News: Suppliers

4 March 2021

Aixtron’s growth accelerates in Q4

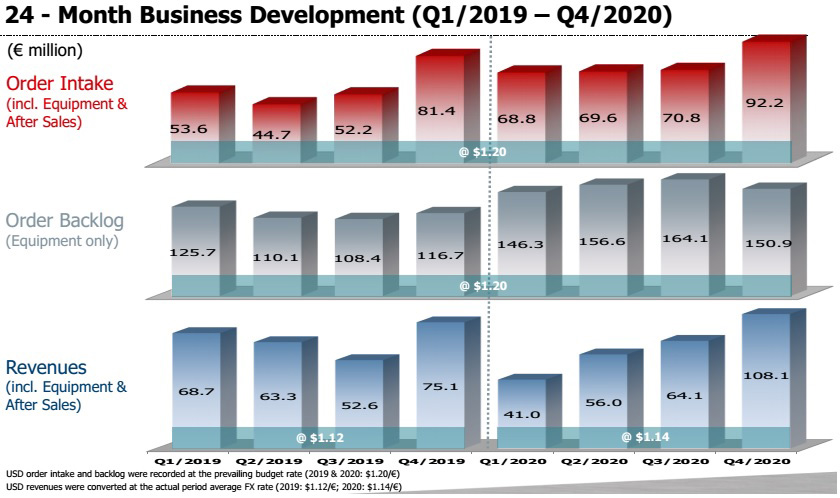

For full-year 2020, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported 4% revenue growth, from €259.6m in 2019 to €269.2m for 2020. However, growth accelerated in fourth-quarter 2020, with revenue of €108.1m up 69% on Q3’s €64.1m and 44% on €75.1m a year ago.

Aixtron’s revenue development benefited from the growing need for higher energy efficiency and data transmission speeds, as well as the growing use of innovative display technologies in consumer electronics.

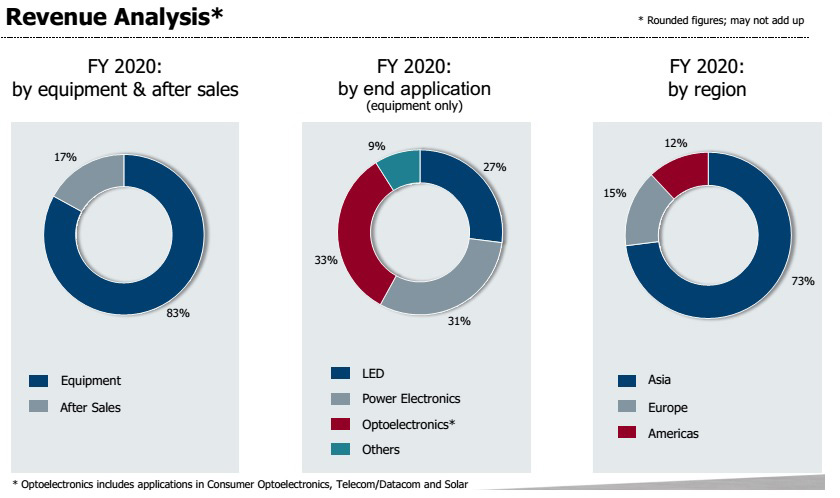

Of full-year equipment revenue, power electronics manufacturing nearly doubled from 2019, rising from 18% to 31% of total revenue, driven by strong demand for gallium nitride (GaN) power equipment. Metal-organic chemical vapor deposition (MOCVD) systems for manufacturing optoelectronic components (i.e. lasers and solar, excluding LEDs) still comprised the largest contributor, but fell back from 43% of total revenue to 33% (although order intake almost doubled in 2020, driven by strongly increasing demand towards the end of the year). Equipment for LED production fell from 35% to 27% of revenue.

On a geographic basis, Asia rose from 68% to 73% of revenue, while Europe fell from 16% to 15% and America from 16% to 12%.

Full-year gross margin has fallen from 42% in 2019 to 40% for 2020, attributed to the US dollar-euro exchange rate effect between the two years. However, quarterly gross margin rose from 40% in Q3 to 42% in Q4/2020.

