Italy, that it can fit out to quickly expand production capacity. First shipments should start contributing to revenue in Q4/2024, then ramp up in Q1 and Q2/2025, thus addressing the expected increase in demand from major customers (and able to cover future order peaks). Capacity could be doubled in future after additional investment in its infrastructure.

Despite these extra investments, free cash flow was –€1.5m in Q3/2024 (a big improvement from –€23.4m in Q2/2024), driving improvement for the first nine months from –€82.3m in 2023 to –€58m in 2024.

During Q3, cash and cash equivalents (including other current financial assets) hence fell only slightly, from €79.4m to €78.1m. This has more than halved from €181.7m at the end of 2023 and €209.9m a year ago, due mainly to the CapEx projects and a dividend payment of €45m in May. However, underlining the firm’s continuing financial strength, during Q3/2024 the equity ratio rose from 75% to 79%.

Order intake and backlog rise year-on-year

Order intake in Q3/2024 was €143.5m, down on €175.7m last quarter but up 21% on €118.5m a year ago, as momentum continues in demand for equipment for GaN- and SiC-based power electronics.

Equipment order backlog at the end of September 2024 was €384.5m, down from €400.6m at the end of June but up on €368m a year ago.

Revised full-year 2024 guidance confirmed

In fourth-quarter 2024, inventories should be reduced further by shipment of the large project that was pushed out from Q3 to Q4 at the customer’s wishes, boosting revenue dramatically to €215–255m.

This should also improve operating cash flow. Meanwhile, CapEx will come down as Aixtron nears completion of Innovation Center. “These two effects should result in a strong free cash flow,” reckons Danninger.

After on 4 July lowering its guidance for full-year 2024 revenue from €630–720m, Aixtron confirms its adjusted guidance of €620–660m. Expected gross margin remains 43–45%. The firm also confirms its revised EBIT margin guidance of 22–25% (reduced on 4 July from 24–26%).

Full-year 2025 revenue to be level or slightly below 2024

Aixtron says that the medium- and long-term drivers for revenue growth remain intact: efficient power electronics for IT and AI applications, SiC technology for e-mobility, and micro-LEDs for next-generation displays. However, in the short term, momentum in the end markets remains slow, so revenue for full-year 2025 is likely to be level or slightly below that of 2024.

Aixtron notes that some orders for 2026 are already being placed, and some orders are being pushed out towards 2026.

Aixtron’s revenue rebounds in Q2, boosted by LED segment

Nexperia orders Aixtron G10-SiC and G10-GaN systems for Hamburg fab

Aixtron’s Q2 order intake driven by silicon carbide and gallium nitride power electronics

Aixtron acquires Italian production site near Turin

Aixtron grows Q1 revenue and profit significantly year-on-year

Aixtron’s Q4 revenue grows to record €214.2m, aiding full-year growth of 36%

Aixtron’s Q3 revenue and earnings up significantly year-on-year