News: Suppliers

11 May 2020

Veeco’s Q1 revenue at high end of revised guidance range

For first-quarter 2020, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $104.5m, down 7.7% on $113.2m last quarter but up 5.1% on $99.4m a year ago, and at the high end of the $100-105m guidance range (which had been revised on 31 March from mid-February’s initial guidance of $95-120m), driven by strength in data storage business in the Scientific & Industrial segment.

“Due to disruptions related to various governmental measures implemented to contain the [COVID-19] virus in mid-March, we withdrew our [original] financial guidance for the first quarter. Shortly thereafter, as an essential business supporting critical infrastructure, we maintained operations at all our manufacturing facilities with minimal disruptions,” says CEO William J. Miller Ph.D. “Our supply chain, manufacturing and service operations have been successful in maintaining our ability to source materials, ship products and provide support for our customers with only minor disruptions,” he adds.

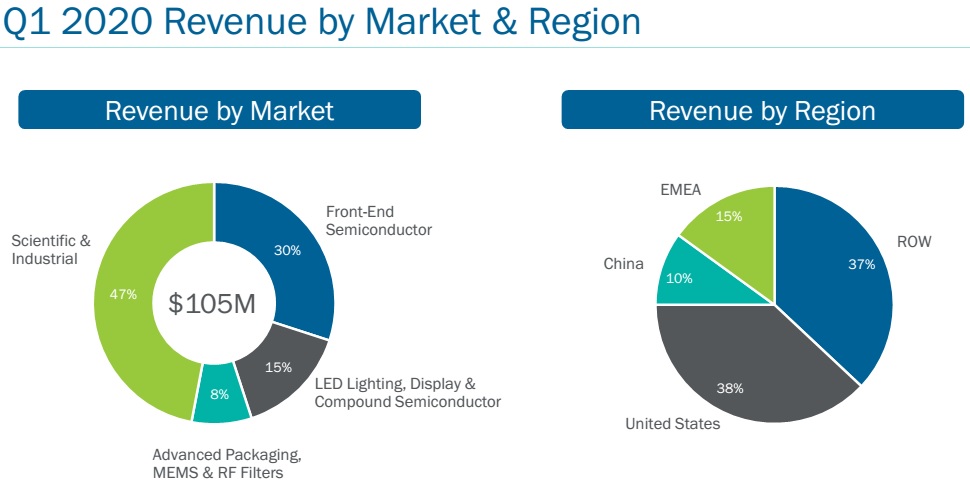

The Scientific & Industrial segment contributed 47% of total revenue, up from 28% last quarter, with ion beam system shipments to data storage customers (driven by demand in cloud computing) comprising a higher-than-normal proportion of revenue.

The Front-end Semiconductor segment (formerly part of the Scientific & Industrial segment, before the 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech) contributed 30% of total revenue, down from 35% last quarter but up from 23% a year ago, driven by shipments of multiple ion beam deposition systems (for EUV mask blank customers) and laser spike annealing (LSA) systems (for leading-edge technology nodes).

The LED Lighting, Display & Compound Semiconductor segment – which includes photonics, 5G RF, power devices and advanced display applications – contributed 15% of total revenue, falling back from 23% last quarter but still up slightly on 14% a year ago, as the firm sold further slow-moving inventory of LED-related metal-organic chemical vapor deposition (MOCVD) systems and shipped multiple wet etch & clean systems to RF device makers for 5G-related power amplifiers.

The Advanced Packaging, MEMS & RF Filter segment – including lithography and Precision Surface Processing (PSP) systems sold to integrated device manufacturers (IDMs) and outsourced assembly & test firms (OSATs) for Advanced Packaging in automotive, memory and other areas – has fallen further, from 23% of total revenue a year ago and 14% last quarter to just 8%, reflecting the softness in the lithography sector of the advanced packaging market that’s lasted for well over a year.

By region, China has fallen back from 22% of total revenue last quarter to just 10%, mainly from legacy MOCVD system and service revenue. Driven by sales to data storage customers, the USA has rebounded from 23% to 38% of total revenue and Europe, the Middle East & Africa (EMEA) has rebounded from 7% to 15%. The rest of the world (including Japan, Taiwan, Korea and Southeast Asia) has correspondingly fallen back from 48% to 37% of total revenue (mainly EUV mask blank and LSA systems).

On a non-GAAP basis, gross margins has risen further, from 35.5% a year ago and 40.2% last quarter to 44.9% (well above the 39–41% guidance). This was driven by improved product mix and reduced reserves, along with reduced manufacturing costs and service-related expenses, some of which were a result of COVID-19 related restrictions.

