News: Suppliers

27 May 2021

Aixtron’s Q1 revenue up 21% year-on-year, driven by optoelectronics

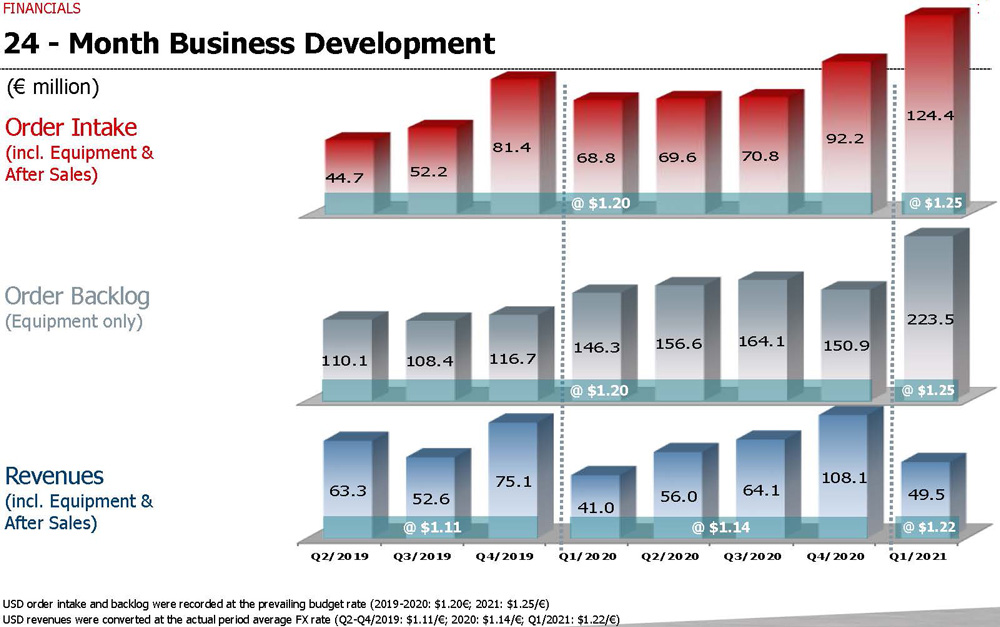

For first-quarter 2021, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €49.5m, down 54% from €108.1m last quarter (due to many customer requests for shipments to be pulled forward into Q4/2020) but up 21% on €41m a year ago.

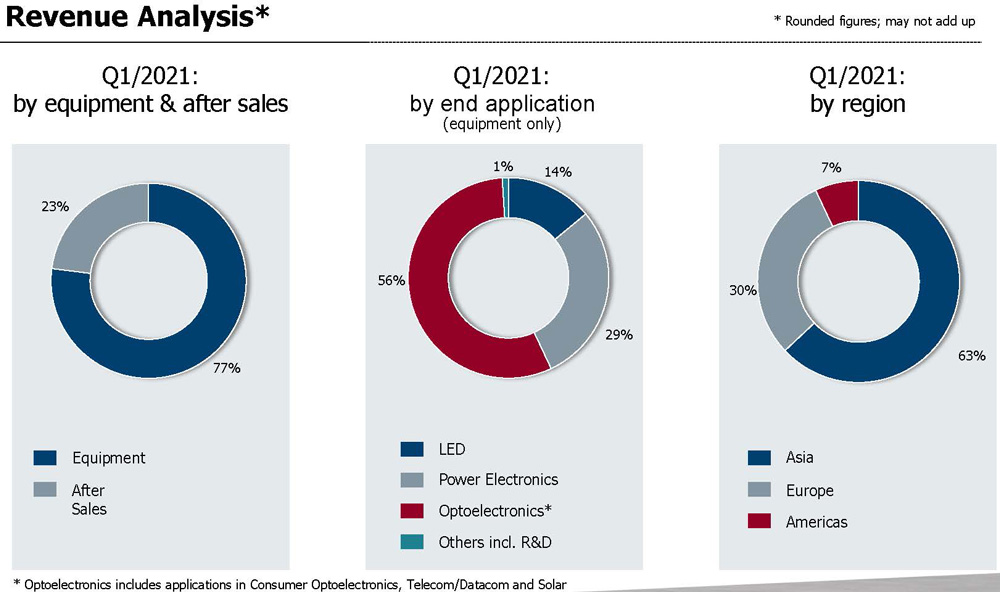

Equipment comprised 77% of revenue (rebounding from just 73% a year previously) and after-sales comprised 23%.

Growth was driven mainly by systems for producing optoelectronics devices (particularly lasers for optical data communications and 3D sensing), rising to 56% of total revenue (up from just 38% a year previously).

Another key driver, at 29% of total revenue, was systems for manufacturing energy-efficient power electronics based on gallium nitride (GaN) and silicon carbide (SiC), e.g. for fast charging of batteries in mobile devices such as smartphones and in the powertrain of electric vehicles (EVs).

Equipment for LED production comprised 14% of revenue (up on 9% a year ago).

On a geographic basis, Asia contributed 63% of revenue, Europe 30% (up from 17% a year ago) and the Americas just 7% (falling from 18%).

