News: Suppliers

17 February 2020

Veeco’s revenue rebounds in Q4, as cost cutting yields a second quarter of profit

Epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported full-year revenue of $419.3m for 2019, down 22.6% on $542.1m for 2018.

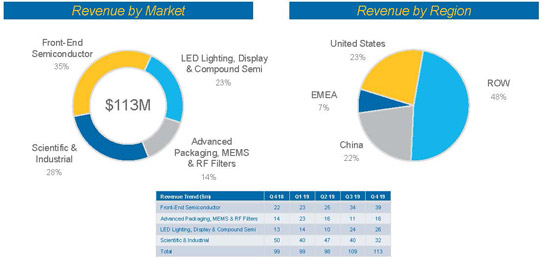

However, quarterly revenue recovered in Q4/2019 to $113.2m, up 3.9% on $109m in Q3 and 14.3% on $99m a year ago (and above the midpoint of the $100-120m guidance), with strong revenue in the Front-end Semiconductor and Data Storage market segments.

The Front-end Semiconductor segment (formerly part of the Scientific & Industrial segment, before the 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech) contributed $39m (35% of total revenue), up 14.7% on $34m last quarter and 77% on $22m a year ago, driven by shipments of multiple ion beam deposition systems (for EUV mask blank customers) and laser spike annealing (LSA) systems (for leading-edge technology nodes). Full-year revenue has almost doubled from 2018’s $63m to $120m in 2019 (rising from 12% to 29% of total revenue).

The Scientific & Industrial segment contributed $32m (28% of total revenue), down 20% on $40m last quarter and 36% on $50m a year ago. Nevertheless, full-year revenue has grown from 2018’s $139m to $160m in 2019 (rising from 25% to 38% of total revenue), with shipments of ion beam systems to data storage customers remaining solid.

The LED Lighting, Display & Compound Semiconductor segment – which includes photonics, 5G RF, power devices and advanced display applications – contributed $26m (23% of total revenue), up 8.3% on $24m last quarter and doubling from $13m a year ago, boosted by multiple wet etch & clean system shipments to RF device makers for 5G-related power amplifiers plus the sale of slow-moving LED-related inventory. Full-year revenue has dropped from 2018’s $250m to just $73m in 2019 (falling from 46% to just 17% of total revenue).

The Advanced Packaging, MEMS & RF Filter segment – including lithography and Precision Surface Processing (PSP) systems sold to integrated device manufacturers (IDMs) and outsourced assembly & test firms (OSATs) for Advanced Packaging in automotive, memory and other areas – contributed $16m (14% of total revenue), up 45% on $11m last quarter but only 14.3% on $14m a year ago, reflecting the softness in the lithography sector of the advanced packaging market that’s lasted for well over a year. Full-year revenue has dropped from 2018’s $91m to $67m in 2019 (falling slightly from 17% to 16% of total revenue).

By region, the rest of the world (RoW, which includes Japan, Taiwan, Korea and Southeast Asia) comprised 48% of overall revenue (up from 41% last quarter), driven by EUV mask blank and LSA systems. The USA contributed 23% (down from 25%), which included sales to the data storage market. China comprised 22% of overall revenue (up from 16%), mainly from multiple wet etch and clean systems. Europe, the Middle East & Africa (EMEA) contributed 7% of revenue (down from 18%).

On a non-GAAP basis, full-year gross margin has risen from 36.6% for 2018 to 38.5% for 2019, benefitting from improving product mix and volume increases. Q4/2019 gross margin was 40.2%, up from 36% a year ago albeit down slightly from 40.3% last quarter. “Selling off a portion of our slow-moving inventory, there was a slightly negative impact on gross margin [of 1-2 percentage points],” notes chief financial officer John Kiernan.

Operating expenses (OpEx) have been cut further, from $42.6m a year ago and $40m last quarter to $38m in Q4/2019, favorable to the forecasted $39m (contributing to full-year operating OpEx being cut from $175.2m in 2018 to $156.5m for 2019). “We are beginning to see the impact of the infrastructure cost reductions ahead of our target plan,” says Kiernan.

Full-year net income has gone from a profit of $14.2m ($0.30 per diluted share) for 2018 to a loss of $1.3m ($0.03 per diluted share) for 2019. However, quarterly net income was a profit of $5.4m ($0.11 per diluted share), almost doubling from $2.6m ($0.05 per diluted share) last quarter and compared with a loss of $7.5m ($0.16 per diluted share) a year ago. “We returned to non-GAAP profitability by posting two consecutive quarters of positive EPS in Q3 and Q4 of 2019,” says CEO Bill Miller. “We executed well on the first phase of our transformation in 2019 by improving gross margins and reducing expenses, leading to a return to profitability in the second half of the year,” he adds.

“During this transformational year, where we lost over $100m of commodity LED revenue, we were able to generate $5m in operating income,” notes Miller. “Our 13% second-half revenue growth over first half exceeded our 10% outlook,” he adds.

Veeco’s transformation (begun last year) is in two phases: (1) returning the company to profitability and (2) driving growth. “The first phase, returning the company to profitability, is well underway and includes reducing costs and de-levering the company,” says Miller. “As part of the de-levering process, we eliminated the chief operating officer role when Sam Maheshwari announced his resignation from the company last December. I promoted John Kiernan to the position of senior VP, chief financial officer as of the beginning of the year. John has been at Veeco for 25 years,” he adds.