Operating expenses (OpEx) have been cut further from $40m a year ago and $38m last quarter to $34.2m (much better than the $37m target). “We are ahead of schedule on our expense target reduction and, in addition, Q1 OpEx benefited from less travel and other variable expenses as a result of COVID-19-related restrictions,” notes chief financial officer John Kiernan.

“We improved gross margin and reduced operating expenses, driving solid non-GAAP EPS,” says Miller. Compared with a loss of $6.4m ($0.14 per diluted share) a year ago, net income has doubled from $5.4m ($0.11 per diluted share) last quarter to $10.9m ($0.22 per diluted share), better than the guidance of $0–11m ($0.00-0.22 per share). This is the third consecutive quarter of non-GAAP profitability (and the most profitable quarter in several years).

Working capital increased, as accounts receivable rose to $84m (from a historically low $45.7m last quarter), resulting in days of sales outstanding (DSO) rising from 36 to 73 days, due mainly to the timing of when customer payments were due (with some falling just outside of the quarter). This was partially offset by accounts payable rising from $21m to $36m, doubling the days of payables outstanding (DPO) from 28 to 57 days. Inventory has been cut further, from $133m to $130m, due to progress in selling slow-moving inventory.

Capital expenditure (CapEx) was $1.1m (cut from $2.7m last quarter). During the quarter, cash and short-term investments fell from $245m to $242m. Long-term debt was $303m, representing the carrying value of $345m in convertible notes (maturing in January 2023).

In April, Veeco finalized the sale of a non-core product line that was designated as held for sale in the March balance sheet. The sales price was $11.4m, of which $9.7m was paid on closing the transaction, with the balance to be paid in 18 months.

The divestment is part of Veeco’s two-phase business transformation (begun last year) that aims to: (1) return the company to profitability (reducing costs and de-layering the company, involving eliminating over 30% of VP-level and above positions – including the chief operating officer role and promoting John Kiernan to chief financial officer at the beginning of this year – while trimming about 7% of staff); and (2) drive growth.

“Our cash balance, quality of our backlog and the cost reductions we realized over the last several quarters give me confidence in our ability to weather uncertainties we may face,” says Miller.

However, given the level of uncertainty resulting from the COVID-19 pandemic, Veeco is refraining from providing Q2/2020 revenue guidance.

Specifically, the firm had a few systems for one Chinese LED manufacturing customer (that happens to be close to Wuhan) push out of Q2.

“The other area that we’re experiencing some delays is really an acceptance of new products, which is really driven by travel restrictions that our engineers from our factories are unable to visit the customer sites,” says Miller. “In compound semiconductor markets, we are not seeing significant traction of 3D sensing or laser diodes, but we are encouraged with recent GaN MOCVD order activity for power electronics applications,” he adds.

“Otherwise, the rollout of our backlog and timing of bookings appear to be on track,” says Kiernan.

“Currently all our facilities are running at or near-normal capacity,” says Miller. “We’ve had no supply chain disruptions. We’re not seeing significantly reduced or changed customer demand. The quality of our funnel is strong. We had a strong order flow in April. Our cash collections in April are so far strong.”

For Q2/2020, gross margin is expected to be over 40%. “Gross margins have been trending positive over the last number of quarters as a result of transformational actions taken to improve profitability. But, given the size of individual transactions and product mix, our gross margin will likely fluctuate from quarter-to-quarter,” says Kiernan. “We do not expect gross margin to remain as high as 45% we achieved in Q1.”

“From an OpEx perspective, we expect to incur lower spending related to travel and other variable costs due to COVID-19-related restrictions in the near term, but we continue to maintain our longer-term $36m or less quarterly OpEx target at current revenue levels when business activity returns to normal,” says Kiernan. “Although there is uncertainty related to the anticipated impact of the COVID-19 outbreak, we believe our business model, our current cash and short-term investments, and the recent steps we've taken to rationalize expenses leave us well positioned to manage our business through the crisis as it continues to unfold,” he adds.

“Our semiconductor technologies enable a variety of important megatrends that are expected to perform well, such as cloud and high-performance computing, artificial intelligence (AI) and 5G RF,” concludes Miller.

Veeco’s revenue rebounds in Q4, as cost cutting yields a second quarter of profit

Veeco launches Lumina As/P MOCVD platform

Veeco’s revenue rebounds in Q3 as 300mm GaN MOCVD cluster system accepted for pilot production

Veeco’s Q1 revenue levels out at $99m after drop off of commodity LED MOCVD system sales to China