Gross margin was 35%, down from 42% last quarter but roughly level with 36% a year ago. Higher sales volume effects year-on-year were partially offset by the impact of the weaker US dollar. Furthermore, additional expenses were incurred for preparing production capacities for the increased output planned for second-half 2021.

Operating expenses of €18m were up on €15.7m a year ago but cut from 20.5m last quarter. To bring next-generation MOCVD systems for various applications to market maturity, Aixtron spent €11.9m on R&D. This includes lower ongoing costs for OLED technology.

Operating result (EBIT) was -€0.7m (EBIT margin of -1%), improving from -€1.1m (-3% margin) a year ago, mainly due to revenue growth.

Net income of €3.8m was an improvement on a net loss of -€0.8m a year ago, due primarily to further recognition of deferred tax assets.

Operating cash flow was €31.8m. Capital expenditure (CapEx) was €3.7m. Free cash flow was hence €28.1m, significantly higher than €3m a year ago and €17.3m last quarter.

During the quarter, cash and cash equivalents rose from €309.7m to €341m, due mainly to an increase in customer deposits and despite the scheduled increase in inventories (from €79.1m to €97.3m) in preparation for future shipments.

GaN power electronics driving order growth

Order intake has grown further, to €124.4m, up 35% on last quarter’s record €92.2m and up 81% on €68.8m a year ago, driven largely by GaN power electronics and 5G wireless telecoms. “Demand for our systems is pleasingly high - across all three application areas of power electronics, optoelectronics and LEDs,” comments CEO Dr Felix Grawert.

Equipment order backlog at the end of March was €223.5m, up 48% on €150.9m last quarter and up 53% on €146.3m on a year ago.

Accelerated growth expected in 2021

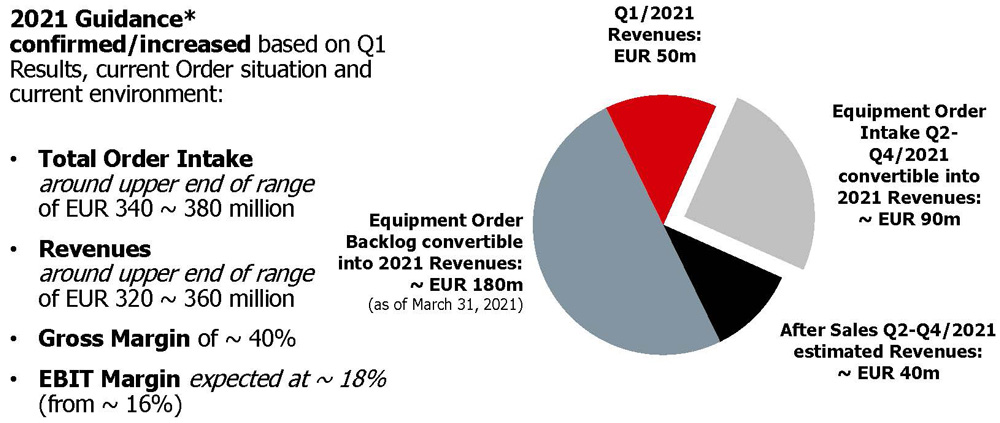

For full-year 2021, Aixtron continues to expect a strong upturn in business. Based on Q1/2021 and the internal assessment of the demand development, Aixtron now expects order intake to come out at the upper end of its €340-380m guidance range.

Based on the equipment order backlog (convertible into 2021 revenue) of €180m as of 31 March joined by an expected €90m of order intake that should be convertible into revenue during 2021 plus €40m of after-sales spares & services revenue, together with the €49.5m of revenue from Q1/2021, for full-year 2021 Aixtron now expects revenue to grow to the upper end of the €320-360m guidance range. Gross margin guidance remains about 40%. But, due to the improved revenue expectations, the Executive Board is now raising its expectation for EBIT margin from 16% to about 18%. This also takes into account the impact of the COVID-19 pandemic, which at this stage is not considered to be significant for Aixtron’s business.

Aixtron says that, as customer discussions initiated with the previous Asian customer after qualification of the Gen2 deposition system did not lead to the envisaged result, its South Korea-based organic light-emitting diode (OLED)-focused subsidiary APEVA is now addressing opportunities in China for the production of OLEDs using its technology. Together with the joint venture partner IRUJA Co Ltd, commercialization of the organic vapor phase deposition (OVPD) core technology is to be driven forward there. APEVA will hence focus on the supply of key components. The successful conclusion of talks with potential customers in China is not expected before 2022.

“With our focused investment program to further develop our leading-edge technologies and product portfolio, we have set the course at an early stage to be able to continue to satisfy our customers’ demand for innovative equipment in the years to come in the best possible way,” believes Grawert.

At the end of March, Dr Bernd Schulte left the Executive Board (at the end of his contract) and retired, and Dr Felix Grawert was appointed chairman of the Executive Board. On 1 May, Dr Christian Danninger joined the Executive Board as the new chief financial officer.

Imec and Aixtron demo 200mm GaN epi on AIX G5+ C for 1200V applications with breakdown over 1800V

Aixtron’s AIX G5+ C MOCVD system selected for micro-LED production

Aixtron’s growth accelerates in Q4

Aixtron appoints chief financial officer

Aixtron’s Q3 up 21.9% year-on-year

Aixtron’s revenue rebounds by 37% in Q2