“Throughout the year, as part of our de-layering, we eliminated over 30% of vice-president-level and above positions, while trimming approximately 7% of our individual contributor positions. This was an intentional approach to our infrastructure reduction and preserves our ability to execute,” states Miller.

“We also reorganized along product lines with a central R&D organization, which enables us to better allocate our R&D spend to our highest-priority project across the company. This allows us to improve our customer focus and operational efficiency,” he adds.

“In addition to prioritizing R&D spend on projects with highest financial and strategic importance to the company, we are evaluating our existing product portfolio on a similar set of criteria. In our financials is an asset held for sale, which is an indication of our intent to divest a certain non-core product line.”

Due to earnings in the quarter plus a $7m reduction in working capital, cash flow from operations was +$16m in Q4/2019, compared with outflow of -$15m in Q3. Capital expenditure (CapEx) was $2.7m (contributing to $10.9m for the year). Cash and short-term investments hence rose from $232m to $245m. Long-term debt was recorded at $300m, representing the carrying value of $345m in convertible notes.

During Q4/2019, accounts receivable fell from $73m to $45.7m, due to the timing of customer payments, resulting in days of sales outstanding (DSO) falling from 60 to 36 days (lower than the historical average). Accounts payable was reduced from $35m to $21m, resulting in days payables outstanding (DPO) being cut from 47 to 28 days. Inventory has been cut further, from $156.3m at the end of 2018 and $135m at the end of Q3/2019 to $133m at the end of 2019 (reducing the days of inventory from 185 to 177 days during Q4/2019). “We made progress selling slow-moving inventory in Q4 [selling off about $5m of the $25m inventory categorized as slow-moving], which has been a focus of ours for some time,” says Kiernan.

Order bookings were $110m in Q4/2019, down 4.3% on $115m last quarter, contributing to quarter-end order backlog falling from $279m to $268m.

For first-quarter 2020, Veeco expects revenue of $95-120m. “There is still a significant level of uncertainty from coronavirus-related travel, restriction and factory shutdowns in China,” notes Kiernan. “Accordingly, we have widened the low end of our guidance range to accommodate this.” Gross margin should be 39-41%. OpEx is expect to be cut further, to about $37m. Net income should be steady, at $0-11m ($0.00-0.22 per share).

“We do expect to continue to sell-off the slow moving inventory in 2020 [given order activity in this area], which may provide gross margin headwinds. However, we are still targeting 40% gross margin or better going forward,” says Kiernan.

“Based on our current visibility, we see Q2 revenue trending similar to or slightly higher than Q1. This Q2 outlook does not incorporate any potential coronavirus impact, which is unknown at this time,” Kiernan continues. “Additionally, we are ahead of plan with OpEx reduction and reiterate that, at current revenue level, we expect non-GAAP OpEx to decline toward our target of $36m per quarter by Q3.” This compares with $49m in Q3/2017, with most of the reduction coming in sales, general & administrative (SG&A) expenditure, rather than R&D spending.

“As we enter 2020, we are focused on optimizing our product portfolio, extending our core technologies into new markets, and further increasing our profitability,” says Miller. “We are positioning the company for long-term growth in the Front-end Semiconductor, Advanced Packaging and Compound Semiconductor markets by executing on our product roadmaps,” he adds.

“For 2019, our priorities were to innovate, penetrate markets and improve profitability,” recalls Miller. “Regarding our market penetration objective, we had mixed results. We enjoyed great success in the EUV mask blank market, with our ion beam deposition systems. We have promising traction at very advanced nodes with our laser annealing product at two semiconductor industry leaders. In advanced packaging, we are still experiencing soft market conditions for lithography products. In the photonics market, we are disappointed with weak market condition for VCSELs.”

“Regarding our innovation objective, we executed very well,” says Miller. “We shipped multiple ion beam deposition systems for EUV mask blank production. We optimized our MOCVD platform for photonics applications and shipped our first beta system to a premier compound semi customer. We developed a 300mm single-wafer fully automated MOCVD cluster tool and shipped, with acceptance, to a major front-end semiconductor fab. We updated our advanced packaging lithography product to improve its performance and we made major enhancements to our laser annealing product to improve our competitiveness at the next nodes.”

On 4 February Veeco launched the Lumina arsenide phosphide (As/P) MOCVD platform for photonics applications. “The Lumina system [beta tool] is currently being evaluated by a leader in photonics, and we are achieving excellent feedback [for not only VCSEL stacks but also other photonics applications]… Also, we’re sharing our VCSEL and micro-LED data with several of the important end-customers and they’ve been impressed with their results as well,” says Miller. “Additionally, during the quarter [Q4/2019], we received a purchase order from a second customer… our understanding is that it’s for VCSEL applications”

Veeco launches Lumina As/P MOCVD platform

Veeco’s revenue rebounds in Q3 as 300mm GaN MOCVD cluster system accepted for pilot production

Veeco promotes chief accounting officer & treasurer to CFO

Veeco’s Q1 revenue levels out at $99m after drop off of commodity LED MOCVD system sales to China

Veeco’s revenue falls 22% in Q4/2018 due to commoditization of China LED MOCVD market