Full-year operating expense rose from €70m in 2019 to €73m in 2020. General & administrative (G&A) expenses increased from €16.5m in 2019 to €18m in 2020, due mainly to increased recruitment costs and other variable expenses. R&D expenses rose from €55m in 2019 to €58.4m in 2020 (22% of revenue), due to product development for next-generation MOCVD systems for various applications, including power electronics and mini- and micro-LEDs. Aixtron’s staffing rose during 2020 from 688 to 728 (more than a third of whom are engaged in R&D). “We will start to ship first systems [for mini- and micro-LEDs] to test customers worldwide,” notes VP of finance & administration Charles Russell. Spending on organic light-emitting diode (OLED) development reduced towards the end of the year, but €17m for the full year remained similar to 2019. Following completion of the Gen 2 OLED development project, customer discussions are currently being held on the final qualification phase of this technology.

Full-year operating result (EBIT, earnings before interest and taxes) has fallen from €39m in 2019 to €34.8m (with margin falling from 15% to 13% of revenue). Quarterly EBIT almost tripled from €8.2m (13% margin) in Q3 to €24.5m (23% margin) in Q4/2020.

Full-year net income rose slightly from €32.5m in 2019 to €34.5m for 2020 (remaining 13% of revenue, although rising from €0.29 per share to €0.31 per share). Q4 net income was €24.9m (23% of revenue, €0.22 per share), more than tripling from Q3’s €7.1m (11% of revenue, €0.07 per share).

Operating cash flow more than doubled from €8.1m in Q3 to €18.4m in Q4. However, full-year operating cash flow was still down, from 2019’s €42.8m to €23.3m for 2020, because of the increase in receivables at the end of 2020.

Capital expenditure (CapEx) was increased from €7.7m in 2019 to €9.3m for 2020, reflecting an increase in demonstration equipment to the expanded product range and investments in facilities needed for expanding business activity.

Full-year free cash flow fell from €35.1m in 2019 to €14m for 2020 (although quarterly free cash flow rose from €5m in Q3 to €17.3m in Q4). Cash and cash equivalents (including financial assets) has changed from €298.3m at the end of 2019 and €292.8m at the end of Q3/2020 to €309.7m at the end of Q4/2020 (or €249.7m, excluding €60m shown in other non-current assets).

Full-year order intake has grown by 30%, from 2019’s €231.9m to €301.4m in 2020, exceeding the €270-300m guidance range. In fourth-quarter 2020, new orders were €92.2m, up 30% on €70.8m in Q3, the highest order intake in a single quarter since 2011. Growth is driven by demand for manufacturing:

- gallium nitride (GaN)- and silicon carbide (SiC)-based power electronics – “We continue to receive orders from customers to address the growing end market of efficient GaN chargers for consumer electronic devices such as smartphones and notebooks as well as efficient GaN power management solutions for servers and data centers,” says executive board member & president Dr Felix Grawert. “In 2020, we have clearly seen the tipping point of broad GaN power adoption, and we are now in the volume ramp phase for GaN power solutions that replace the incumbent silicon-based power management systems,” he adds. “At the same time, we see increasing momentum in the area of gallium nitride and gallium arsenide RF solutions, driven by the 5G build-out,” Grawert continues. “In silicon carbide, we have achieved the qualification of our fully automated, high-throughput system from two customers and we continue to work hard to achieve the same with additional customers.”

- optoelectronics – orders were particularly strong in Q4/2020, driven by datacom lasers (for the 5G infrastructure build-out) as well as lasers for 3D sensing (due to growing adoption for both sides of the smartphone and other devices).

- specialty LEDs for displays – “Customer inquiries for tools to make ROY LEDs are strong, driven by demand from the areas of full-color mini-LED displays and backlighting units,” notes Grawert. “For the first time in 2020, we have received significant orders for ROY [red-orange-yellow] LEDs targeting the horticulture market [indoor farming],” he adds. “In micro-LEDs, we have seen the transformation of the industry from pure R&D to the manufacturing feasibility stage, making the adoption of this technology more probable than before. At this stage, the order volumes for this segment are still comparatively small.”

Order backlog was €150.9m at the end of Q4/2020, down 8% from €164.1m at the end of Q3/2020 but up 29% from €116.7m at the end of 2019.

The high level of sales in Q4 drove a substantial reduction in inventory, from Q3’s €101.6m to €79.1m and an increase in trade receivables from €19m to €41.3m (most of which will be collected in Q1/2021). Advance payments received from customers in Q4 were €50.8m (equivalent to 34% of the order backlog), down on €63.2m last quarter but similar to €51.1m a year ago.

