News: Suppliers

12 February 2021

Veeco’s revenue grows 24% in Q4, driven by advanced-node semiconductor and 5G RF compound semi markets

Epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA says that its full-year revenue has risen by 8.3% from $419.3m in 2019 to $454.2m in 2020.

“Reflecting on 2020, we completed our organizational restructuring and began to reshape our product portfolio,” says CEO Bill Miller. For example, in Veeco’s metal-organic chemical vapor deposition (MOCVD) system business, it has pivoted away from the commodity LED market and towards providing high-value solutions. “These include applications in photonics such as indium phosphide (InP) lasers and vertical-cavity surface-emitting lasers (VCSELs), as well as micro-LED with our Lumina MOCVD arsenide-phosphide platform and our Propel gallium nitride (GaN) MOCVD system used for power electronics, RF devices and micro-LED applications,” he adds.

To align with its evolving strategy, Veeco has modified the way it reports revenue by end market, from (1) Front-End Semiconductor; (2) LED Lighting, Display & Compound Semiconductor; (3) Advanced Packaging, MEMS & RF Filters; and (4) Scientific & Industrial (including Data Storage) to:

- Semiconductor (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) contributed $166m (36% of total revenue), down 6% on 2019’s $176m.

- Compound Semiconductor (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, Laser Diodes) contributed $108m (24% of total revenue), up 26% on 2019’s $86m, driven by photonics and RF applications.

- Data Storage (equipment for thin-film magnetic head manufacturing) contributed $123m (27% of total revenue), up 47% on 2019’s $84m, as hard disk drive customers added capacity for thin-film magnetic head manufacturing.

- Scientific & Other (research institutions and other applications) contributed $57m (13% of total revenue), down 23% on 2019’s $74m.

By region, the Asia-Pacific (excluding China) comprised 39% of revenue, the USA 32%, Europe, Middle-East & Africa (EMEA) 16%, China 13%, and the rest of the world less than 1%.

“Our year-over-year financial performance dramatically improved in 2020 and we are proud to conclude this remarkable year of transformation by delivering solid fourth quarter results,” comments Miller Ph.D.

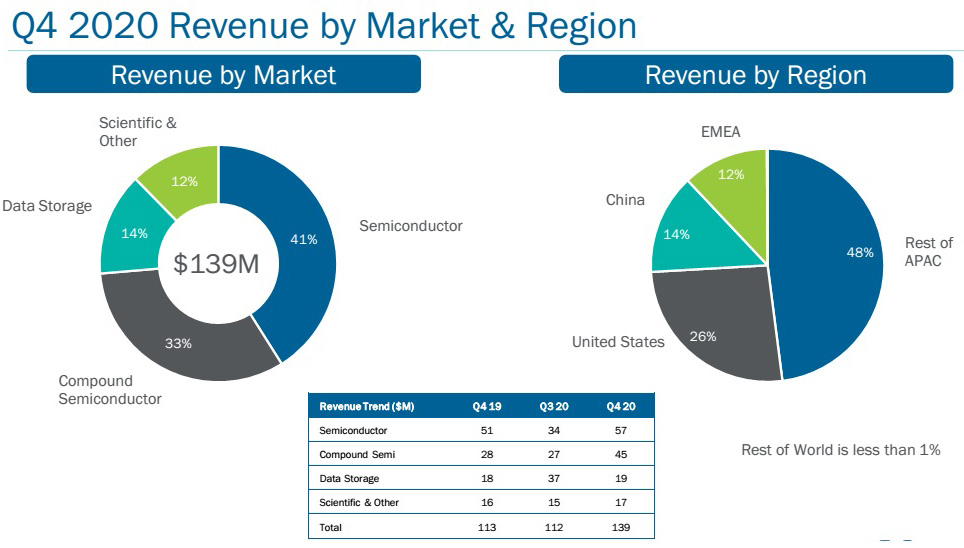

Q4/2020 revenue was $138.9m (exceeding the guidance of $120-136m), up 23.9% on $112.1m last quarter and 22.7% on $113.2m a year ago.

“These fourth quarter results were driven primarily by system sales in support of semiconductor advanced-node manufacturing, as well as compound semiconductor system sales for 5G RF applications,” Miller says.

The Semiconductor market contributed $57m (41% of revenue), up 68% on $34m in Q3, driven by multiple laser annealing systems and an EUV ion-beam system shipment.

The Compound Semiconductor market contributed $45m (33% of revenue), up 67% on $27m in Q3, driven by multiple system shipments for 5G RF applications and shipments to photonic customers. Also, the sale of commodity LED [MOCVD] systems enabled Veeco to monetize slow-moving inventory (generating about $10m of revenue).

The Data Storage market contributed $19m (14% of revenue), down 49% on $37m in Q3.

The Scientific & Other market contributed $17m (12% of revenue), up 6.7% on $15m in Q3, with systems shipped for a variety of research applications.

By region, the Asia-Pacific region (excluding China) comprised 48% of revenue, the USA 26%, China 14%, EMEA 12%, and the rest of the world less than 1%.

Due to monetizing slow-moving LED inventory, as well as service costs related to both 5G installations and future semiconductor growth, non-GAAP gross margin was 41.3%, below the 42-44% guidance and down from 44.5% last quarter. Nevertheless, this is still up from 40.2% a year ago. Full-year gross margin has grown from 38.5% for 2019 to 43.3% for 2000. “These improvements reflect the impact of our transformation effort,” says chief financial officer John Kiernan.

Operating expenditure (OpEx) was $39.7m, up from $35.7m last quarter and $38m a year ago (and exceeding the targeted $36-38m, although falling from 32% of revenue in Q3 to 29% in Q4/2020). “We incurred higher variable expenses associated with the increase in revenue and order intake,” notes Kiernan. “Additionally, we strategically increased R&D expenses as planned in support of our growth initiatives.” Despite this, full-year OpEx has still been cut from $156.5m in 2019 to $144m for 2020, as a result of the firm’s reorganization and expense management.

Operating income has risen further, from $7.4m a year ago and $14.1m last quarter to $17.6m, boosting full-year operating income from $5.1m in 2019 to $52.5m in 2020.

Quarterly net income has risen further, from $5.4m ($0.11 per diluted share) a year ago and $11m ($0.22 per diluted share) to $15m ($0.30 per diluted share). This has taken full-year net earnings from a loss of $1.3m ($0.03 per diluted share) in 2019 to a profit of $42.3m ($0.86 per diluted share) in 2020.

Quarterly cash flow from operations has risen from $10m in Q3 to $15m in Q4 (making $43m for full-year 2020). CapEx was $3.5m (making $6.8m for the year). During Q4, cash and short-term investments hence rose by $10m, from $310m to $320m (up on just $245m a year ago).

“We improved gross margins, reduced operating expenses and improved profitability. We restructured our debt and strengthened our balance sheet,” summarizes Miller.

Long-term debt on the balance sheet is $321m, representing the carrying value of $389m in convertible notes. “Over the course of 2020, we went from a single $345m tranche of debt due in January 2023 to a more manageable debt structure with three maturities roughly evenly staggered over the next six years [$132m due in January 2023, $133m due in January 2025, and $125m due in January 2027],” says Kiernan. Total cash interest expense should be $12.9m. “With this debt structure and strong balance sheet, we have the flexibility and capital to focus on driving long-term organic growth across our business,” he adds.

From a working capital perspective, accounts receivable remained flat at $80m on increased revenue. Days sales outstanding (DSOs) were reduced from 64 to 52 days. Accounts payable also remained flat at about $34m.

Inventory rose by about $3m, from $143m to $146m, resulting from investments that Veeco is making to ship evaluation systems in 2021 in support of its growth strategy in the Semiconductor and Compound Semiconductor markets.

As a result of a strong year of order intake, Veeco ended 2020 with $366m in order backlog (mostly Data Storage, followed by Semiconductor, Compound Semiconductor and Scientific & Other). A significant portion of the increased Data Storage backlog should be delivered in the second and third quarters of 2021.

“We enter 2021 with healthy backlog, strong customer engagements and overall positive momentum. We look forward to executing our near-term growth strategy, driven in large part by our laser annealing, 5G RF and data storage applications.”

For first-quarter 2021, Veeco expects revenue to fall to $115-135m (including just $5m of low-margin slow-moving inventory of LED MOCVD systems). Gross margin should hence be roughly flat at 40-42%, reflecting the anticipated product mix, as well as service costs related to both evaluation systems for Semiconductors and customers’ 5G RF ramps.

“We see a tremendous pull for our technology and are planning for success. Typically, we would have one to two evals in the field at a time. In 2021, we expect the evals to reach about 10 in the field [about half in LSA (including some advanced platforms that won’t be out until the end of 2021) and some MOCVD tools for power electronics as well as micro-LEDs, plus a wet-processing tool going out shortly] and many of these evals would have a period lasting more than one year or so,” notes Kiernan. “As a result, there will be limited amount of benefits that we get to 2021 revenue from these increased evals. So we are supporting these evals ahead of revenue and we are planning for growth in 2022 and beyond,” he adds. “We currently view the Q1 gross margins in the 40-42% range as the low point for 2021 and view quarterly gross margins in the range of 40-44% in the quarters as we move forward.”

Operating expenses should be cut to $37-39m in Q1/2021, due mainly to a reduction in sales, general & administrative (SG&A) expenses. The firm expects operating income of $10-19m and net income of $6-15m ($0.12-0.30 per diluted share).

Based on its current visibility and backlog, Veeco is increasing its full-year 2021 outlook to revenue of $520-540m (17% annual growth) with EPS of $1-1.20. “We expect Semiconductor market revenue to grow in 2021 on strength in laser annealing systems,” says Kiernan. “We expect growth in 2021 in our Data Storage market based upon our order backlog going into the year,” he adds.

“As we look out beyond 2021, Semiconductor demand is growing and, as such, we evaluated options that increase production capacity for our laser annealing systems,” notes Miller. “We decided investing in a new facility offers the best solution,” he adds “We are currently in the final stages of lease negotiations for San Jose property of approximately the same size as our current facility, but with a better footprint allowing us to increase the size and efficiency of our production space,” notes Kiernan. CapEx associated with this project should be $30-40m over the next two years. “Additionally, there will be a period of duplicate expenses until the transition to the new facility is completed,” he adds.

“With the first phase of our transformation behind us, we will continue to focus on the second phase of our transformation, growing the company organically in the Semiconductor and Compound Semiconductor markets,” says Miller. “We think of this growth in two phases, near-term 2021 growth and longer-term 2022 and beyond. Our near-term growth outlook is supported by recent Semiconductor orders from our advanced-node logic customers, demand for 5G RF-related capacity, and market demand and backlog in Data Storage. Looking beyond 2021, we have been investing in our core technologies, which will drive the next phase of Veeco’s growth that enable game-changing applications like artificial intelligence (AI), virtual and augmented reality (VR/AR) and electric vehicles (EVs),” he concludes.

Veeco’s revenue grows 14% in Q3

Veeco returns to positive operating cash flow as it completes restructuring

Veeco’s Q1 revenue at high end of revised guidance range

Veeco’s revenue rebounds in Q4, as cost cutting yields a second quarter of profit