In view of the positive business development in 2020, at the Annual General Meeting of shareholders on 19 May, Aixtron’s executive board and supervisory board will propose to pay a dividend of €0.11 per share (a payout ratio of 36% of the firm’s net income of €34.5m). Aixtron last distributed a dividend to shareholders for 2011.

Accelerated growth expected in 2021

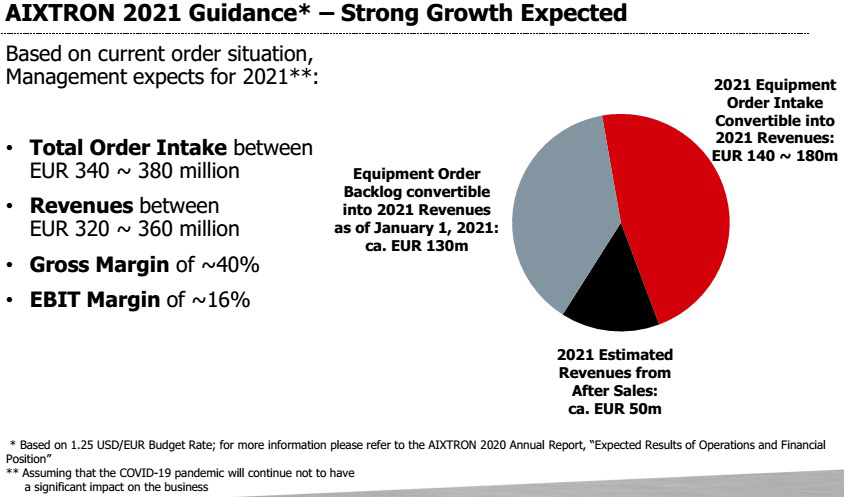

For 2021, Aixtron expects a strong upturn in business development. Based on its current corporate structure, the assessment of the order situation and the budget rate of $1.25/€ (versus 1.20$/€ in 2020), it anticipates significant growth in order intake volume to €340-380m.

Based on the equipment order backlog (convertible into 2021 revenue) of €130m as of 1 January joined by an expected €140-180m of order intake that should be convertible into revenue during 2021, plus €50m of spares & services revenue, for 2021 Aixtron expects revenue to grow significantly to €320-360m. In particular, Aixtron expects demand for equipment for the manufacture of energy-efficient power components made of GaN to make an increased contribution to sales compared with 2020.

The executive board has set itself the goal of ensuring continued high profitability in 2021. Despite the adverse US dollar-euro currency effect, gross margin should remain about 40%, while EBIT margin should rebound to about 16% of revenue. This is despite increased R&D expenses for completing the development of Aixtron’s next-generation products for lasers, micro-LEDs, GaN power & RF, and 8-inch silicon carbide. “With this large portfolio initiative, we expect to secure our leading market position in our rapidly growing core market,” says Grawert.

The expectations for 2021 fully include the results of Aixtron’s South Korea-based OLED-focused subsidiary APEVA (including all necessary investments). “We have achieved customer acceptance of our Gen2 in December 2020 and we are now in customer discussions related to a scale-up of the system to larger size, which would be the final part of the qualification process,” notes Grawert.

The 2021 also remains subject to the COVID 19 pandemic not having a significant impact on the development of business.

“In 2020, we have taken a major step forward in strengthening our competitive position in the relevant growth markets for our MOCVD technology,” says executive board member & president Dr Bernd Schulte. “With our ambitious and focused investment program to further develop our leading-edge technologies, we are setting the stage for progress in clearly aligning our product portfolio with the growing demands of our customers’ future markets,” he believes.

“These markets include, in particular, e-mobility, the expansion of the 5G mobile network, and the growing demand from our customers in the semiconductor industry to be able to deploy energy-efficient solutions,” adds Grawert. “We will again increase our growth rate in 2021.”

Aixtron appoints chief financial officer

Lumicore orders Aixtron AIX 2800G4-TM MOCVD systems

EpiWorld qualifies Aixtron AIX G5 WW C system for production ramp-up

Aixtron’s Q3 up 21.9% year-on-year

Aixtron’s revenue rebounds by 37% in Q2